Sunway Bhd (Feb 28, RM3.23)

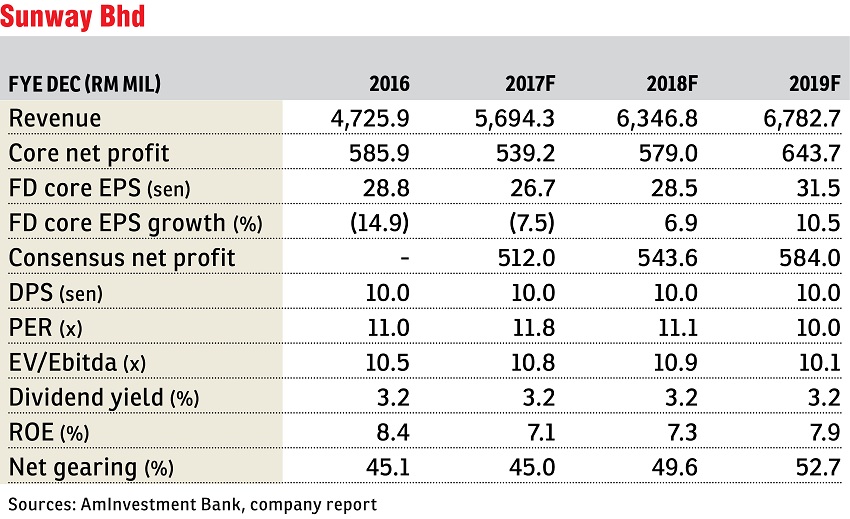

Maintain buy with a fair value of RM3.48: Sunway Bhd’s financial year 2016 (FY2016) core net profit (CNP) of RM547.4 million (excluding fair value gains and employee share option scheme expense) came in above our expectations at 113% and 107% of our full-year forecast and the full-year consensus estimates respectively.

FY2016 CNP dropped 7.3% year-on-year (y-o-y) to RM547.4 million although revenue increased 6.2% y-o-y to RM4.73 billion. The lower earnings were mainly due to its construction division, which recorded lower revenue recognition from local construction projects and higher intra-group eliminations.

Sunway recorded RM1.2 billion new property sales in FY2016 (+0% y-o-y), underpinned largely by sales from Sunway Mont Residences (RM219 million), Singapore (RM184 million), Iskandar (RM128 million) and China (RM188 million). Its unbilled sales stood at RM1.5 billion (from RM1.8 billion as at end third quarter of 2016 [3QFY2016]), mainly due to substantial billings during the quarter.

Its 54.5%-owned unit Sunway Construction Group Bhd’s order backlog stood at RM4.8 billion as at end 4QFY2016, which should keep the unit busy for the next 12 to 24 months. It replenished in total RM2.7 billion of its order book in FY2016.

We continue to like Sunway for its strong earnings visibility, underpinned by sizeable property unbilled sales and construction order book. It has been weathering the slowdown in the property market relatively well due to its well-located land bank locally, as well as its geographical diversification.

Its construction division has already benefitted from the booming local construction sector, with its involvement in the construction of mass rapid transit Line 2 and the massive new government complex called Parcel F in Putrajaya.

We expect Sunway’s earnings to remain resilient even with the slowdown in the property sector due to its diversified earnings base, as only 40% of its net earnings are contributed by the property development division.

The rest of its earnings base is made up of property investment and its stake in Sunway Real Estate Investment Trust, its construction segment and other businesses, including healthcare. — AmInvestment Bank, Feb 27

This article first appeared in The Edge Financial Daily, on March 1, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

Desa ParkCity (The Northshore Gardens)

Desa ParkCity, Kuala Lumpur