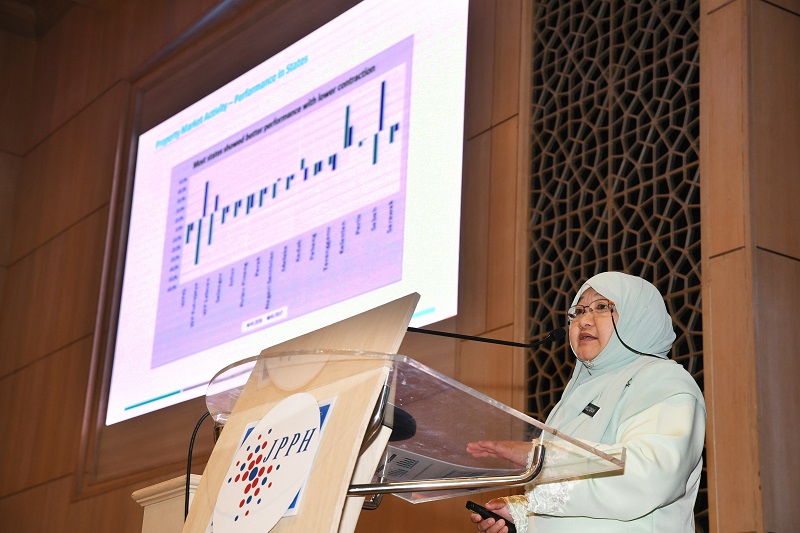

PUTRAJAYA (Nov 13): The slow market absorption has led to an increase in residential overhang of 20,867 units worth RM12.26 billion, a 40% growth in overhang volume against 1H16.

The bulk of the overhang units comprise condominiums and apartments priced between RM500,000 and RM1,000,000, according to the Valuation and Property Services Department during the Preliminary Property Market 2017 briefing today.

Meanwhile, housing price growth in Malaysia has moderated to 5.6% in the second quarter of 2017 (2Q17) compared with 7.1% a year ago, based on the latest Malaysian House Price Index (MHPI) data.

The MHPI in 2Q17 is at 184.1 points, an increase of 0.4% q-o-q from 183.3 points in 1Q17.

The director of the National Property Information Centre (Napic), Khuzaimah Abdullah said house prices have been on an increasing trend, but growth has slowed from previous years, which witnessed double-digit increments annually (3Q12: 13.2%; 4Q12: 14.3%).

“House prices will always increase but the increment is not as much as the previous years. For example, previously if you bought a property at RM100,000 two years down the road you may be able to sell it for RM120,000. Today, if you buy a RM100,000 property, you can only sell it for RM110,000,” said Khuzaimah during the briefing.

Overall, the property market has softened in 1H17, with more than 153,000 transactions recorded worth RM67.82 billion, a decline of 6% in volume as compared with 12.3% in 1H2016.

However, transaction value increased by 5% compared to 1H2016 as compared to a decrease of 12% from a year ago.

“The rate of contraction has reduced, indicating that the property market is adjusting to the changing market landscape,” Khuzaimah added.

Meanwhile, the residential market represented 61.8% of volume and 48.4% of transactions.

Moreover, there were almost 95,000 transactions worth RM33 billion, representing a 7% dip in volume but a 0.5% increase in value year-on-year.

New launches have also declined by 9.1% to 28,000 units, compared with 32,000 units in 1H16.

Sales performance has increased slightly to 23.9% as compared to 23.5% in the same period a year ago.

“I strongly urge all parties including local authorities and developers to study the data released by JPPH before planning any new developments so that the issue of oversupply situation can be avoided,” said Khuzaimah.

For commercial properties, over 10,000 transactions were recorded worth RM12 billion, representing a dip by 11% in volume but an increase of 5.9% in value.

The increase in value is due to several large transactions involving offices, retail space and hotels.

The office and retail sectors are seeing an occupancy rate of 83.5% and 81.5% respectively, although the private office unoccupied space stood at 3.4 million sq m.

Kuala Lumpur recorded the highest unoccupied office space of more than 1.62 million sq m while retail space occupancies dipped from 86.8% to 84.9%.

TOP PICKS BY EDGEPROP

Seri Intan Apartment

Setia Alam/Alam Nusantara, Selangor

Garden Villas @ Taman Bukit Indah

Johor Bahru, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)