Property sector

Maintain positive stance on the property sector: In the Budget 2018 announcement last Friday, the government announced that the “step-up” end financing scheme will be extended to private property developers to encourage more affordable property projects. The “step-up” end financing scheme was implemented on Jan 1, 2017 for the PR1MA programme with the aim of making financing easier to buyers with a total loan up to 90% to 100%. Under the “step-up” end financing scheme, homebuyers pay interest only for the first five years and pay interest plus principal in the subsequent years, making a reduction in monthly home-loan instalments for the first five years with an increase to a higher amount in the consecutive years. The scheme is expected to lead to a lower loan rejection rate and provides opportunities for homebuyers to get a higher loan. While the criteria for affordable property projects to qualify for the “step-up” end financing scheme is yet to be determined, it is positive to the property market as the scheme will help address the issue of homebuyers in securing home loans.

The government has outlined seven measures with a RM2.2 billion allocation for affordable housing measures. The long list of measures to address the issue of first-homebuyers’ affordability is largely expected as the government has been looking into the issue of affordable housing. Notably, we view the reintroduction of the “MyDeposit” scheme positively as it will help more young Malaysians own homes by assisting in down payments.

Post-Budget 2018 announcement, we are maintaining our “positive” view on the sector as we view that the property market is on a marginal recovery. Property developers with affordable home projects, such as Mah Sing Group Bhd and UOA Development Bhd, are the key beneficiaries of the measures outlined in Budget 2018 as they are expected to benefit from the extension of the “step-up” end-financing scheme to private property developers.

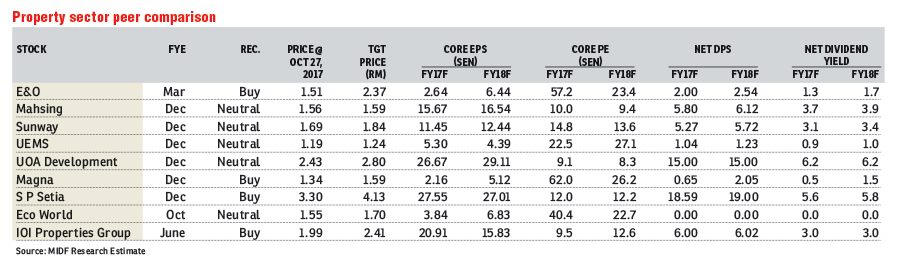

We have a “buy” call for S P Setia Bhd Group, IOI Properties Group Bhd, Eastern & Oriental Bhd (E&O) and Magna Prima Bhd. We like S P Setia (target price [TP]: RM4.13) for: i) its plan to achieve FBM KLCI status is now on a fast track to 2018 (from 2020); ii) the attractive price for its I&P Group deal; and iii) good dividend yield.

We like IOI Properties Group Bhd (TP: RM2.41) due to improving prospects for its property development in Singapore following the rise of Singapore’s private home prices for the first time in four years in the third quarter of 2017. Besides, we also expect establishment of a joint venture with Hongkong Land for the development of a Central Boulevard site to remove overhang and improve its balance sheet.

For E&O (TP: RM2.37), its long-term prospects remain positive with the Retirement Fund Inc (KWAP) entered as strategic investor of the Seri Tanjung Pinang (STP) 2A project. Reclamation works are on track and the first launch of its project in the STP2A project is expected to be in 2019. E&O is also looking to further improve its balance sheet by disposing of non-core assets with the latest being Lone Pine Hotel in Penang. Its latest net gearing declined to 0.59 times in June 2017, from 0.72 times in March 2017.

For Magna Prima (TP: RM1.59), we are turning positive on its sales outlook following a visit to The View Residence sales gallery. We expect new property sales to improve in FY17 and this should underpin its earnings in FY18. Another potential catalyst for Magna Prima is the value of unlocking its land in Jalan Ampang. — MIDF Research, Oct 30

This article first appeared in The Edge Financial Daily, on Oct 31, 2017.

This article first appeared in The Edge Financial Daily, on Oct 31, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Mayfair Residences @ Pavilion Embassy

Keramat, Kuala Lumpur

Seksyen 8, Kota Damansara

Kota Damansara, Selangor

Seksyen 5, Kota Damansara

Kota Damansara, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)