Kerjaya Prospek Group Bhd (Aug 2, RM3.60)

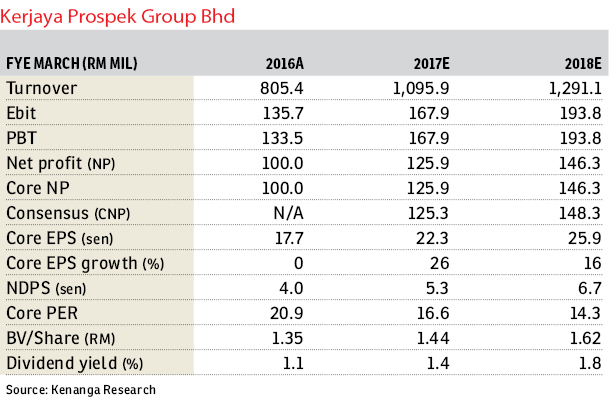

Downgrade to underperform with a higher target price (TP) of RM3.15: Kerjaya Prospek Group Bhd on Tuesday announced that its 70%-owned subsidiary Future Rock Sdn Bhd had secured a RM45.9 million subcontract from China Communications Construction Co, which entails setting up a perimeter bund for Seri Tanjung Pinang Phase 2B slated for completion in July 2018.

We are neutral about the award as its 70% effective stake in this newly secured contract together with existing year-to-date wins amount to RM412 million — which is still within our targeted replenishment of RM1.6 billion; accounting for 25% of our full-year target. We note that management targets a more conservative replenishment of RM800,000 for the financial year ending Dec 31, 2017 (FY17). Assuming a profit before tax margin of 14%, the contract is expected to contribute around RM3.4 million to Kerjaya Prospek’s bottom line for the next 10 months.

Currently, Kerjaya Prospek’s outstanding order book stands at RM2.6 billion, giving it a visibility of around 2.5 years. Meanwhile, Kerjaya Prospek’s tender book stands at RM1.4 billion, which we believe, comprises jobs from its core clients (S P Setia Bhd, Eastern & Oriental Bhd, and Eco World Development Group Bhd). We note that Datuk Tee Eng Ho’s (Kerjaya Prospek executive chairman) private property arm plans to launch a mixed development project in Old Klang Road with a gross development value of RM1 billion, which we believe would amount up to around RM300 million to RM400 million of contracts likely to be secured. Furthermore, we believe that Kerjaya Prospek could possibly undertake a one-for-one bonus issue as the Companies Act 2016 states that the share premium account will no longer be applicable from FY18 onwards and Kerjaya Prospek had a high share premium of RM332 million versus a share capital of 257 million as of the first financial quarter ended March 31, 2017.

Year to date (YTD), Kerjaya Prospek’s share price has gained 67%, surpassing our initial TP of RM3.10 and is also among the top gainers compared to other KL Construction Index members’ average YTD gain of 18%. In addition, we highlight replenishment risk whereby Kerjaya Prospek would have to replenish RM1.2 billion worth of contracts (vs current tender book of around RM1.4 billion) in the next five months based on our targeted replenishment of RM1.6 billion and it is currently behind schedule. Even should it manage to achieve our FY17 to FY18 target replenishment of RM1.2 billion to RM1.6 billion to sustain earnings moving forward, Kerjaya Prospek is already currently trading at FY18 price-earnings ratio of 14 times, much higher than small- and mid-cap peers’ average of 11 times. Even in a more optimistic scenario whereby Kerjaya Prospek exceeds our FY17 to FY18 replenishment target and we upgrade its construction valuation to 14 times from 13 times previously, there would still be a downside of 8% versus its last closing price of RM3.70, indicating an “underperform” call.

We note that our existing applied construction valuation of 13 times is already the peak among the small- and mid-cap construction peers under our coverage. Given that risk-to-reward ratio is no longer compelling, we downgrade Kerjaya Prospek to “underperform” from a previous call of “market perform”, but with a higher sum-of-parts-derived TP of RM3.15 from RM3.10 previously after updating property valuations to six times (from five times) to reflect closer to average valuation of small- and mid-cap property counters. We believe Kerjaya Prospek’s rerating catalyst would be implementation of a dividend policy with a dividend payout rate of more than 35% and a higher-than-expected replenishment or margin. — Kenanga Research, Aug 2

This article first appeared in The Edge Financial Daily, on Aug 3, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Pangsapuri Orchid View Luxury Apartment

Johor Bahru, Johor

TriTower Residence @ Johor Bahru Sentral

Johor Bahru, Johor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor

Havona Residence @ Taman Mount Austin

Johor Bahru, Johor