Pavilion REIT (Oct 30, RM1.70)

Maintain hold call with a lower target price of RM1.70: Pavilion Real Estate Investment Trust’s (REIT) third quarter of financial year 2017 (3QFY17) net profit was RM55.4 million (-7% year-on-year [y-o-y]; +2% quarter-no-quarter [q-o-q]), totalling RM166.8 million for nine months (9M) of FY17 (-8% y-o-y), 70%/66% of our and consensus’ full-year estimates. 3QFY17 y-o-y earnings growth was encouraged by: i) improvement in Pavilion KL’s occupancy rate (96%; 3QFY16: 92%), in line with gradual completion of its tenant remixing exercise (started in mid-FY16) towards the end of FY17; and ii) a higher occupancy rate at Intermark Mall (87%; 3QFY16: 67%). However, this was offset by: i) lower rental income from Da Men USJ (-26% y-o-y) due to lower rental rates to entice new tenants (occupancy was 87% versus 84% in 3QFY16); and ii) higher operating expenditure (opex) at Pavilion KL (pictured) from maintenance costs (air conditioning system improvements, upgrading works and replacement expenses) and sponsorship of the 29th Southeast Asian Games. Q-o-q earnings growth was mainly supported by some improvements in tenancies at Pavilion KL and Intermark Mall.

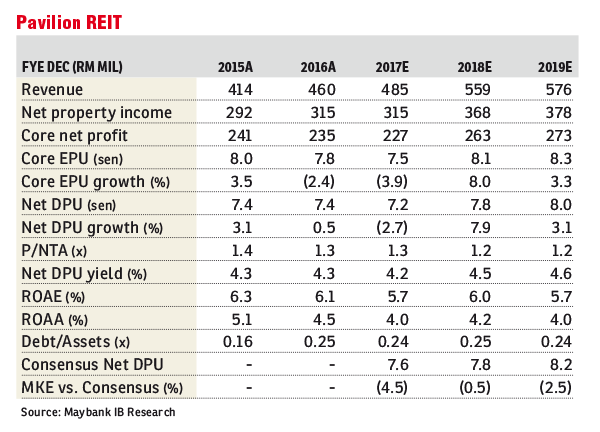

We lower our FY17 to FY19 earnings forecasts by about 5% per annum. Our estimates have factored in the injection of Pavilion Elite and completion of the proposed placement of up to 218 million new units in FY18.

We remain positive on Pavilion KL’s resiliency and long-term outlook, attributed to its prime location. However, there are downside earnings risks from Da Men Mall USJ due to the oversupply of retail space and malls in the Klang Valley, which raises occupancy risks. Rerating catalysts are the injection of yield-enhancing assets in the near future. — Maybank IB Research, Oct 27

This article first appeared in The Edge Financial Daily, on Oct 31, 2017.

For more stories, download EdgeProp.my pullout here for free.