Many property investors have been drawn to Penang because of its robust tourism and industrial activities. On Penang island, land scarcity has also limited future developments and hence driven up property prices. But dampened economic sentiments have moderated prices on such properties on the secondary market recently.

Based on data collated by EdgeProp.my, mid to high-end non-landed residential projects (except flats) on the secondary market on Penang island have an average compound annual growth rate (CAGR) of 5% from 2012 to 2016.

Prices have certainly moderated last year. Data released by the National Property Information Centre (Napic) in its Property Market Report 2016 showed that only 12 of the 79 high-rise residential projects (except flats) on Penang island had enjoyed a price growth of above 2% last year. Transaction prices have remained flat (growth of less than 2%) in 19 projects while 25 projects have seen transaction prices drop. Another 23 projects did not have y-o-y comparable data as there were no transactions in 2015.

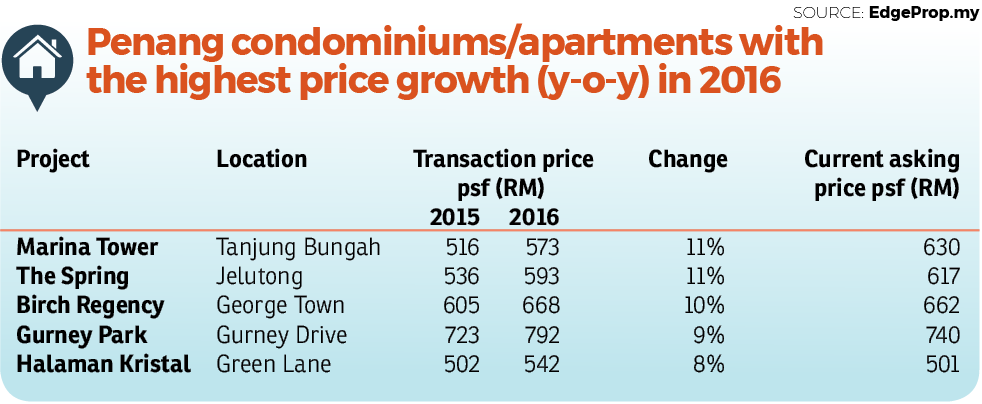

Nevertheless, EdgeProp.my data revealed a handful of condominiums and apartments that achieved significant y-o-y price growth of between 8% and 11% in 2016. These projects are showing their resilience. Let’s find out what they have going for them.

Strategic location

Based on EdgeProp.my’s data, only three condo projects enjoyed a double-digit annual price growth in 2016. They were Marina Tower in Tanjung Bungah (11%), The Spring in Jelutong (11%) and Birch Regency in George Town (10%). They were followed by Gurney Park in Gurney Drive (9%) and Halaman Kristal in Jelutong (8%).

Property prices in these projects have been climbing steadily over the years and EdgeProp.my data showed that these projects have enjoyed an average CAGR ranging between 6% and 21% from 2012 to 2016.

Landserve Penang Sdn Bhd executive director Ooi Choon Seong says the strategic locations of these projects within prime areas on the island, coupled with good accessibility as well as proximity to various amenities, are supporting the price growth of these condos.

Marina Tower

Marina Tower, also known as Ratu Mutiara Marina Tower, is a low-density development located at Tanjung Bungah. It comprises a 5-storey low-rise tower and two 23-storey residential towers, offering a total of 280 units with built-ups ranging from 1,050 sq ft to 2,700 sq ft (penthouse units).

Completed 11 years ago, Marina Tower has remained popular because it offers beautiful sea views, says Ooi.

According to EdgeProp.my data from 2012 to 2016, the CAGR for Marina Tower is around 21%. The transaction price of Marina Tower averaged RM573 psf in 2016, compared with RM516 psf in 2015. Its average asking price in September 2017 was RM630 psf.

The Spring

The Spring, like Marina Tower, had also recorded 11% growth in its transacted price last year. It is located near Persiaran Karpal Singh next to the Tun Dr Lim Chong Eu Expressway. Completed nine years ago, this 23-storey freehold development offers a total of 396 units with built-ups ranging from 925 sq ft to 1,281 sq ft.

Despite its good location and accessibility, Ooi notes that the price growth of this condo was initially rather low, hovering around RM500 psf because of its proximity to the Jelutong landfill located just 1.5km away.

