Sunway Bhd (Aug 2, RM4.37)

Maintain neutral with a higher target price (TP) of RM4.25: Sunway Bhd announced the acquisition of four parcels of freehold land totalling approximately 14.8 acres (5.98ha) in USJ 1 for a total purchase consideration of RM168 million. Moreover, Sunway also announced the acquisition of approximately 5.3 acres of freehold land in Kajang for RM63 million. The acquisitions are estimated to be completed by February 2018.

In the interim, Sunway intends to use the four parcels of industrial lots in USJ 1 as warehouses and storage facilities for its trading and manufacturing business. Nevertheless, Sunway sees future redevelopment opportunity on the land as the land is strategically located 500m from Da Men Mall and Summit USJ.

Besides, the land is also located only 600m from the South Quay bus rapid transit station. The land is ideal for redevelopment into mixed-use development with estimated gross development value (GDV) of RM1.4 billion. We are positive on the land acquisition as it is expected to serve as an extension to its Sunway City township given the close proximity of the land to Sunway City.

On its land acquisition in Kajang, it comprises a semi-completed commercial development that was discontinued by the previous developer. We are positive on the land acquisition as Sunway intends to complete the semi-completed structure but will replace the original development plan with a proposed transit-oriented development due to its proximity to the Sungai Jernih mass rapid transit station. The proposed mixed-development comprises a retail podium/commercial lots, and serviced apartments or small office home office units with indicative GDV of RM460 million.

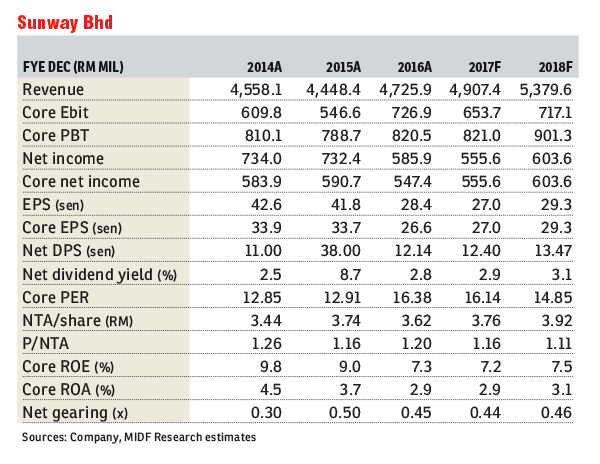

Sunway intends to fund the acquisitions via internally generated funds and borrowings. We estimate the net gearing of Sunway to be lifted marginally to 0.5 times post acquisitions from a net gearing of 0.47 times as of the first quarter of financial year 2017. Meanwhile, we expect no immediate earnings impact from the land acquisitions as we estimate launches for transit-oriented development in Kajang to take place soonest in FY18.

We left our earnings forecasts for FY17-FY18 unchanged as we expect earnings contribution from the proposed development to kick in from FY19. Meanwhile, we revised our sum-of-parts-based TP for Sunway upward to RM4.25 from RM3.82 after taking into account the net present value from the proposed development and updating the valuation of other divisions to reflect the latest sector price-earnings ratio. — MIDF Research, Aug 2

This article first appeared in The Edge Financial Daily, on Aug 3, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

The Cove @ Horizon Hills

Iskandar Puteri (Nusajaya), Johor

TAMAN LAVENDER HEIGHTS (SENAWANG)

Seremban, Negeri Sembilan

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Twentyfive.7 Lucent Residences

Telok Panglima Garang, Selangor