Malaysia Building Society Bhd (Jan 17, RM1.12)

Downgrade to neutral with an unchanged target price (TP) of RM1.08: Malaysia Building Society Bhd’s (MBSB) share price may consolidate after a strong price action. We note that the share price of MBSB has surged 20% since the start of the year to a high of the day of RM1.09 yesterday. We are not surprised that the stock has rallied to the current level as we opine the negative side of the company’s past quarterly results had been flushed out of the market and eventually, its share price reacted positively to its financial year ending Dec 31, 2017 (FY2017) earnings prospect, reflecting our view on the company. The stock is expected to consolidate at this level after a strong recent price action.

We also opined that the price rally of late is related to positive expectations of negotiations on a proposed merger with Asian Finance Bank Bhd (AFB). Recall that Bank Negara Malaysia (BNM) requires that the negotiations be completed within six months from the date of BNM’s letter of Dec 21, 2016. Having said that, we do not see any significant impact from the proposed merger on the company’s FY2017 earnings prospect even if MBSB were able to complete the proposed merger with AFB this year. We are of the view that it would take time for the management to make use of the full-fledged banking licence. Therefore, we view all positives should have already been priced in in the current rally.

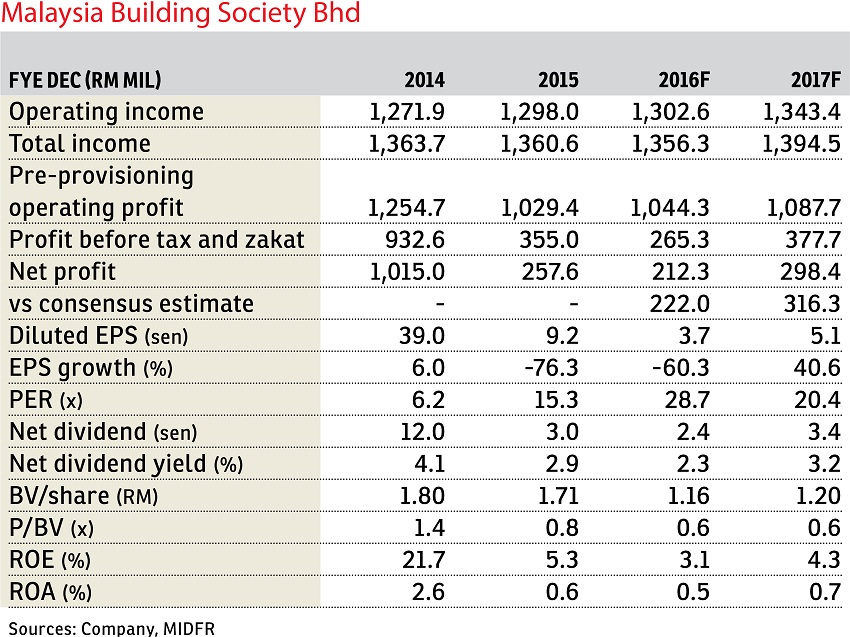

We make no changes to our earnings forecast at this juncture. Our existing forecasts are based on its current non-banking operations, which will see its FY2017 earnings growth of 40% from a low base and improvement in its asset quality.

We downgrade our recommendation on MBSB to “neutral” from “buy” with an unchanged TP of RM1.08. Our valuation is pegged at a price-to-book value (PBV) of 0.9 times, which is one standard deviation below its three-year average PBV of 1.6 times. — MIDF Research, Jan 17

This article first appeared in The Edge Financial Daily, on Jan 18, 2017. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Clarinet @ Taman Desa Tebrau

Johor Bahru, Johor