Hua Yang Bhd (Oct 30, 79.5 sen)

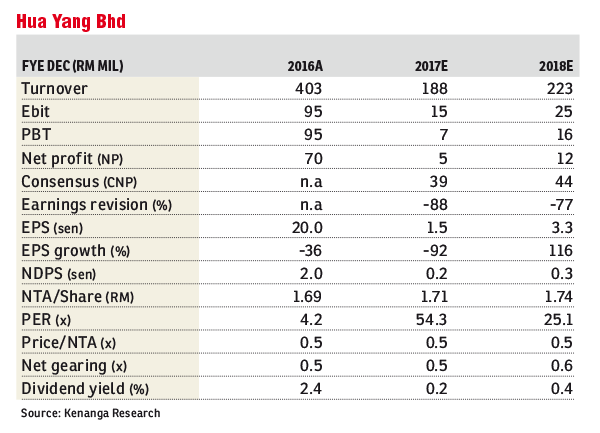

Downgrade to underperform with a lower target price of 65 sen: Hua Yang Bhd’s earnings for the first six months of financial year 2018 (1HFY18) came in sharply below expectations, accounting for 5% of both our and the streets’ full-year estimates. The disappointment in earnings was driven by lower-than-expected billings and higher-than-expected interest expense for the acquisition of the 30.9% stake in Magna Prima Bhd. Its 1HFY18 property sales of RM102 million also fell short of our full-year target of RM253 million. Its earnings and sales performance are currently at record lows. No dividends were declared as expected.

Hua Yang’s 1HFY18 core net profit (CNP) saw a drastic decline of 94% year-on-year (y-o-y) as revenue came off by 63%, while pre-tax margins compressed by 19 percentage points (ppts) to 5%, coupled with a higher effective tax rate of 53% (+27ppts y-o-y). The sharp decline in revenue was due to timing of recognition since its newly launched projects had yet to reach a meaningful billing stage, while these projects also suffered from weak sales. Compression in pre-tax margin was due to the loss of economies of scale due to the slump in revenue, coupled with high fixed overhead cost and interest expense (up by more than 600%) incurred for the acquisition of the 30.9% stake in Magna. Subsequently, its net gearing increased to 0.7 times from 0.4 times. Quarter-on-quarter, Hua Yang’s CNP for the second quarter of FY18 (2QFY18) declined 66% due to a higher effective rate of 72% vis-à-vis 39% in 1QFY18 due to non-deductible expenses.

Going forward, we would not expect any major landbanking activity as we believe Hua Yang needs to focus on realising its pipelines and also future plans with Magna. Considering its unbilled sales, which have fallen to historical lows of RM209 million, which are only sufficient for another one to two quarters, we opine that Hua Yang should be more aggressive driving its sales for launched projects, which have received slow response from the market albeit its positioning as an affordable housing player (more than 50% of products priced around RM550,000 per unit) in the Klang Valley, Penang and Johor. We also believe the recent Budget 2018 measures (step-up financing scheme) would increase the odds of better sales for Hua Yang. Nonetheless, we do not rule out a potential cash call exercise if Hua Yang acquires the remaining 70% stake in Magna in the future.

Following its weak results, we slash our FY18-FY19 estimated CNPs by 88%/77% respectively, after factoring in a higher operating cost and rescheduling of our billing progress. That said, we also reduce our FY18-FY19 estimated sales targets by 13%/23% to RM219 million/RM249.7 million respectively. — Kenanga Research, Oct 30

This article first appeared in The Edge Financial Daily, on Oct 31, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Sunsuria Forum @ 7th Avenue

Setia Alam/Alam Nusantara, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Taman Industri Oug

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Taman Industri Oug

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Jalan Kenari, Bandar Puchong Jaya

Puchong, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor

Bandar Puteri Puchong

Bandar Puteri Puchong, Selangor