Gamuda Bhd (Dec 19, RM4.82)

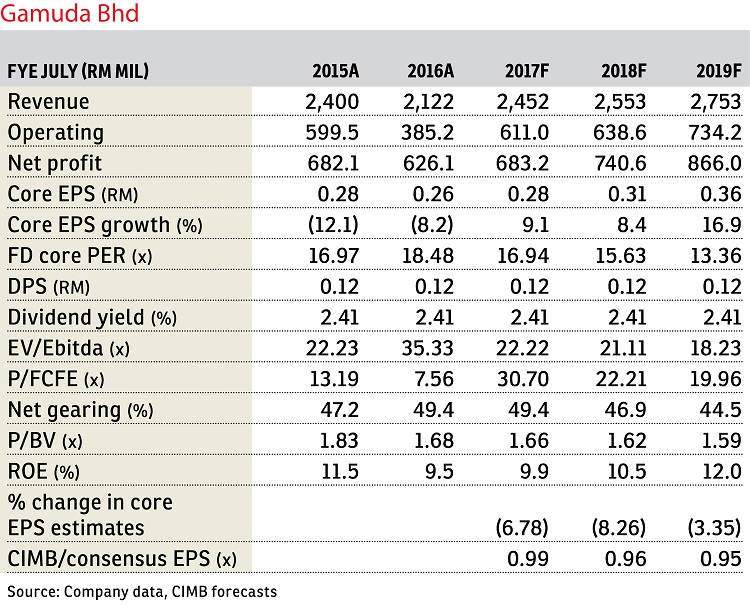

Maintain add with a lower target price of RM5.88: Gamuda Bhd’s annualised first quarter of financial year 2017 (1QFY2017) core net profits made up 89% of our full-year forecast and 91% of the consensus. The results were below expectations as we had overestimated the property pre-tax margin, which fell four percentage points to 17.5% in 1QFY2017 versus our forecast of 24%. 1QFY2017 property margins are likely to sustain, weighed down by lower-margin overseas sales. The good news was the 20% year-on-year growth in construction pre-tax profit (8.5% margin).

New profits from mass rapid transit 2 (MRT2)’s tunnelling and project development partner portions should begin contribution from 2QFY2017 onwards given the current progress of less than 2%. Tunnelling works are scheduled to commence in November 2017 for one of the 12 tunnel boring machines. The outstanding order book of RM8.9 billion comprises the RM7.7 billion (50% share) MRT tunnelling job and RM1 billion portion of the Pan Borneo Highway Sarawak contract.

Management reiterated its FY2017 total property sales target of RM2.1 billion, which is 3% higher than FY2016 as it is optimistic about the launch of new townships Gamuda Gardens (RM150 million target sales; RM6.9 billion gross domestic value [GDV]) and Kundang Estates in Rawang (RM50 million target sales; RM600 million GDV) given accessibility to MRT, and its venture in Ho Chi Minh City. Overseas property sales make up 63% of the total targeted sales in FY2017.

The second quarter of calendar year 2017 is now the new target for the sale of Syarikat Pengeluar Air Selangor Sdn Bhd (Splash). Management confirmed that a final independent valuation is underway, while negotiations on the price are based on the RM2.8 billion to RM3.2 billion book value (BV) of Splash. If the likely 15% discount to BV (highlighted by The Edge weekly) materialises, Gamuda’s cash proceeds would amount to as much as RM1.1 billion (40% stake; 45 sen per share). We now believe there is a fair chance of a partial special dividend as major capital expenditure is manageable even without the sale of Splash.

Gamuda’s RM3 billion to RM4 billion contract win target is higher than our RM2 billion estimate for FY2017. This is because the group aims to secure the biggest package from the Gemas-Johor Bahru double tracking, while it is fairly confident of securing light rail transit Line 3 and Pan Borneo Highway Sabah. Gamuda will bid for the East Coast Rail Line and high-speed rail (potentially RM30 billion to RM40 billion for local players). The group is keen to participate in new MRT tunnelling jobs in Singapore, which was a positive surprise during the briefing, but this will not materialise soon, in our view.

Our FY2017 to FY2019 earnings per share (EPS) forecasts are cut to reflect weaker property sales and margins. Though cash-enhancing, we estimate the sale of Splash would lower its FY2018 to FY2019 EPS by a further 15% to 18%. In the medium term, early election plays, job flows and Splash’s sale are key catalysts, which is why Gamuda remains our top big-cap sector pick and the biggest proxy for the rail theme. — CIMB Research, Dec 18

This article first appeared in The Edge Financial Daily, on Dec 20, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

The Stride Strata Office @ BBCC

Pudu, Kuala Lumpur

Berjaya Park (Taman Berjaya)

Shah Alam, Selangor

Taman Yarl @ Old Klang Road

Jalan Klang Lama (Old Klang Road), Kuala Lumpur