Matrix Concepts Holdings Bhd (Aug 7, RM2.73)

Maintain buy rating and a target price (TP) of RM3: Matrix Concepts Holdings Bhd announced the proposed acquisition of 21 parcels of 132 acres (53.4ha) of agricultural land in Port Dickson for RM57 million from individual landowners. We understand that the land parcels are located next to its existing Bandar Sri Sendayan township.

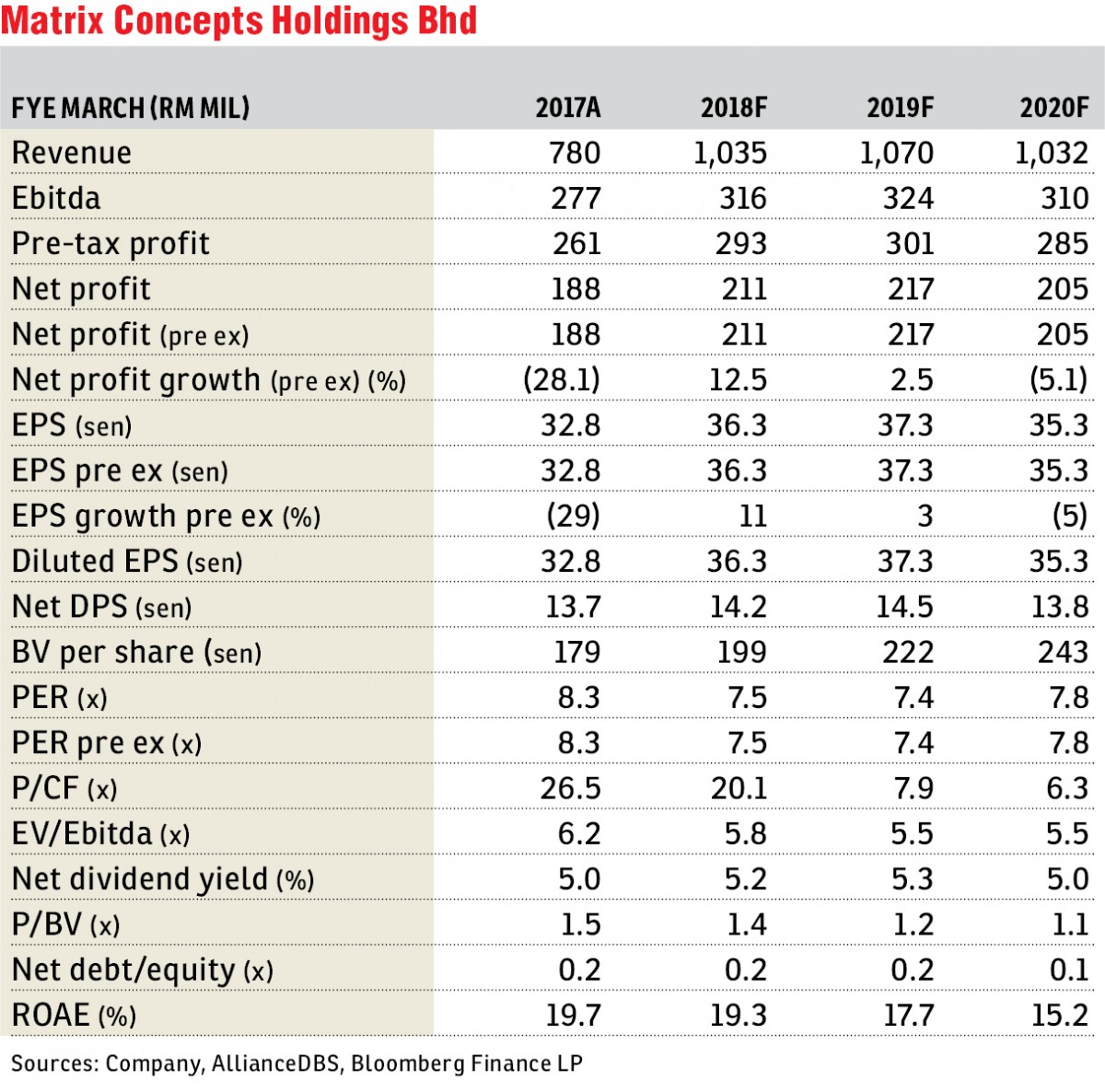

Matrix Concepts currently has an estimated 1,750 acres (708.2ha) of land bank worth RM9 billion in gross development value (GDV), mainly concentrated within its vast Bandar Sri Sendayan township. The proposed acquisition is expected to contribute an additional RM700 million to GDV, further extending the vibrancy of Bandar Sri Sendayan.

The purchase price of RM57 million implies a payment of RM9.90 per sq ft which is a bargain valuation in our view, taking into consideration the daunting task of negotiating with the respective small-parcel owners. This acquisition also makes up 8% of the estimated potential GDV, which should ensure strong margins for Matrix Concepts for its affordable housing products.

We maintain our “buy” rating and TP of RM3, based on a 30% discount to our fully diluted revised net asset value of RM4.27. Matrix Concepts is currently trading at a bargain 7.5 times financial year 2018 forecast (FY18F) price-earnings ratio despite strong earnings visibility and a decent dividend yield of about 5% for this township developer. — AllianceDBS Research, Aug 7

TOP PICKS BY EDGEPROP

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur

Halya @ Daunan Worldwide

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Citizen 2

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Razak City Residences

Salak Selatan, Kuala Lumpur