UEM Sunrise Bhd (Dec 13, RM1.04)

Maintain buy with a higher target price of RM1.26: UEM Sunrise Bhd (UEMS) announced that its wholly-owned subsidiary, Sunrise Alliance Sdn Bhd, has inked a sale and purchase agreement (SPA) with Kemaris Residences Sdn Bhd for the acquisition of 19.24 acres (7.78ha) of land in Taman Equine, Seri Kembangan for RM109.5 million.

We are positive on the land acquisition as it will increase UEMS’ presence in the central region of Malaysia. Note that UEMS is gradually shifting its focus from the southern region to the central region of Malaysia.

Currently, UEMS’ presence in the central region is mainly in Bangi and Mont'Kiara.

The land is strategically located 1.3km from the Equine Park MRT2 station which is currently under construction.

We view the acquisition price of RM131 per sq ft (psf) as fair as it is within the asking price of RM100 psf to RM150 psf for residential land in Equine Park.

UEMS is planning to build 924 residential units on the land where the development order has been approved. Estimated gross development value (GDV) for the project is at RM700 million, translating into average selling price per unit of RM758,000.

We do not expect earnings impact from the land acquisition in the near term as the first launch of the project is expected to take place in 2019.

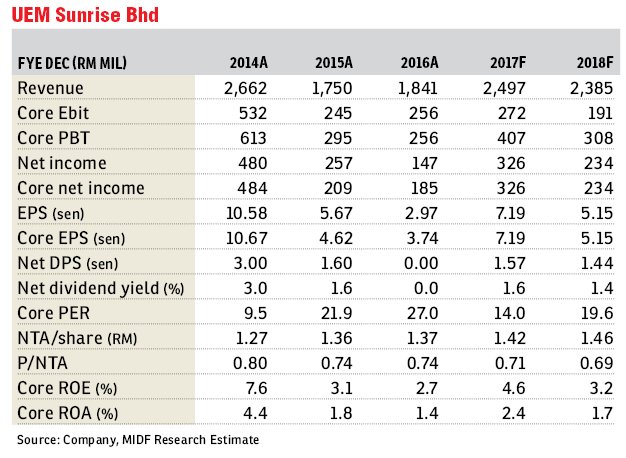

Hence, we maintain our earnings forecast for financial year 2017 (FY17) and FY18. Meanwhile, the land acquisition is expected to be funded by internally generated funds. Net gearing is estimated to climb marginally from 0.43 times to 0.45 times post-land acquisition. — MIDF Research, Dec 13

This article first appeared in The Edge Financial Daily, on Dec 14, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)