Magna Prima Bhd (June 6, RM1.53)

Initiate market perform with a target price (TP) of RM1.60: Magna Prima Bhd is a niche high-end property developer with pure exposure in the Klang Valley with a total land size of 29.6 acres (11.98ha).

Notable developments by Magna include The Avare and Boulevard Business Park. In recent years, Magna has expanded overseas with “The Istana” in Melbourne, Australia.

Excluding unbilled sales of RM49 million and unsold inventories with a gross development value (GDV) of RM198 million, Magna has a remaining GDV of RM2.5 billion, which should provide another six to eight years of earnings’ visibility on the back of average annual revenue of circa RM150 million to RM200 million.

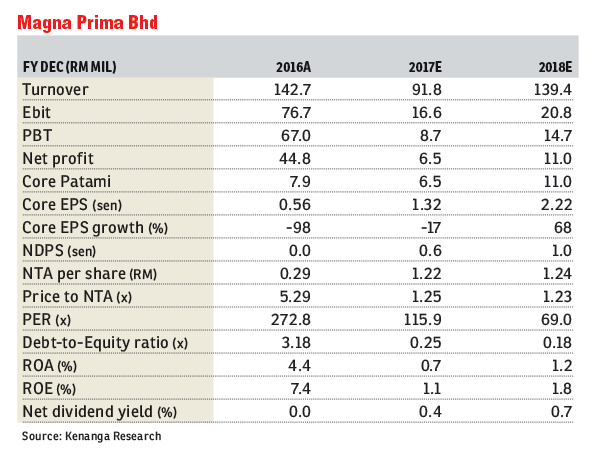

With the completion of its flagship projects, we expect the financial year ending Dec 31, 2017 (FY17) revenue to decline by 36% to RM91.4 million, while FY18 revenue should recover by 51% to RM138.2 million thanks to the low base effect, and higher sales (RM155.2 million — RM183.2 million for the FY17-FY18E).

In line with lower revenues, FY17 core earnings could weaken by 17% to RM6.5 million albeit with a margin improvement from 5.5% to 7.1% as construction costs have already been incurred. Meanwhile, the FY18 earnings should rise on revenue growth.

Despite average gearing, return on equity (ROE) at 2% to 3% is weaker than the sector average of 9% to 10% as earnings trended down post flagship completions, while its investment properties lock in significant value, which should improve ROE once a sale materialises.

ROE should also improve on new largescale developments. However, we do not expect ROE to reach sector average levels until its investment properties’ values are realised and/or if the momentum of development earnings increases significantly.

Media sources mentioned that Magna may sell some 2.6 acres along Jalan Ampang at about RM400 million (at RM3,500psf) with potential disposal gains of RM230 million. Should the sale go through, we anticipate the proceeds to pare down borrowings (current net gearing of 0.3 times) and support working capital needs. Note that we have not imputed the land sale into our estimates.

Recently, Hua Yang Bhd acquired a 20.1% stake in Magna for RM1.85/share, raising its stake to 30.9%. We are positive on Huayang’s move as we believe that there are synergies between the two companies such as similar development perspectives, landbank advantage and affordable housing expertise. However, as management has not specified the details of their collaboration, we believe the move should be more a long-term catalyst

Fully-diluted (FD) revalued net asset valuation (RNAV) per share of RM2.94 is driven by an 11% weighted average cost of capital, 15% net margin for a planned RM2.5 billion GDV, RM48 million unbilled sales, and full warrants conversion.

Our TP is based on a 35% property RNAV discount rate, among the narrowest for Klang Valley developers because land banks can be readily launched. Its FY17 to FY18 FD price-earnings ratios of 50.6 times and 28.6 times are substantially above-average as implied by the price paid by Hua Yang of RM1.85 per share, affirming the company value on a “land acquisition basis”.

This may have raised the pricing benchmark for the stock ahead of current earnings and tighten the gap of its RNAV discount. Nonetheless, we believe it is tough to price the company at such acquisition levels as premiums are usually paid for strategic/controlling stakes in a company. — Kenanga Research, June 6

TOP PICKS BY EDGEPROP

Andana Condominium @ D'Alpinia

Puchong South, Selangor

Pangsapuri Angsana, Bandar Mahkota Cheras

Cheras, Selangor

South Brooks @ Desa ParkCity

Desa ParkCity, Kuala Lumpur

Paloma @ Tropicana Metropark

Subang Jaya, Selangor