S P Setia Bhd (May 12, RM3.63)

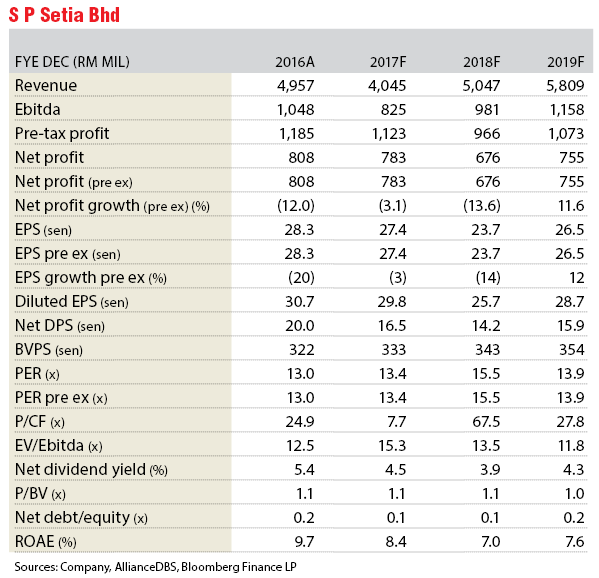

Maintain hold with a target price of RM3.50: Despite S P Setia Bhd’s diversified product offerings to cater to various target markets, the relatively challenging property market in Malaysia and London may weigh on its new property sales.

We believe slow property sales are the new norm going forward, which will result in subdued earnings growth prospects.

S P Setia achieved RM3.82 billion sales in the financial year ended Dec 31, 2016 (FY16), exceeding its FY16 sales target of RM3.5 billion (revised earlier from RM4 billion), thanks to strong demand from Malaysian projects. Nevertheless, this was S P Setia’s lowest sales since FY12. Also, sales of the Battersea Power Station project in London, which contributed 46% of its RM7.8 billion unbilled sales (as at end of March 2017), have slowed down considerably in the aftermath of Brexit. Overseas unbilled sales have been on a declining trend after the completion of several projects in Singapore, Australia and London. Weaker sales replenishment thereafter could pose downside risk to earnings. S P Setia’s sales will be mainly driven by township developments in Malaysia, which remain well received as the group focuses on launching more affordable and mid-range housing.

S P Setia reported earnings of RM105 million (-75% quarter-on-quarter) for the first quarter ended March 31, 2017 (1QFY17), accounting for 13%/14% of our/consensus estimates. The seemingly weak 1QFY17 earnings were due to the minimal contribution from Battersea Power Station phase 1 project, which only delivered one block of residential unit during the quarter, and there are still nine residential blocks to be delivered by September 2017. Therefore, 1QFY17 results were deemed in line given the much-improved results expected in the subsequent quarters. S P Setia achieved RM427 million sales in 1QFY17, of which 82% came from Malaysian projects in the central region. The seasonally slow sales were within expectations given the shorter working period in 1QFY17 due to festivities.

S P Setia has a strong launch pipeline for the remainder of FY17, which will help contribute to its FY17 sales target of RM4 billion. Some of the key projects to be launched include KL Eco City (RM615 million gross development value [GDV]), Setia Sky Seputeh (RM478 million GDV) and Australian projects worth RM1.65 billion GDV. Its strategy to launch more mid-priced-range products for its township developments bodes well for its sales given the strong demand for lifestyle landed properties with good infrastructure and amenities. Its earnings visibility remains healthy with RM7.8 billion unbilled sales, which will underpin its earnings over the next two years. Nevertheless, we notice that its overseas unbilled sales, which account for 48% of the total, have been on a declining trend due to weaker replenishment and they are set to drop further after the delivery of Battersea Power Station phase 1. Therefore, strong domestic sales will be critical to sustain its earnings growth. Its balance sheet remains healthy with net gearing at 19% as at end of March 2017. The group still has ample room to gear up for major land-bank acquisition should there be any attractive opportunity. Nevertheless, S P Setia boasts a vast land bank of 5,141 acres (2,080ha) worth RM76 billion GDV, which will generate revenue for decades.

Strong property sales from its township developments could reinforce investor confidence with regard to S P Setia’s ability to weather the downturn in the property sector. This is critical for maintaining its earnings momentum going forward given the challenging property market outlook. The relatively soft property market could lead to weaker sales. Nevertheless, S P Setia’s focus on township development will make it less vulnerable to the weaker sentiment, judging by the strong demand for its recent launches. — AllianceDBS Research, May 12

This article first appeared in The Edge Financial Daily, on May 15, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Damansara Heights

Damansara Heights, Kuala Lumpur

Taman Jaya Utama

Telok Panglima Garang, Selangor