Crescendo Corp Bhd (Dec 30, RM1.50)

Maintain market perform call with a higher target price (TP) of RM1.68: Core net profit (CNP) of Crescendo Corp Bhd for financial period ended Dec 31, 2016 (9MFY2017) came in above expectations, accounting for 84% of our full-year estimates due to better-than-expected margins.

9MFY2017 CNP saw an impressive growth of 48% underpinned by the 28% improvements in revenue, driven by the billings of its new sales, which are higher than last year’s coupled with the decrease in minority interest contribution (-37%). Quarter-on-quarter, its 3QFY2017 CNP improved by 13% despite registering a magnificent growth in revenue (+47%), due to compression in earnings before interests, taxes, depreciation and amortisation margins due to the sale of lower margin products and decline in construction margins.

The unexpected results came amid contribution from better priced properties such as commercial properties. Property sales around RM220 million by 9MFY2017 were also ahead of our financial year ending Jan 31, 2017 (FY2017) target of RM197 million, driven by the group’s Bandar Cemerlang project. No dividends declared as expected.

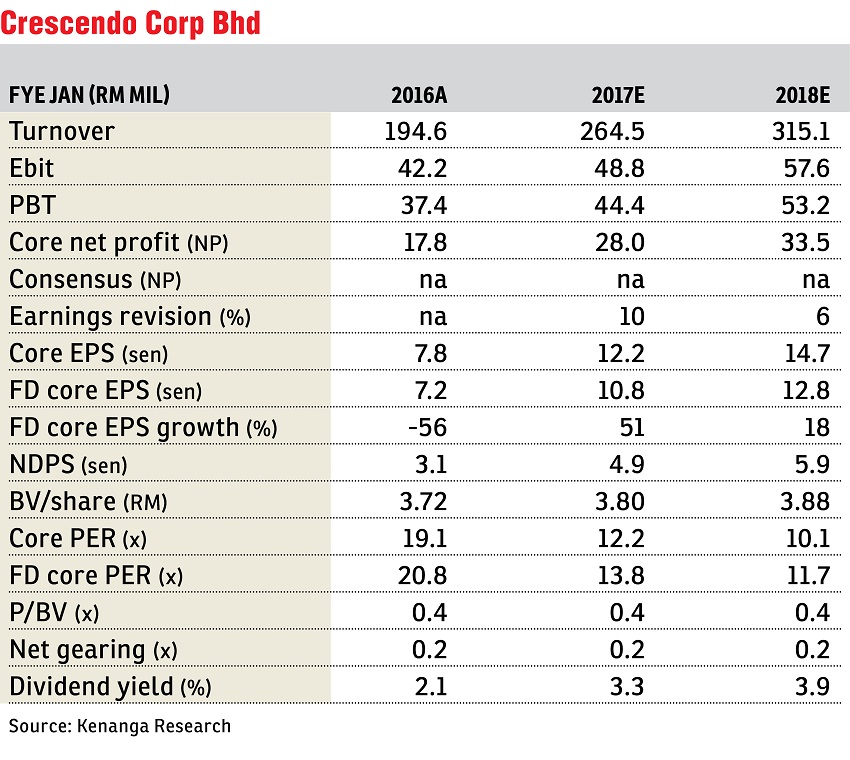

Post results, we raised our FY2017 and FY2018 sales estimates to RM235 million and RM221 million respectively (previously RM197 million and RM214 million). Subsequently, we also raised our FY2017 and FY2018 CNP estimates by 10% and 6% respectively, after the adjustment in our sales target and also fine tuning in our margin assumptions. Its unbilled sales currently stand at RM171 million, which provides earnings visibility for at least a year.

We are of the view that in the near-to-midterm outlook for Crescendo remains unexciting due to its exposure in industrial property and projects concentration in the Johor region, while the group remains cautious about launches going forward. Whilst the ringgit remains weak, domestic confidence issues are keeping industrial property investors on the sidelines.

We maintain our call on Crescendo despite its stellar performance. However, the higher TP (previously RM1.60) was set after we fine-tuned our discount to its fully diluted revised net asset value of RM6.32 to 73% (previously 75%) given the group’s ability to position itself as an affordable property player which has garnered strong interests of serious buyers for reasonably priced landed properties in Johor despite a soft market environment. — Kenanga Research, Dec 30

This article first appeared in The Edge Financial Daily, on Jan 3, 2017. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Setia Damai

Setia Alam/Alam Nusantara, Selangor

Pudu Impian II @ Villa Tropika

Cheras, Kuala Lumpur

Bandar Kinrara

Bandar Kinrara Puchong, Selangor

Taman Sungai Besi Indah

Seri Kembangan, Selangor

Nusari Aman 2 @ Bandar Sri Sendayan

Seremban, Negeri Sembilan