Malaysian Resources Corp Bhd (May 18, RM1.54)

Downgrade to hold with a higher target price (TP) of RM1.76: Malaysian Resources Corp Bhd (MRCB) proposes a one-for-one renounceable rights issue together with free warrants on the basis of one warrant for every five rights shares (one-for-five).

The cash call will raise between RM2.2 billion and RM2.9 billion based on the illustrative rights price of RM1 per share (27% discount to the last traded price).

Separately, the free rights warrants, based on the illustrative strike price of RM1.60 per share (8% discount to last traded price), will generate between RM695 million and RM914 million in proceeds. This deal is targeted to be completed in the third quarter ending Sept 30, 2017 (3QFY17).

Major shareholders — Employees Provident Fund Board with a 34% stake, and Gapurna Sdn Bhd (16.7% stake) — will fully subscribe to the rights issue. As this may trigger a mandatory offer for the remaining shares, both parties will collectively apply for an exemption.

A sizeable portion (34% to 45%) of the proceeds will be set aside to fund the refurbishment and upgrading of the Bukit Jalil National Sports Complex.

Some 29% to 38% of the new money will be used to repay borrowings, resulting in RM47 million in interest savings per annum. Under the maximum scenario (including RM1.4 billion from full conversion of the existing out-of-the-money warrants A), net gearing will fall from 0.73 times (net debt: RM2.2 billion) as at end of financial year 2016 (FY16) to net cash post the rights issue.

Even if the employee share option scheme and existing warrants A are assumed unexercised, the rights issue and free warrants will bump up share capital by 120% to 4.8 billion fully diluted (FD) shares. If all convertibles are accounted for, share capital will jump 189% to 6.3 billion FD shares.

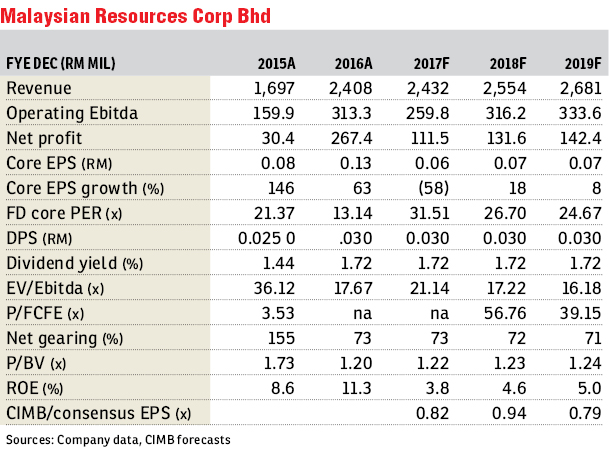

We estimate 24% to 39% dilution to FY17 earnings per share (EPS) and 28% to 43% dilution to FY18 EPS after taking into account potential interest savings and income from warrants proceeds. Our revalued net asset value (RNAV)/TP will be diluted by up to 17%.

We acknowledge the longer-term benefits of this deal for the group’s ongoing and new property and construction ventures, mainly in KL Sentral, Cyberjaya, Kwasa Damansara and Bukit Jalil. However, a rights issue of this magnitude typically weighs on sentiment and could create an overhang on the share price over the short term.

Our ex-all FD TPs (20% discount to RNAV) of RM1.39 (minimum scenario) and RM1.36 (maximum scenario) imply 1% to 3% upside (with dividend yield) to the theoretical ex-all price of RM1.37.

Our FY16 to FY18 EPS forecasts are unchanged pending the completion of the rights issue. We downgrade from “add” to “hold” with a higher TP as we fine-tune the value of selected land banks (unchanged 20% RNAV discount).

An upside risk to our call is if the Bandar Malaysia memorandum of understanding materialises with a major transport hub project for the group. Delays in potential contract wins and the long overdue sale of the Eastern Dispersal Link Expressway in Johor are likely downside risks. — CIMB Research, May 18

This article first appeared in The Edge Financial Daily, on May 19, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Desa Idaman, Taman Puchong Prima

Puchong, Selangor

Duduk Huni @ Eco Ardence

Setia Alam/Alam Nusantara, Selangor

Taman Sengkang @ Pasir Panjang

Port Dickson, Negeri Sembilan