“However, the Wesley Methodist School Penang (International), which will start operation in October this year, has spurred the market’s interest in The Spring as it is located within walking distance to this international school,” he reveals.

EdgeProp.my data showed that the transaction price for The Spring climbed to RM593 psf in 2016 from RM536 psf a year before. The current asking price averages RM617 psf.

Birch Regency

Birch Regency, which also enjoyed double-digit price growth last year, is popular because of its convenient location in the heart of George Town, says PA International Property Consultants (Penang) Sdn Bhd executive director Michael Loo.

“George Town is the most visited tourist destination in Penang. The condo owners there anticipate they could get good returns by providing short-term vacation home services,” he offers.

He notes that this project has registered high transaction volume last year — a 25% y-o-y increase.

EdgeProp.my listings showed that Birch Regency was selling at an average of RM668 psf last year compared with RM605 psf in 2015. Its current average asking price is RM662 psf.

Gurney Park and Halaman Kristal

Gurney Park and Halaman Kristal, both which enjoyed high growth last year, also shared similar strengths as the other three condos — strategic locations, high traffic and populated areas, and proximity to amenities.

Located at Gurney Drive, the freehold Gurney Park condo is just about 10 to 20 minutes’ walk to the famous Gurney Drive seafront promenade, which is about 750m away. This so-called X factor has allowed units in Gurney Park to enjoy average transacted price of RM792 psf last year, with current asking prices at around RM740 psf.

Meanwhile, Halaman Kristal is situated in the matured Jelutong area and surrounded by various amenities. It has seen transaction prices climb to RM542 psf from RM502 psf a year earlier. Current asking price averages RM501 psf.

Double-digit dives

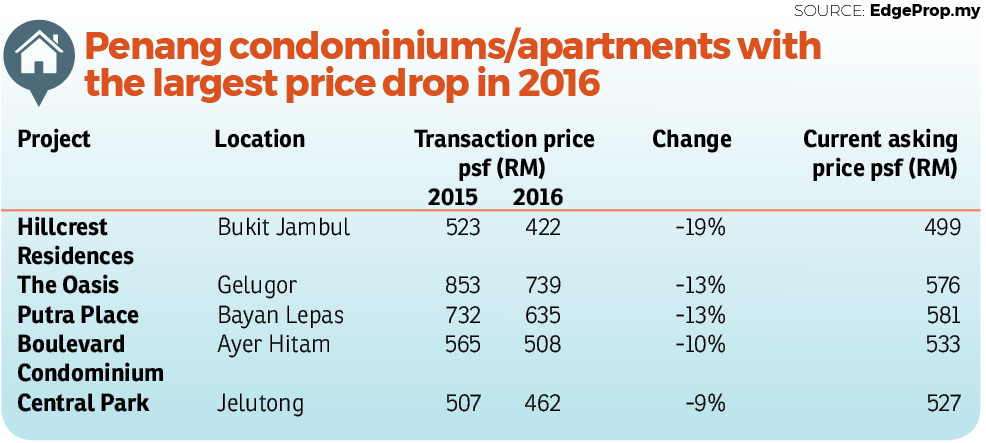

On the other hand, among the 25 projects from Napic’s data that saw transaction prices dip last year, four recorded double-digit dips, with drops between 10% and 19%.

These projects were (in descending order) Hillcrest Residences in Bukit Jambul, The Oasis in Gelugor, Putra Place in Bayan Lepas and Boulevard Condominium in Ayer Hitam. Another project that has seen a steep drop in terms of transaction price was Central Park in Jelutong, which recorded an average drop of 9% last year.

Hillcrest Residences experienced an average price drop of 19% y-o-y. The leasehold condo saw its units being sold at RM422 psf, compared with RM523 psf in 2015.

However, PA International’s Loo notes that out of the 11 units transacted at Hillcrest Residences last year, six should be excluded as they were meant for charity.

In October last year, Amcorp Group Bhd, one of the investors of this project, donated six units worth RM5.52 million to Universiti Sains Malaysia (USM) for the purpose of setting up the Azman Hashim Endowment Fund to provide financial assistance for USM undergraduates.

Thus, based on PA International’s calculation, the fair market value for Hillcrest Residences in 2016 should be at RM506 psf, which brings the decrease in price to only 3% y-o-y.

