Property sector

Upgrade to positive: Property sales are poised to grow in 2017 after three consecutive months of year-on-year (y-o-y) increase in approved loans. Based on Bank Negara Malaysia’s Monthly Statistical Bulletin for March 2017, approved loans for the purchase of property (ALPP) has increased 3% y-o-y to RM11.43 billion. The increase is mainly driven by the 20% increase in loan application which implies that demand has improved significantly.

Note that the ALPP numbers have shown a third consecutive month of positive growth y-o-y, we believe that the uptrend of better sales for developers has just been confirmed.

For the first quarter of 2017 (1Q17), approved loans grew 9% to RM28.62 billion. On a monthly basis, ALPP surged 35% month-on-month (m-o-m) due to a 40% increase in loan applications. In our view, the higher approved loans disbursed into the market is a good leading indicator that the value of property transactions has increased, hence property sales should naturally improve.

Property transaction value showed trend reversal in 4Q16. According to the latest Property Market Report released by the National Property Information Centre, Malaysia’s property market transaction value improved 60% quarter-on-quarter (q-o-q) and 38% y-o-y to RM49.6 billion in 4Q16. By segment, the highest growth in transaction value is seen for “commercial” properties priced above RM1 million. We believe that the data reflects demand recovery among consumers due to the stable ringgit and employment outlook.

Consumer Sentiment Index improved in 1Q17. The latest publication from the Malaysian Institute of Economic Research shows that 1Q17 Consumer Sentiment Index improved to 76.6 from 4Q16’s 69.8 and 1Q16’s 72.9. We gather that consumers are generally more optimistic and have indicated their cautiously ambitious spending plans. We believe that the data suggest that the demand outlook for property among the potential buyers has improved and this should translate into better sales in 2017.

House Price Index (HPI) growth was stable at 5.6% in 4Q16. HPI growth remains positive as it grew by 5.6% y-o-y to 243.3 in 4Q16 although it is lower than the five-year average growth of 9.1%. There is also some decline q-o-q but we think that this should be temporary as the Malaysian economy has picked up. Among the key states, the highest y-o-y growth was recorded in Selangor (+8.2% y-o-y to 244.5). This is followed by Johor’s +7.7% y-o-y, Kuala Lumpur’s +5.3% y-o-y and Penang’s +0.7% y-o-y. We believe that the outlook for property price growth is better in Greater Kuala Lumpur (Selangor and Kuala Lumpur) due to the support from the urbanisation factor.

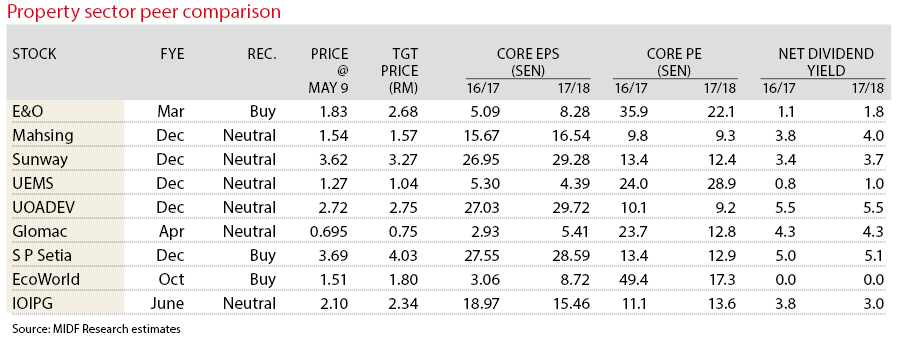

Upgrade the sector to “positive” with S P Setia Bhd (buy; target price [TP]: RM4.03) as our top pick. We recently upgraded S P Setia to “buy” due to: i) our belief that it will gain FBM KLCI status in three years’ time; ii) positive newsflow surrounding the I&P Group Sdn Bhd deal; and iii) good dividend yield of 5%.

We like Eco World International Bhd for its excellent sales achievement and strong branding. As for Eastern & Oriental Bhd (E&O), we are positive on the long-term prospect of E&O following the entry of Kumpulan Wang Persaraan (Diperbadankan) (KWAP) as strategic investor of Seri Tanjung Pinang Phase 2A (STP2A). The entry of KWAP as a strategic investor helps to unlock the value of the STP2 project and further ensure the execution of STP2A, which is an all-important project to E&O.

Downgrade UOA Development Bhd to “neutral” with an unchanged TP of RM2.75 due to limited upside. UOA Development’s share price has risen by 14% since our upgrade on Nov 24, 2016. Given limited upside to our TP, we downgrade recommendation to “neutral” from “buy”. Nevertheless, the fundamentals of UOA Development remain intact with decent property sales and a healthy balance sheet with net cash position. Dividend yield remains attractive at 5.5%. — MIDF Research, May 11

This article first appeared in The Edge Financial Daily, on May 12, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Taman Tasik Semenyih (Lake Residence)

Semenyih, Selangor

Pusat Bandar Putra Permai

Seri Kembangan, Selangor

Jalan Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Taman Impian Indah (Paragon Heights)

Bukit Jalil, Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)