PETALING JAYA (June 9): Hong Kong’s residential prices have gone up 75.9% compared to the market peak in 1997 after the city island was handed back to China, according to global real estate firm JLL.

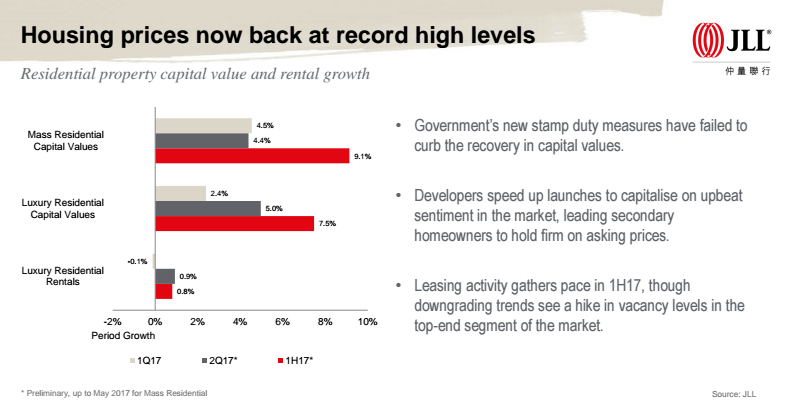

In its latest Land and Residential Market Review report, JLL said capital values of mass and luxury residential rose 9.1% and 7.5% respectively in their first five months of 2017, despite the government introducing new stamp duty measures.

“Leasing activity gathered pace through the first five months of 2017, though ongoing downgrading trends led to a hike in vacancy levels in the top-end of the market. Still, luxury residential rents were able to edge up 0.8% over the same period.

“With prices hitting new record highs, developers have increasingly sought to build smaller units, to keep lump sums affordable. The average size of new flats currently under construction stands at about 600 sq ft, which is the smallest since 2001,” said the report.

A typical flat in Hong Kong now costs about HK$7 million (RM3.8 million), which is about 17 times the average median household income.

“Nevertheless, the mortgage payment to private household income ratio stood at 47% at end-May, much healthier than 1997 when it was up to 100%,” said JLL.

According to JLL, despite the government’s cooling measures, the primary sales market continues to perform well, largely supported by strong pent-up demand from first-time buyers, which accounted for about 90% of overall transactions in recent months.

The appeal of primary market developments has been supported by developer financing, which helps buyers to get on the housing ladder.

JLL noted that some individual developments have reported as much as 35% of buyers utilising developer financing but currently account for very few transactions in the overall market.

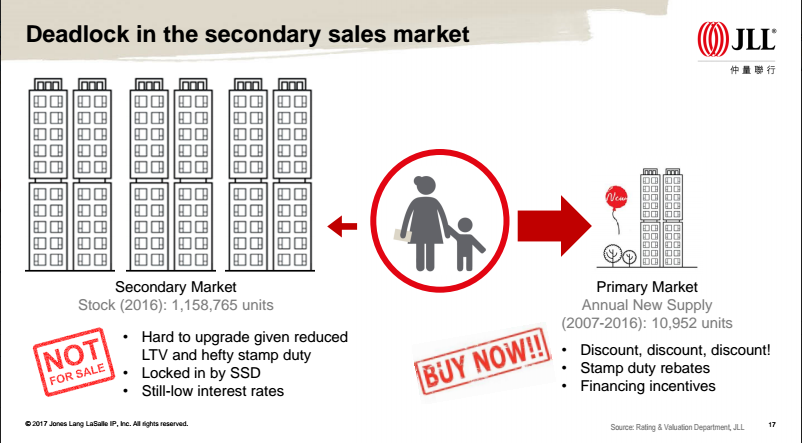

“Average monthly sales in secondary market, however, fell 41% in the first four months to 3,515 compared with the previous 10 years. We believe that the secondary sales deadlock is mainly attributed to the cooling measures restricting liquidity in the secondary market.

“The secondary market is a huge source of supply, with a total of 1.2 million private units. On the other hand, the primary market accounts for only a small share of the overall market, with the last 10 years (2007 to 2016) seeing an average of just 10,952 units being completed per year despite the government’s intention to lift supply,” said the report.

JLL managing director Joseph Tsang said sales activity will be focused in the primary market over the next six months, given the new loan-to-value measures and deadlock in the secondary market.

“This will continue to benefit developers with a line-up of new project launches, against an expanding supply pipeline. Developers will actively re-adjust to any future government policy while remaining eager in their new launches.

“With the Hong Kong Monetary Authority’s new measures unlikely to see changes in the current market dynamics and the impact of the anticipated interest rate rise largely factored into purchased decisions, we expect the capital values across the board to rise 10% to 15% for the full year. Rental of luxury residential will drop 0% to 5% this year,” he said.

Chinese developers keep streaming in

JLL noted that Chinese developers continue to pour into Hong Kong’s land sales market, snapping up all of the residential sites tendered by government so far this year.

“Chinese developers, who withdrew from Hong Kong’s government residential land sale market after the property market bubble burst at the end of 1997, have been steadily returning to the market since 2011.

“In terms of consideration, the share of residential sites awarded to Chinese developers via government public land sale has gradually increased from 1% in 2011 to 100% so far this year,” said the report.

Chinese developers now account for 62% of the total market capitalisation of property development companies listed on the Hong Kong Stock Exchange, suggesting there is still a huge potential for these companies to engage in property development in Hong Kong.

“We believe the government’s latest tightening measures will limit the gearing ratio and increase the cost of land acquisition and property developments. Local heavyweights, which usually carry lower gearing rations, will be minimally affected.

“However, the appetite of small to medium-sized developers with less robust cash positions could potentially be reduced,” said JLL international director and head of valuation and advisory services in Asia Lau Chun-kong.

He expects Chinese developers to remain eager in seeking residential development opportunities in the city island given the ongoing depreciation of the renminbi and their longer-term global expansion strategies.

TOP PICKS BY EDGEPROP

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

Villa Kesuma, Bandar Tasik Kesuma

Semenyih, Selangor

Harmoni Apartment @ Eco Majestic

Semenyih, Selangor

D'Cerrum Apartment @ Setia EcoHill

Semenyih, Selangor

Country Heights Kajang

Country Heights, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor