Co-working centres continue to expand globally, although the rate of growth slowed from 30% in 2015 to 22% in 2016, according to Deskmag’s Global Co-working Survey 2017.

Mature markets in Asia have seen a similar growth trend, with CBRE Research data showing that about 50 new co-working centres have opened in Hong Kong, Singapore, Shanghai and Sydney over the past 12 months, representing growth of around 20%.

China, India and Southeast Asia are the main drivers of growth. In India, co-working operators are expected to lease more than 1.5 million sq ft of additional space this year. In China, growth is being supported by government policies to promote entrepreneurship, with Shanghai now home to more than 100 co-working centres.

CBRE Research has observed a diverse range of strategies among different co-working space operators. Among international operators, several large ones are expanding aggressively in Asia-Pacific, fuelled by private equity and venture capital. International operators tend to take up spaces larger than 20,000 sq ft in prime buildings in CBDs and core locations. After establishing a presence in core locations, they expand into non-core areas.

As for the traditional serviced office operators, several international firms have begun refurbishing some of their spaces to provide a more modern and casual work environment. Some groups have also set up new divisions and brands to provide co-working spaces.

Major growth drivers

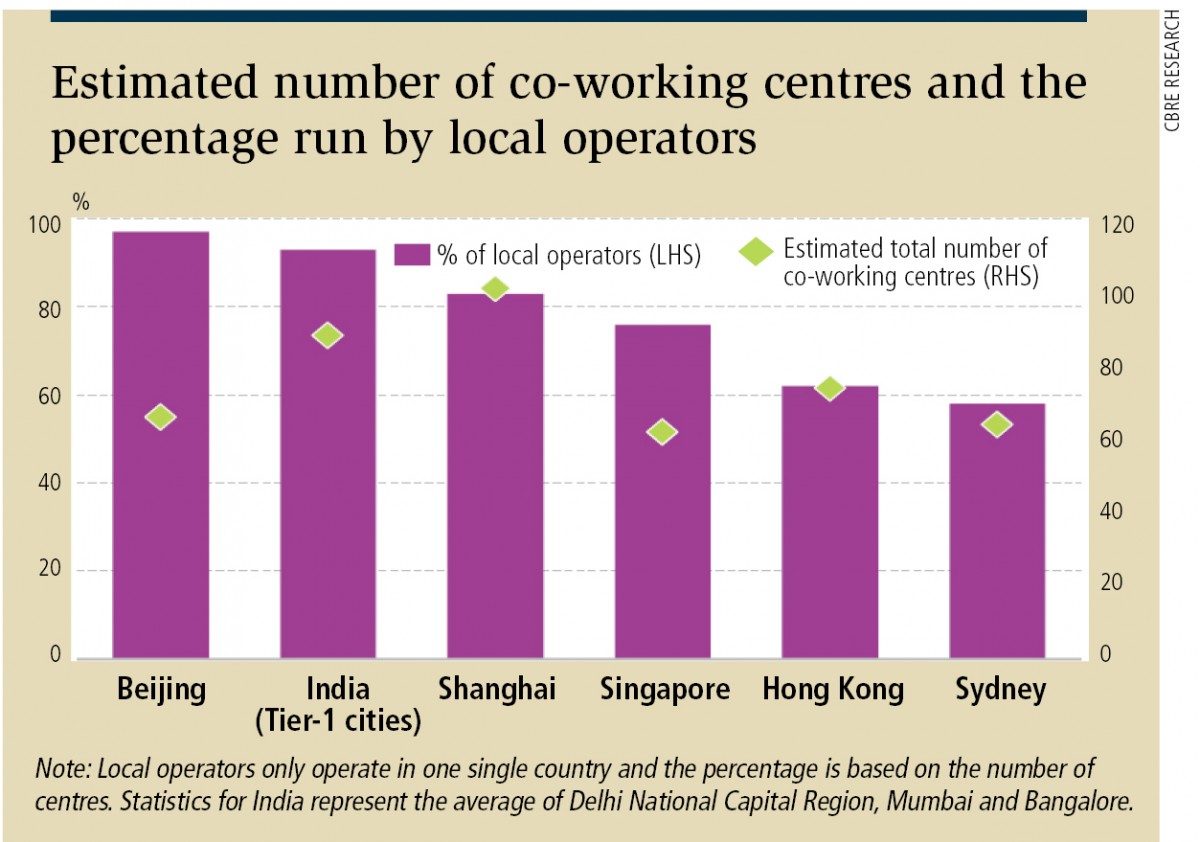

Domestic co-working operators expanding in their home markets are currently the major drivers of growth. In China, India and Southeast Asia (excluding Singapore), domestic operators represent 80% to 90% of the market by number of centres. While several domestic brands have expanded to multiple locations, most have only one stand-alone centre.

