Sunway Construction Group Bhd (March 27, RM1.78)

Maintain buy with a higher target price of RM2: Sunway Construction Group Bhd (SunCon) was awarded an RM152.4 million contract for the engineering, procurement, construction and commissioning of the gas district cooling plant 1 in Precinct 1, Putrajaya, involving both a chilled water supply system and power generation system. The job was awarded by the Putrajaya Group, and works will span from March 2017 to August 2018.

In a separate award, SunCon also managed to bag the bore pilling works subcontract for Sungai Besi-Ulu Kelang Elevated Expressway (SUKE) [RM18.1 million] and Damansara-Shah Alam Elevated Expressway (DASH) [RM15.8 million].

We are positive on these contract wins as they represent SunCon’s eighth project secured from the Putrajaya Group and subcontract works for SUKE and DASH even though SunCon did not manage to participate in SUKE and DASH at the main contractor level.

With these two jobs in the bag, SunCon’s year-to-date job wins now total RM900 million (financial year 2016 [FY2016]: RM2.7 billion). Management is gunning for RM2 billion in new job wins while we remain more optimistic at RM2.5 billion, justified by the strong momentum witnessed thus far into the year. Its order book currently stands at RM4.9 billion, translating into a healthy cover ratio of 2.7 times on FY2016 revenue.

In terms of upcoming mega projects, we reckon that SunCon is a strong contender to participate in light rail transit Line 3 (RM9 billion) in which awards are expected to start rolling in from the second quarter of 2017 onwards. Apart from that, job flows should continue to be sustained by development projects from its parent company, Sunway Bhd, generally amounting to RM500 million to RM800 million per annum.

SunCon is a well-managed company with commendable execution capability across a wide array of project types, putting it in a polar position to ride on the ongoing robust flow of construction jobs.

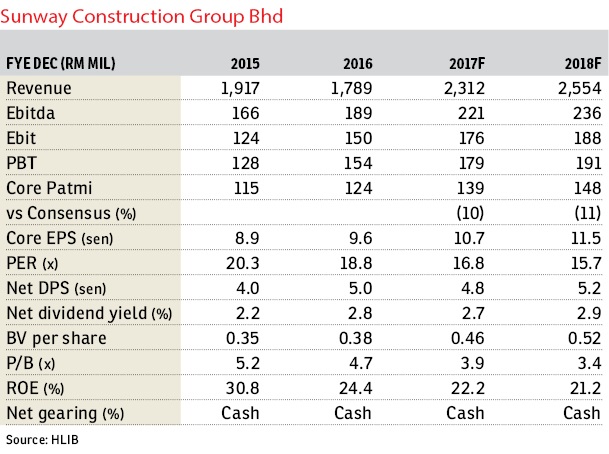

While there are no changes to our earnings forecasts, we raise our TP from RM1.84 to RM2 as we roll forward our valuation horizon from FY2017 to mid-FY2018 at an unchanged price-earnings ratio target of 18 times. We reckon that our premium valuation yardstick is justified by its healthy balance sheet with net cash at 25 sen per share and return on equity of 24% compared with the industry average of 11%. — Hong Leong Investment Bank Research, March 27

This article first appeared in The Edge Financial Daily, on March 28, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Sungai Kapar Indah Industrial Zone

Kapar, Selangor

Trio by Setia

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Asteria Apartment @ Bandar ParkLand

Klang, Selangor

Bungor Precint

Bandar Botanic/Bandar Bukit Tinggi, Selangor