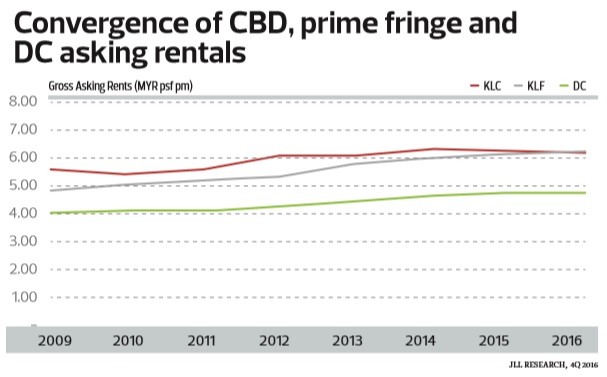

AS connectivity and infrastructure improve and the rental gap between Kuala Lumpur’s central business district (CBD) and city fringe narrows, more companies may move into or relocate to the CBD.

“The multinational companies that moved out may not necessarily move back. But those companies that are considering relocation or setting up a new office may view the CBD as a good possible option because of attractive rental rates while traffic congestion may no longer be an issue once the Mass Rapid Transit (MRT) and other infrastructure is in place by mid-2017 onwards,” JLL Malaysia country head YY Lau tells City & Country.

Multinational companies that moved to the KL fringe and decentralised (DC) area include BG group, Wong & Partners and Accenture. Traffic congestion, better options outside the CBD and lower rental rates were among the reasons they moved out, Lau says.

She adds that the trend of MNCs moving back to the CBD will start this year.

InvestKL CEO Datuk Zainal Amanshah calls the new MRT and Light Rail Transit (LRT) lines a massive game changer and one of the major attractions for investors.

Lau and Zainal were giving their views at a media briefing on Malaysia’s 2016 update and 2017 market outlook by JLL Malaysia.

“Upcoming hubs will be reachable by public transport and people don’t need to own a car anymore. There are options and it is a city that is progressing,” says Zainal. “Despite global uncertainty, they (the investors) still have to grow. But where is the optimal location? We believe Kuala Lumpur is moving on the right path,” he adds.

InvestKL targets to bring in 100 multinational companies to invest in Malaysia by 2020.

Lau tells City & Country that the possibility of new companies setting up offices in the CBD depends on the type of business and availability of options, among other things.

“However, infrastructure is definitely one of the factors that drives office demand. Every one of our clients that wants to relocate or change their office address, the first question on the statement of requirement (SOR) is connectivity,” says Lau.

Office oversupply to continue in 2017

The oversupply situation is expected to continue in the CBD in 2017, which also has to cope with competition from the KL fringe and DC area. Rents are declining as demand softens.

On the other hand, rents are on an uptrend in the KL fringe as the submarkets gained popularity over the years, and they will become more attractive after the completion of MRT line 1.

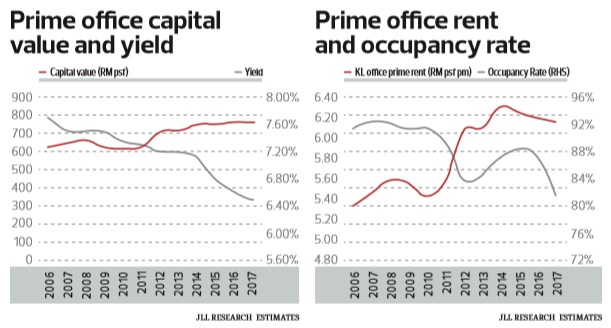

In general however, prime rents could continue to soften this year due to oversupply before recovering.

Lau foresees a drop in office rents of up to 10% generally in the CBD, KL fringe and DC area this year.

“Of the four locations, there is a possibility that rents will soften. We are not looking at buildings but areas. In the CBD, it will drop because of the oversupply situation. The oversupply will also come into play for the KL fringe this year, with some new projects completing. For DC, there is no oversupply situation, but there will be in Cyberjaya and Putrajaya.

“Again, there is a possibility but whether it will really soften or not depends on many other factors. But definitely, we won’t see it shooting up,” Lau says.

She stresses that not all buildings will drop by 10% and it will vary from one building to another.

“If you look at Menara Petronas, they will tell you that the rent has increased because there is no space. But if you go to a newer building that doesn’t have much occupancy yet, then maybe the rent there has decreased,” she says.

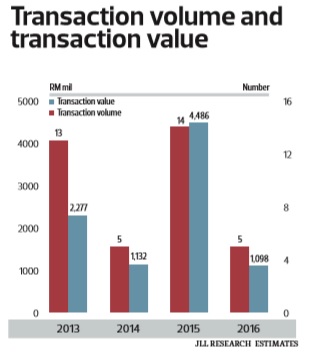

JLL Malaysia capital markets associate director Nick Charlton says rents and capital values will decline further this year, with the latter anticipated to drop 0.3%.

“Several reasons such as the weakening ringgit weighing on overseas investments, decline in office demand affecting investor sentiment, low occupancy rate, transaction volumes on the downtrend and others will affect capital values this year,” he explains.

Transaction volumes hit RM4.49 billion in value in 2015 but plunged 76% to RM1.1 billion in 2016. Investment volumes for 2017 are anticipated to be in line with 2016’s.

Overall, the medium-term outlook for Malaysia is positive due to infrastructure development.

“There is continued investment in infrastructure and these developments are going to be the key to opening up new areas in Kuala Lumpur,” Charlton says.

He adds that over the past two years, he has seen a steady influx of overseas investors coming into Malaysia.

“We have seen in excess of 20 to 30 overseas investors actively looking to come to Malaysia,” he says.

But the general election, which is expected to be called in 2017, may weigh on investment decisions in 1H2017, he adds.

This article first appeared in City & Country, a pullout of The Edge Malaysia Weekly, on Jan 30, 2017.

For more stories, download TheEdgeproperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Endah Ria

Bandar Baru Sri Petaling, Kuala Lumpur

Residensi Bintang Shamelin ( Shamelin Star )

Cheras, Kuala Lumpur

University View Apartments (Bukit Beruang Bestari)

Bukit Beruang, Melaka

Puteri Palma Condominium @ IOI Resort City

Putrajaya, Putrajaya

Jalan Kemuning Permai 33/42

Shah Alam, Selangor

Bukit Kemuning Industrial Park

Shah Alam, Selangor