Although major gateway cities such as Singapore, Hong Kong and Sydney have a higher representation of international operators, domestic groups still account for 60% to 70% of the market.

Large markets such as China and India have seen the rise of big domestic operators with numerous centres across several cities. For example, naked Hub now has 20 centres in operation and in the pipeline in China, while SOHO 3Q has a total of 18 centres in Shanghai and Beijing. In India, Awfis Space Solutions has more than 20 centres and plans to expand to 100.

Some Asian operators, such as The Work Project and UrWork, have expanded into new countries within the region. Co-working centres run by large Asia-based operators are not restricted to decentralised locations. As with international operators, they tend to solicit investment from funds to drive business expansion and provide them with the financial means to lease core and CBD locations. These operators can afford to lease 30,000 sq ft or more spaces in buildings in CBD and fringe districts.

In addition to major local and international players, there are a large number of single-facility co-working centres run by young entrepreneurs or start-ups. These centres tend to operate 5,000 to 10,000 sq ft spaces in non-Grade-A buildings in fringe CBD areas or in decentralised areas, targeting millennials and start-ups.

MNCs’ use of co-working space

Co-working space has traditionally been targeted at start-ups and independent contractors. However, as MNCs seek to build more flexibility into their real-estate portfolios, co-working space has emerged as one potential solution. Co-working operators can also benefit from corporate members as they provide more stable income streams than start-ups and freelancers, thereby de-risking their income stream.

Recently, there have been several major high-profile transactions involving large occupiers committing to space in co-working centres, either in the form of segregated offices or on designated floors. CBRE Research Asia Pacific’s 2017 Occupier Survey found that 64% of MNC occupiers plan to use some form of third-party office space, including co-working space, as an extended resource to their conventional corporate real-estate portfolios by 2020, up from the current 52%.

MNCs’ preferred type of third-party space is also expected to evolve in the coming years. Serviced offices are likely to be eclipsed by co-working spaces and innovation centres as these formats better facilitate collaboration and networking opportunities.

While the open-plan setting featuring shared desks remains the common format, more co-working centres are allocating a larger volume of space for glass-partitioned enclosed offices suitable for individual corporations that have higher requirements around confidentiality. Innovation and business incubators will be more focused on catering to start-ups from a particular industry, such as fintech, and will feature more open space and mentorship programmes, as well as access to capital-raising opportunities.

Cost factor

MNC demand for co-working space is being driven by a number of factors, including cost. Real-estate cost is a significant concern in Asia-Pacific, particularly with rents in most markets at record highs. Besides saving on rent, MNCs can also save a large amount of capital expenditure for a new office fit-out and need not adhere to restrictive traditional lease terms, which in Asia typically run for three years. CBRE’s Occupier Survey found that cost-saving was cited by MNCs as the main driver for using co-working space.

The change in lease accounting standards, which requires companies to record the full value of leases as liabilities starting from 2019, has also prompted large occupiers to consider measures to reduce the financial burden on their real-estate portfolio. While traditional leases require large occupiers to recognise the full value of a lease contract and book it as a liability, the membership format of co-working spaces can be booked as a direct expense and has no impact on liabilities.

CBRE Research has found that the average fees charged by co-working centres are generally lower than Grade-A rents, assuming a standard 100 sq ft space per capita. Hot-desking in co-working centres provides the deepest savings, while the cost of a private office is similar to renting an office. The largest price differential was observed in Beijing and Hong Kong. In Singapore, which is approaching the bottom of the rental cycle, tenants should evaluate the option of committing to office space at the current low rents.

Collaboration and flexibility

The flexible and collaborative nature of co-working space makes it an attractive option for corporates seeking to foster greater interaction within and between working groups. Many MNCs are already using co-working space to house staff for new product development and to test new businesses.

MNC occupiers can adjust their space requirements to align with broader business expansion and contraction more effectively by using third-party space. More occupiers, particularly technology firms, are using innovation centres and business incubators to foster an entrepreneurial culture and enable their employees to access new ideas.

Technology is improving work mobility and enabling occupiers to locate work infrastructure for employees in co-working centres similar to their own premises. The use of co-working space can also provide occupiers with the flexibility to accommodate fluctuation in space requirements and this means that they do not need to adhere to the terms of the traditional three-year lease.

Until recently, there was a very clear disconnect between major corporations and small start-ups. Large corporates would rarely consider engaging or doing business with new firms with little or no track record. However, co-working centres now play host to a wide variety of end-users, including both large companies and start-ups, and are providing an innovative new platform for these two parties to interact, understand and collaborate with each other. In many ways, co-working spaces are at the forefront of a new emerging business ecosystem, which comprises start-ups and larger corporates.