The 5.4-acre Hillcrest Residences is located at the top of Bukit Jambul, approximately 5.75m above sea level. The low-density development offers only 144 units.

Meanwhile, like Hillcrest Residences, The Oasis and Putra Place are also leasehold projects.

Penang-based Elite Properties Sdn Bhd senior negotiator Season Ting says leasehold properties are not popular among most Penangites.

The Oasis is located in Gelugor, near to Karpal Singh Learning Centre and Penang Badminton Academy. It comprises 557 units housed in three blocks. Units in The Oasis were transacted at RM739 psf last year, compared with RM853 psf in 2015. However, its current asking price is about RM576 psf. Landserve’s Ooi says The Oasis is located away from the main road and a bit far from the city centre. There is also a lack of public transportation within short walking distance.

Meanwhile, the freehold Boulevard Condominium in Ayer Hitam offers 420 units over two 37- and 38-storey blocks. It does not have main road access either. Transaction prices were down to RM508 psf in 2016, from RM565 psf in the previous year. Current asking price averages at RM533 psf.

As for Putra Place in Bayan Lepas, while its location is strategic, the project’s leasehold tenure has deterred investors. Transaction price for Putra Place averaged RM635 psf last year compared with RM732 psf in 2015, while the current asking price averages RM581 psf.

In Jelutong, the 10.9-acre freehold Central Park has seen its average transacted price drop from RM507 to RM462 psf last year, due to lack of demand. It comprises five 36-storey blocks housing 326 condo units. The current asking price is about RM527 psf.

Slow but still full of potential

Despite their weak performance last year, EdgeProp.my data showed that the above properties have enjoyed an average CAGR ranging between 5% and 13% from 2012 to 2016.

Ooi opines that the price correction is mainly due to the general weak market sentiment but these projects still hold investment potential, especially Putra Place and Central Park, which are well located and close to various amenities.

He sees Putra Place’s location as the project’s greatest advantage. “New developments are mushrooming in that area, including a high-density residential project which is jointly developed by Tropicana Corp Bhd and Ivory Properties Group Bhd.

“The only downside for Putra Place is its leasehold title as most residential developments in the surrounding area, including the joint-venture project by Tropicana Corp and Ivory Properties, are freehold,” he explains.

Central Park, Ooi added, will also attract buyers’ attention as units there are reasonably priced and the project offers easy access to major roads including Jalan Jelutong, Lebuhraya Jelutong and Lebuhraya Batu Lanchang.

Waiting for fresh leads

Generally, property consultants and real estate agents observe that residential properties on the secondary market have experienced price corrections over the past two years of around 10% to 20%.

Although Penang island has seen development land shrinking and market observers are confident of the long-term investment potential of Penang properties, this is not reflected in current sales activities as most purchasers are taking a wait-and-see approach.

From Ooi’s observation, secondary market transaction volume for high-rise residential properties has also fallen in the first nine months of this year.

“Ample new supply with attractive marketing packages will put pressure on the price growth of secondary market properties, as the former offers easier entry levels for new homebuyers,” he tells EdgeProp.my.

So then, is it a good time to buy? According to Ooi, rising supply of new and attractive condos and apartments on both the primary and secondary markets are offering good opportunities for buyers.

Ting from Elite Properties concurs that now is a good time to buy and wait for the next upcycle as it’s a buyer’s market with plenty of choices.

PA International’s Loo observes that transaction activities have picked up slightly in the second half of 2017 and anticipates a market recovery next year.

“The market will need three to four years to absorb the excess in supply of residential properties, especially the increased supply of affordable housing,” he says.

Interestingly, the property consultants and real estate agents feel political uncertainties have also affected the island’s economic growth and the property market as well. Loo says that aside from property buyers, business owners have also put their decisions on hold until a clearer picture can be seen after the coming Malaysian general elections.

The current Parliament’s five-year term will expire in June 2018. If the prime minister does not announce the general election sooner, the Parliament will automatically be dissolved then for a fresh ballot.

As such, Loo expects the market to continue at a lackadaisical pace unless there are new catalysts announced before the election. “Penang island needs some growth catalysts to boost the market in the short term,” Loo says.

This story first appeared in EdgeProp.my pullout on Oct 27, 2017. Download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur