WCT Holdings Bhd (Nov 23, RM1.69)

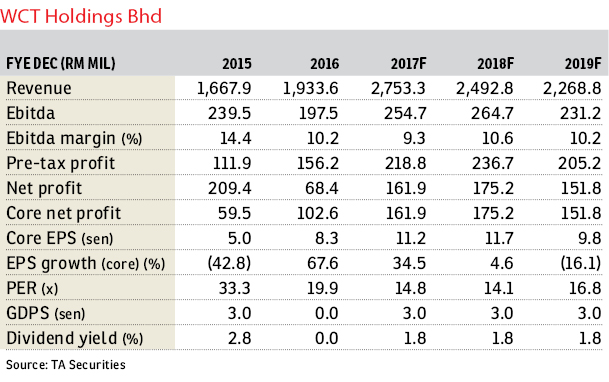

Maintain sell with an unchanged target price of RM1.61: Excluding foreign exchange (forex) losses amounting to RM19.8 million, WCT Holdings Bhd’s nine months ended Sept 30, 2017 (9MFY17) core profit of RM115.1 million came in within expectations, accounting for 71.1% and 78.1% of our and consensus full-year forecast respectively.

Year-on-year (y-o-y), 9MFY17 core profit jumped 55.8% to RM115.1 million despite a lower revenue of 10.4% at RM1.33 billion. The improved bottom line was largely due to a better construction margin (+9.2 percentage points to 12.9%) from local projects.

The property investment division also saw improvement in earnings (earnings before interest and tax [Ebit]: +16%) but the expansion in profit was partially offset by lower contribution from the property development division (Ebit: 25.4%).

Quarter-on-quarter (q-o-q), third quarter ended Sept 30, 2017 (3QFY17) core profit was 6.3% higher at RM40 million as both construction (+20%) and property (+44.1%) divisions recorded profit improvements, but partly offset by lower contributions from property investment division (-16.2%), associates and joint ventures, as well as higher finance costs.

We maintain our financial year ending Dec 31, 2017 (FY17) to FY19 earnings forecasts at this juncture pending the analyst briefing scheduled for yesterday.

Year to date (YTD), WCT has secured new construction orders amounting to RM1.8 billion. Its outstanding construction order book is estimated at RM5.6 billion, translating into 3.6 times FY16 construction turnover. This could provide construction earnings visibility for the next three to four years.

We expect to see an expansion in its investment property portfolio with expected openings of Paradigm Mall in Johor Baru in November 2017 and New World Hotel at Paradigm in Kelana Jaya in January 2018.

We keep the TP unchanged at RM1.61 based on unchanged 16 times 2018 construction earnings and 10 times 2018 property earnings. — TA Securities, Nov 23

This article first appeared in The Edge Financial Daily, on Nov 24, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)