Co-working and the new business ecosystem

Co-working space makes it easier for start-ups to navigate the business environment by helping them connect with potential business partners and purchase services provided by other members. Many fledgling businesses are reluctant to seek professional accounting or legal support, owing to their focus on working lean and their perception that such services involve high costs.

Now, however, co-working spaces are helping start-ups connect with a range of professional services to help them to grow and expand. At the same time, larger companies have come to recognise that co-working spaces present a major opportunity for them to leverage new ideas and embrace innovation and entrepreneurship, which is sometimes lacking in an institutionalised corporate environment.

Several large business services companies in Asia-Pacific have utilised these co-working centres specifically to generate business from start-ups, such as developing go-to-market strategies covering marketing, financial and legal services.

MNCs have also found co-working centres fertile ground for recruiting new staff directly from start-ups. Several recruitment companies have picked up on this trend and taken out memberships with co-working centres.

Evolving landlord-tenant relationship

While there is not yet a major trend for developers to open their own co-working or incubation centres, some landlords are trying to replicate the concept from a real-estate perspective. So far, developer-operated co-working spaces have mainly been provided as complementary services to tenants in the form of additional amenities and as extended spaces to host start-up partners from the broader business community.

In Japan, Mitsubishi Estate established FINOLAB for fintech start-ups and EGG for new B2B firms with a supporting community comprised of entrepreneurs, managers in charge of new business at major companies and specialists in professional business services.

Elsewhere, Singapore’s CapitaLand set up a joint venture with Collective Works to operate centres in CBD locations in its portfolio. In Hong Kong, Swire Properties’ blueprint includes a six-month accelerator for 10 B2B tech start-ups, tech-focused co-working space and a multipurpose events venue, while on the mainland, SOHO China formed SOHO 3Q in February 2015 and has already expanded to 18 locations.

Adding co-working space to office buildings can help landlords enhance the occupancy of spare floors or older space, sometimes in core locations. More progressive landlords have gone further and fully embraced the co-working business model. Examples include Lendlease, which recently committed to temporarily relocating its Asia headquarters in Singapore to The Work Project ahead of its planned move to Paya Lebar Quarter (PLQ) in 2018, which will also have a co-working element.

Landlords are advised to closely examine how leasing terms with co-working operators are structured. Most serviced office providers and co-working space operators with centres in Tier-2 cities engage in profit-sharing agreements with landlords and do not pay market rents.

However, some co-working space operators tend to pay market rents that do not include large discounts in gateway cities. The profit-sharing model has been proven to survive the downward market cycle, but co-working space business models paying market rents have yet to be tested during one full economic cycle.

In the US, several major co-working space operators have front-loaded their leasing transactions with incentives such as rent-free periods and tenant improvement allowances that tend to expire after three years. While their transactions have been structured differently in Asia-Pacific, issues around leasing models should be monitored closely as many markets are close to or already at the top of the rental cycle. One co-working space operator in the region has already opted to cease paying market rents and moved to a profit-sharing model.

Outlook

The past 12 months have seen steady expansion across many key markets in Asia-Pacific by large Western co-working operators. CBRE Research expects to see more cross-border expansion by large Asian operators searching for new markets after having established their footprint in their country of origin. Several Asian co-working operators such as The Work Project, UrWork and naked Hub have recently announced plans to expand in Hong Kong, Southeast Asia and Australia.

Smaller co-working space operators that lack the financial capacity to compete with larger groups may be vulnerable as the industry experiences a period of rapid expansion.

CBRE Research believes the co-working sector is likely to experience some consolidation and merger & acquisition activity in the next couple of years. Operators that will survive this phase and adapt successfully are those that can understand occupier needs and factor them into the design, culture, experience and workplace strategy of their co-working centres.

In the medium term, CBRE Research foresees that co-working space operators will deepen and expand their relationships with corporate occupiers. In addition to providing co-working space, potential new services could include real-estate facilities management outsourcing, office design and workplace strategy advisory. If these services eventually materialise, the co-working sector could emerge as a major disruptor to the mainstream commercial real-estate services industry.

Manish Kashyap is regional managing director, advisory & transaction, Asia-Pacific, CBRE.

This article first appeared in The Edge Property Singapore, a pullout of The Edge Singapore, on Aug 21, 2017.

For more stories, download TheEdgeProperty.com pullout here for free.

TOP PICKS BY EDGEPROP

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

Desa ParkCity (The Northshore Gardens)

Desa ParkCity, Kuala Lumpur

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Taman Bukit Senawang Perdana

Seremban, Negeri Sembilan

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)