WCT Holdings Bhd (Oct 17, RM1.60)

Maintain market perform with an unchanged target price (TP) of RM1.83: On Monday, WCT Holdings Bhd proposed a new placement of up to 10% of its existing issued and paid-up share capital, which entails the issuance of up to 140 million new shares that would potentially raise RM235.2 million based on its last closing price of RM1.68.

We were not entirely surprised with WCT’s move in applying for the approval in principle for the proposed new share placement as equity fundraising has always been part of WCT’s de-gearing strategy.

To recap, WCT made a proposal to issue 125 million new shares in January and successfully placed out 100.5 million shares with the remaining 24.5 million shares unissued and the approval had since lapsed.

Hence, management has now proposed for a new placement of up to 140 million shares as a move to renew the lapsed placement.

We believe this fresh proposal for 140 million shares, which is substantially higher than the lapsed unissued 24.5 million placement shares, could be management’s backup plan to raise fund from the market in case the outstanding Warrants-D (122.7 million shares, exercise price: RM1.71) that could raise up to around RM210 million upon conversion are not fully converted when they expire in December.

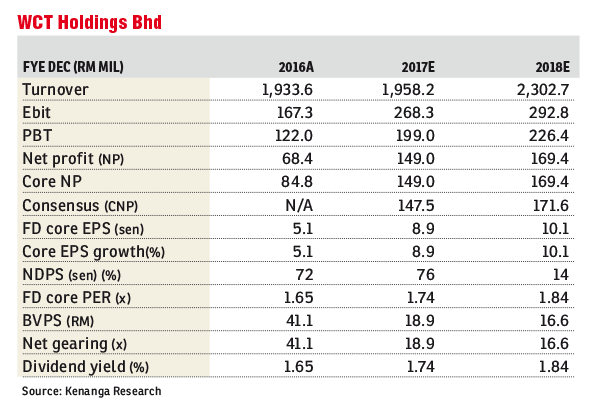

No changes to our financial year 2017 (FY17) to FY18 estimated core earnings, pending further clarity on the timeline of the placement exercise.

Its outstanding order book currently stands at around RM6 billion providing earnings visibility for the next 2½ to three years.

As for its property division, its unbilled sales stand at RM487 million with 1½-year visibility and management intends to continue with its repricing strategy to clear its existing inventories amounting to a gross development value of RM644 million.

Maintain “market perform” call with an unchanged sum-of-parts-driven TP of RM1.83 as we did not factor in the potential dilution from its newly proposed placement exercise pending clarity on the placement timeline given that the previous placement exercise had lapsed.

Our TP implies FY18 estimated price-earnings ratio of 18.5 times in line with the big boys’ range of 18 times to 20 times which we are comfortable with especially for concession owners. — Kenanga Research, Oct 17

This article first appeared in The Edge Financial Daily, on Oct 19, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Permas Ville, Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Maya Heights-Solar Series @ Bandar Seri Alam

Masai, Johor