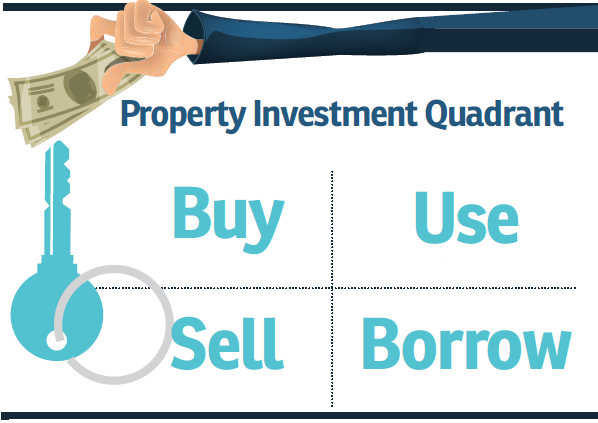

The concept of “borrow” is the final piece of the parcel in our uniquely crafted Property Investment Quadrant (PIQ). Having taken you through “buy”, “sell” and “use” of the PIQ in this 4-part series, we will now explore the final and most important part of them all. The ability to borrow (or leverage) is that one single special feature that puts property investment heads and shoulders ahead of other types of conventional investments.

Property or any form of real estate is the favourite collateral of any banks or financial lending institutions. The majority of the lending offered is backed by assets as security, and again, most of these assets are the solid brick and mortar of real estate. In other words, investors can own properties of much bigger value than their initial cash commitment.

A journey in property investment will not be complete and may not be successful without leveraging the magic of borrowing. Banks or any licensed lenders are more than willing to assist your property acquisition by offering substantial margin of financing and yet only asking for a fixed return made known to you upfront.

Furthermore, when the property has increased in value, refinancing to cash out on the value appreciation is another option to expand your investment portfolio. And when times are bad, you can also restructure your borrowings to accommodate your tightened cash flow, particularly when your property value has remained strong.

To make your property investment sustainable in the long run, you need to master the art of borrowing. Learn how the entire lending system works and outsmart the system. Do you also know you can “borrow” many other things that could be useful for you as a property investor and not just money alone?

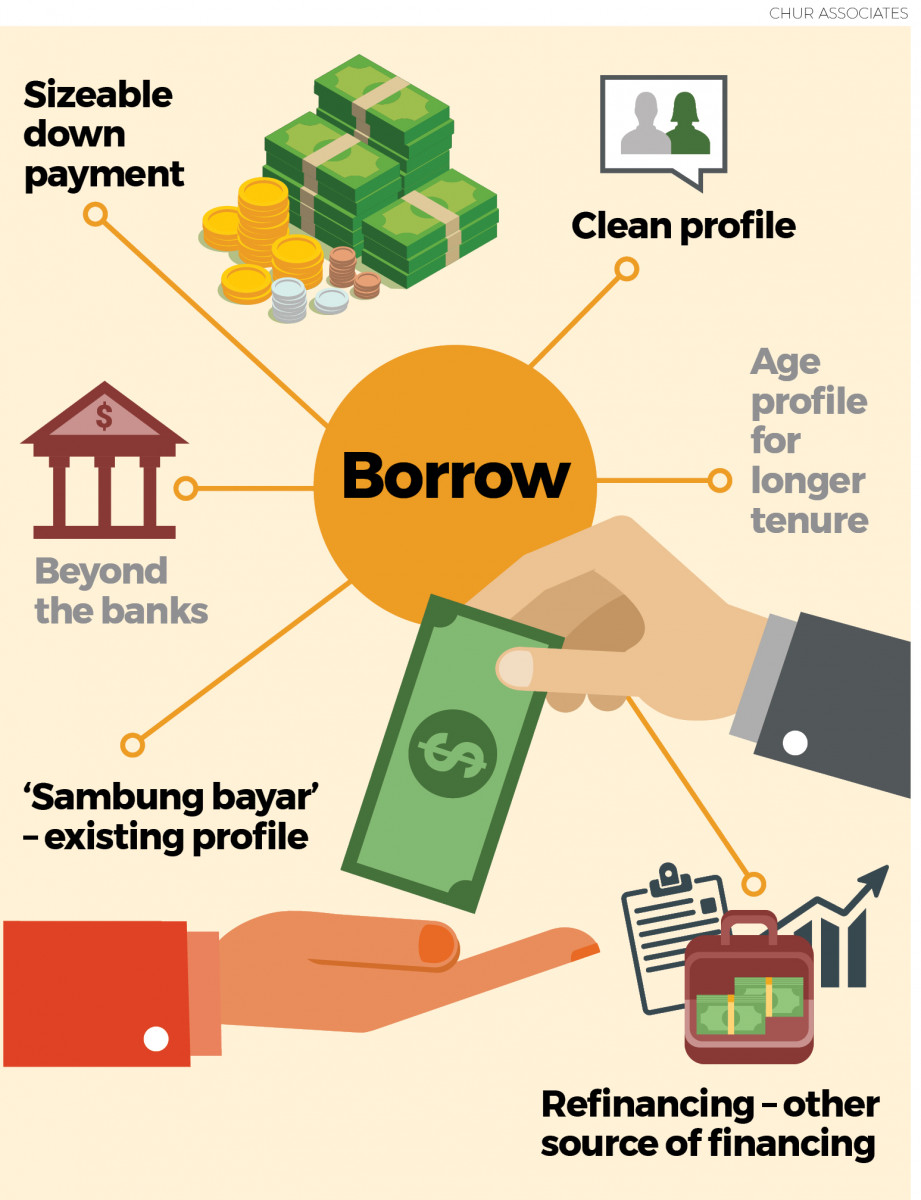

1. Clean profile

When you have bought many properties and have borrowed from banks to finance each of them, you become risky in the eyes of the banks, especially when your income is limited and your cash flow stretched. In this stage of your property investment portfolio, you will find that you will be granted a lower margin of financing (therefore higher initial capital outlay) or outright rejection, or if you are lucky, conditional approval with harsh requirements like the pledge of additional fixed deposit to secure the loan. It’s no longer about the value of the property that you are buying but rather your ability to pay back.

This is when you need to look for a “clean” profile to continue your property investment journey with a win-win collaboration. The obvious targets would be your immediate family and friends who have admired your investment returns but have never taken any action beyond admiration. Try approaching them and offer them an investment collaboration based on your past records. The fact that these potential partners have stable incomes and little borrowing would make them the darlings of any lending institution. Besides, their investment risks are also reduced with your participation.

2. Age profile

Seasoned property investors know that property investment is essentially a game of cash flow. They know that the monthly instalment for a new loan will be more substantial as they age and effectively reduce the loan tenure. While the projected value appreciation of the property is promising, the higher monthly loan repayment made is not feasible, especially when market rental does not match the repayment amount to the bank.

This is where you want to “borrow” the age of your new investment partners. Your younger spouse, siblings, friends or even your children who have perhaps just joined the work force. Having these partners to borrow and acquire your next property investment would strategically stretch the loan tenure to reduce the monthly loan repayment to be more compatible with the market rental generated.

3. Refinancing

It is either yield or appreciation that you are after in property investment. How do you borrow for the same property twice? By unleashing certain capital derived from the value appreciation of the property. This is nothing new and is commonly called “refinancing”. This is particularly useful when you know how to deploy these newfound capitals.

You have a choice to either refinance from the same bank based on the increased valuation of the property acquired earlier, or you can ask a new bank to take over the loan with a higher valuation from the existing bank.

Sometimes you may be motivated to refinance if you can save on the bank interest or from a bank’s flexible repayment programme, but do consider all the direct and indirect costs that may be incurred in the process.

Besides, the refinanced portion of the loan is commonly considered as a personal loan, resulting in shorter loan repayment tenure.

4. ‘Sambung bayar’

This is where you collaborate or be an investment joint-venture partner with a property owner who is facing cash flow difficulty and is unable to pay the monthly loan repayment. With proper documentation in place, you can offer to pay the monthly loan repayment on his/her behalf in exchange for a profit-

sharing arrangement in the event of the ultimate disposal, while the property owner can still enjoy the premises without the need to concede to any fire sales and all his/her contribution remains intact in the value preservation of the property investment.

5. Beyond banks

Borrowing to purchase property is not just limited to conventional banks. You can consider Islamic banking or other lenders such as the Malaysian Building Society Bhd, or even the many insurance companies that can also offer financing for your property acquisition.

Licensed moneylenders can be an option too. But be aware that the loan interests and packages are not the same as those commonly offered by banks.

When the margin of financing for a loan is lower than expected, one can consider the permitted withdrawal from the Employees Provident Fund.

6. Sizeable down payment

If it is regarding cash flow, do consider a higher down payment for your property acquisition than the usual 10% to 20%, especially when you have some idle funds sitting around not working hard enough for you for good returns. In the long term, you will have the ease of a lower cash flow commitment to get your desired returns.

So this completes the entire PIQ. The intention is to let you have more options and thus allowing enough flexibility to take you through any challenges along your journey as an astute property investor.

If you have any property-related legal questions for Tan, please go to the Tools section of www.EdgeProp.my.

Chris Tan is a lawyer, author, speaker and keen observer of real estate locally and abroad. Mainly, he is the founder and now managing partner of Chur Associates.

Disclaimer: The information here does not constitute legal advice. Please seek professional legal advice for your specific needs.

This story first appeared in EdgeProp.my pullout on Dec 15, 2017. Download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Sri Endah

Bandar Baru Sri Petaling, Kuala Lumpur

Medini Signature

Iskandar Puteri (Nusajaya), Johor

Laman Haris @ Eco Grandeur

Bandar Puncak Alam, Selangor

Seksyen 6, Kota Damansara

Kota Damansara, Selangor