IOI Properties Group Bhd (Oct 20, RM1.97)

Maintain buy with an unchanged target price (TP) of RM2.54: IOI Properties Group Bhd’s financial year 2017 (FY17) results surpassed expectations as core profit grew 60.6% year-on-year mainly driven by growth in property development, boosted by earlier-than-expected contribution from Trilinq in Singapore.

Its management is guiding for a flattish sales target of RM2.8 billion after having outperformed the FY17’s initial target of RM2.3 billion despite a soft domestic market, thanks to the contribution from the Trilinq project. The sales will be supported by RM3 billion worth of new domestic and international launches.

The current low unbilled sales are not expected to affect the sustainability of FY18 earnings considering the recognition of the remaining 155 Trilinq units. Besides, more than RM2 billion worth of inventory is set to be monetised following the recovery of interests among prospective buyers. Notably, new sales in China are also expected to come in timely towards the end of FY18.

International contribution from China will increase given the pipeline launches at Xiamen 2 and Xiamen 3 to sustain the earnings from the international segment as the Trilinq project has been completed.

A GDV of two billion yuan (RM1.28 billion) from the remaining GDV of 4.6 billion yuan at Xiamen 2 is expected to be launched in the FY18. This will be followed by 2.6 billion yuan worth of GDV at Xiamen 3 in the following years.

A stable domestic contribution is expected as more projects are rolled out at its growing township in Bandar Puchong (Cruise Residences, GDV: RM300 million), Bandar Puteri Bangi (The Strata townhouse, GDV: RM150 million), Bandar Puteri Kota Warisan (Ayden townhouse & serviced apartments, GDV: RM420 million), Sierra 10 (service apartments, GDV: RM110 million) and others.

We understand that the Central Boulevard project in Singapore (partnering with Hong Kong Land [33%]) is currently pending approvals from both the Malaysian and Singaporean authorities. However, management is looking to commence construction by the end of 2017 given that the target of completion is by the end of 2021.

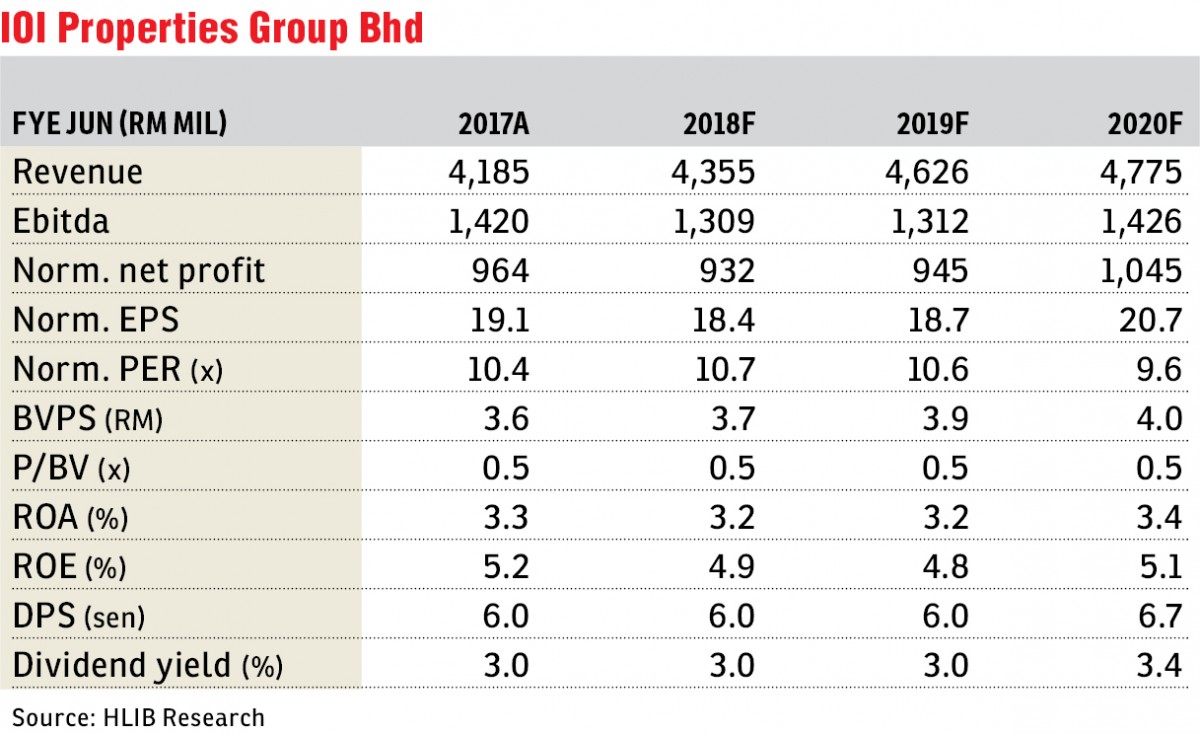

We see value emerging given the attractive book value at 0.5 times (industry average of 1.0 times) on the back of consistency in earnings growth, reinforced by the improved take-up rates for its projects and strong track record. The TP is maintained at RM2.54 based on an unchanged 35% discount to revalued net asset value of RM3.91. — HLIB Research, Oct 20

This article first appeared in The Edge Financial Daily, on Oct 23, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Pangsapuri Titi Mukim (Pangsapuri Pinggiran Perdana)

Penaga, Penang

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Pusat Komersial Seksyen 7

Shah Alam, Selangor

JALAN PUNCAK ALAM JAYA

Bandar Puncak Alam, Selangor

Pavilion Residences

Bukit Bintang, Kuala Lumpur