Eversendai Corp Bhd (May 17, 88.5 sen)

Maintain underperform with a higher target price (TP) of 49 sen: On Tuesday, Eversendai Corp Bhd announced that it had secured new contracts of over RM557.6 million since April, bringing year-to-date (YTD) contracts won to RM1.3 billion.

These new contracts worth RM557.6 million are split between India (64%) and the Middle East (36%). These projects comprise residential developments, office buildings, a start-up incubator complex, a museum and a metro station.

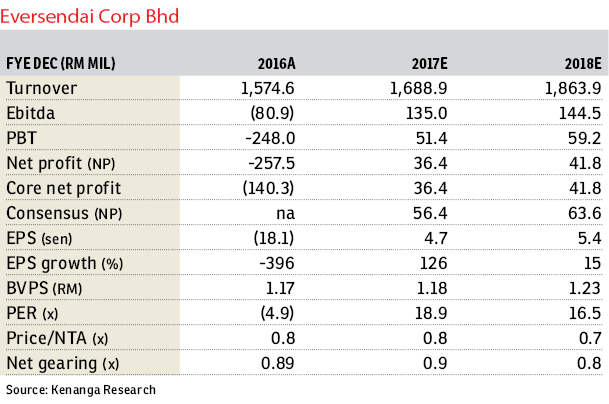

We remain “neutral” on these wins (RM1.3 billion YTD) as they still remain within our financial year ended Dec 31, 2017 (FY17) replenishment target of RM1.8 billion, making up 72% of our target with a remainder of RM500 million to be achieved.

Assuming a 36-month span for the contracts, coupled with profit before tax margins of 3% for India and 6% for the Middle East, the projects are expected to contribute about RM5.7 million to bottom line per annum.

Post contract wins, Eversendai’s outstanding order book stood at about RM3.2 billion, providing visibility for the next two years. We note that we have taken a more conservative stance and assumed a replenishment target of RM1.8 billion in FY17 versus management’s target of RM2.5 billion.

On a separate note, Eversendai’s first liftboat (85% completed) is scheduled for delivery in July 2017 and the second one (55% completed) is scheduled for delivery in FY18. While we understand that the client, Vahana Holdings Sdn Bhd, has obtained financing for the first liftboat, we remain cautious about the second liftboat in case it failed to secure financing, potentially raising the risk of impairments.

We maintain our FY17 to FY18 earnings of RM36.4 million and RM41.8 million post contract awards.

YTD, Eversendai’s share price has increased 51% and is currently trading at FY18 price-earnings ratio (PER) of 16.5 times — which is deemed steep. Hence, we reiterate our “underperform” call even with a higher TP of 49 sen (from 42 sen) after rolling forward our valuation base year to FY18 on an unchanged nine times PER.

While our valuation at nine times PER for Eversendai is at the lower end of our targeted small- to mid-cap peers’ range of nine times to 13 times, we believe it is fair given that Eversendai’s historical earnings have been volatile with impairments of receivables due to payment collection issues, the potential risk of impairments from the liftboats scheduled for delivery in FY18, and their existing high gearing of 0.9 times (as of FY16) versus peers’ average of 0.1 times. — Kenanga Research, May 17

This article first appeared in The Edge Financial Daily, on May 18, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Taman Perindustrian Ehsan Jaya

Kepong, Kuala Lumpur

Peranakan Straits, Setia Eco Templer

Rawang, Selangor

Country Heights Damansara

Country Heights Damansara, Kuala Lumpur

East Residence @ KLGCC

Damansara, Kuala Lumpur

The Ritz-Carlton Residences

KLCC, Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)