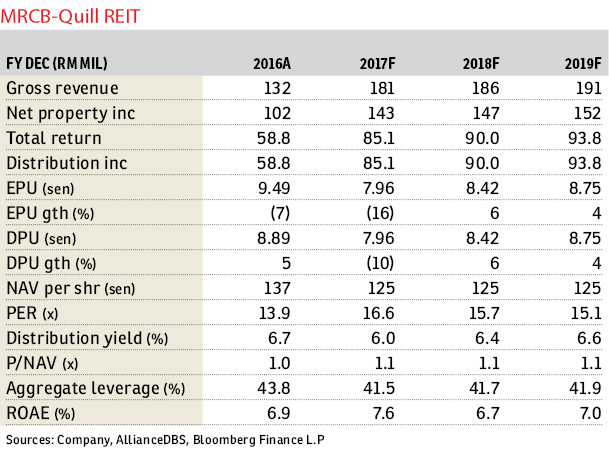

MRCB-Quill REIT (May 5, RM1.32)

Recommend hold with a target price of RM1.34: MRCB-Quill Real Estate Investment Trust’s (REIT) net distributable income for the first quarter of financial year 2017 (1QFY17) of RM23.2 million (+52% year-on-year [y-o-y]) was in line with our/consensus expectations. The increase in income was attributable to the contribution from the sizeable Menara Shell injection from 4QFY16 onwards and higher rental income due to step-up rent adjustments from QB2, QB3 and Wisma Technip. MRCB-Quill REIT’s 1QFY17 net property income margin of 79.3% was within expectations.

In addition, property operating expenses were also higher at RM9.4 million (+30.9% y-o-y) due to the acquisition of Menara Shell. The higher finance costs this quarter were mainly due to higher borrowings after the drawdown of RM164 million commercial papers on Dec 22, 2016 to finance the acquisition of Menara Shell and RM191 million medium term notes (MTNs) to refinance the RM190 million MTNs that matured on March 6, 2017.

Portfolio occupancy was steady at 97%, slightly lower against 4QFY16’s 98%. This was may be partly due to the tenancy reconfiguration of Plaza Mont Kiara. About 14.1% of total net lettable area (NLA) is due for renewal in FY17, out of which 1.8% of these leases have been renewed while 0.3% have not. The remaining 12% will expire in the months ahead. Management will continue to fill up the balance vacant spaces in FY17. The expiring leases in FY18 form 26% of total NLA, and 13% in FY19.

Going forward, we expect some challenges in negotiating positive rental reversions, and occupancy replenishment for MRCB-Quill REIT’s office assets. This is due to additional space coming on stream, exacerbating the office supply overhang, particularly in Kuala Lumpur and Selangor where MRCB-Quill REIT’s office assets are located. Management will be carrying out asset-enhancement works on selected properties within its portfolio, notably, Quill Building 1-DHL and Quill Building 4–DHL. These enhancements will revolve around helping tenants conserve energy and costs, and reduce their carbon footprint.

MRCB-Quill REIT’s asset portfolio has undergone a drastic shift with the acquisition of the RM740 million Platinum Sentral (PS) asset in FY15 and Menara Shell in FY16. We have assumed that PS and Menara Shell will increase the overall occupancy levels for MRCB-Quill REIT’s portfolio from 91% in FY15 to 97% in FY17, and raise the average rent per sq foot from RM4.80 in FY15 to RM5.60 in FY17. MRCB-Quill REIT has the right of first refusal to MRCB’s stable of investment properties, which are worth up to RM1.5 billion in aggregate. However, MRCB-Quill REIT’s current gearing of 37% indicates that new equity issuance will likely be necessary for sizeable acquisitions in the near term. — AllianceDBS Research, May 5

This article first appeared in The Edge Financial Daily, on May 8, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Desa ParkCity (The Northshore Gardens)

Desa ParkCity, Kuala Lumpur

Desa ParkCity (Nadia Parkhomes)

Desa ParkCity, Kuala Lumpur

Desa ParkCity (Adiva)

Desa ParkCity, Kuala Lumpur

Desa ParkCity (Safa)

Desa ParkCity, Kuala Lumpur

Desa ParkCity (The Breezeway Park Homes)

Desa ParkCity, Kuala Lumpur

Periwinkle @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Elemen Residences @ Tropicana Aman

Telok Panglima Garang, Selangor