Damansara Jaya, or DJ as it is more fondly called, is an established township in Petaling Jaya, Selangor with easy accessibility and an abundance of amenities.

Developed by Paramount Garden which was initially part of See Hoy Chan Sdn Bhd in the mid-1970s, it comprises two parts — SS22 and SS22A — and houses approximately 2,000 residential and commercial properties in the area.

On a typical weekday, a normal scene in the commercial area of DJ would be vehicles double-parked along the streets, people rushing in and out of the shops running errands, students heading up to the tuition centres above the shops, and office workers taking a break in the many cafes, restaurants and dessert joints during lunch time or after work.

On a weekend, the work crowd is replaced by families and people of all ages visiting the DJ’s main landmark, the Atria Shopping Gallery, as well as the F&B outlets located in the shoplots surrounding it. Atria is located right in the heart of DJ’s commercial centre, which also offers four rows of 4-storey shoplots located along Jalan SS22/19, Jalan SS22/21D, Jalan SS22/23 and Jalan SS22/25.

DJ is home to popular eateries including Choong Kee Kampar Claypot Rice, Brazilian restaurant Carnaval Churrascaria, and cafes and dessert joints such as Inside Scoop and the Bulb Coffee. Some of its other landmarks include Kolej Damansara Utama (KDU) and the Damansara Jaya secondary school.

DJ’s commercial area

One of the oldest real estate agencies in the Klang Valley Kim Realty Sdn Bhd has its office in one of the shoplots in DJ. Its CEO Vincent Ng shares that the most popular street for those looking to do business in the shoplots in DJ is Jalan SS22/19, as it faces the main road and has the most visibility. This is followed by Jalan SS22/25 and the inner lanes.

However, the reopening of Atria has definitely increased traffic to shops on the inner lanes, says Ng.

“Atria has opened up two entrances along the mall leading to the shoplots, which have been there for more than 30 years,” says Ng.

According to him, Atria was initially built as an entertainment centre comprising a gaming arcade and cinema by developer See Hoy Chan in the 1980s, but was never opened as an entertainment centre. Instead, the mall started off as what was known back then as the Gardenia Town Centre with Printemps and Kimisawa, a French and a Japanese departmental store respectively, as the key anchors.

“Back in those days, many frequented the area and Kimisawa in particular did very well — simply because it was something new at that time and there was no big-scale Japanese supermarkets around,” Ng shares.

He explains that it closed down during the 1987 global recession, followed by Printemps not long after. Subsequently, Lion Group bought the mall over from See Hoy Chan and renamed it Atria Shopping Centre with Parkson as its main anchor tenant. The mall was then sold to Lien Hoe Corp Bhd in 2001 and exchanged hands again with OSK Property Holdings Bhd just 10 years ago.

OSK Property has since redeveloped it into its first and flagship mall, the Atria Shopping Gallery that we see today, which spans a net lettable area of 470,000 sq ft and a total of 392 Small-office Flexible-office (SoFo) units above the mall known as the Atria SoFo Suites.

Meanwhile, Jordan Lee & Jaafar Sdn Bhd Petaling Jaya branch director Sherman Tangga says there is no denying that with the opening of the redeveloped Atria mall, traffic to the commercial area has definitely increased, especially with more car parks available within the mall. “The spillover effect on the shops outside is definitely noticeable,” says Sherman.

Furthermore, traffic has also increased with the area’s improved accessibility over the years.

When DJ was first built, there was no highway connecting DJ to Kuala Lumpur city centre except via Jalan Damansara.

Now with three highways — namely SPRINT, Lebuhraya Damansara-Puchong and North Klang Valley Expressway — connected almost directly to DJ, the landed houses here have been much sought after and the area can be considered one of the more affluent housing areas within Petaling Jaya.

Sherman notes that when the redevelopment of Atria was announced, there were some complaints from the shop owners and tenants facing the site that their businesses have been affected by the construction.

“However, the retail shop unit prices and rents have remained stable during construction while a slight uptrend was noticed around the end of 2014 and 2015 in anticipation of the opening of the new mall,” he shares.

Price correction

An intermediate shoplot has a size of 22ft by 70ft/75ft while a corner lot is 26ft by 75ft. Back in the 1980s, a typical intermediate shoplot was sold for RM555,555, Ng recalls.

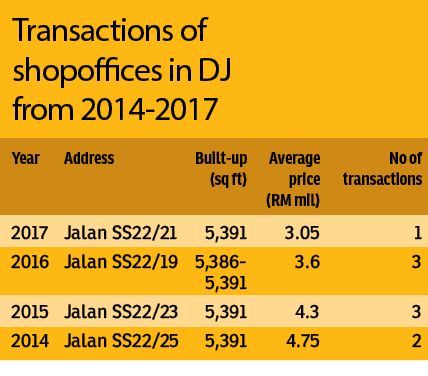

“In January this year, an intermediate unit located on Jalan SS22/21 with a built-up of 5,391 sq ft

was sold for RM3.05 million. In the preceding year, similar units located along Jalan SS22/19 with built-ups ranging from 5,386 sq ft to 5,391 sq ft changed hands for RM3.6 million.

“In 2015, two of the intermediate units located along Jalan SS22/23 was sold for RM5 million. Those were the highest transacted prices recorded in the last three years,” says Ng.

He views the price correction since 2016 as in line with the rest of the market which has been grappling with soft market sentiments and the depreciation of the ringgit.

He observes that asking prices are ranging from RM4 million to RM4.5 million for the intermediate lots while the corner lots can go up to RM5.5 million. However, most buyers are only willing to pay around RM3.5 million in the current market environment. Available listings on EdgeProp.my also saw average asking prices for the intermediate lots range around RM3.9 to RM4.1 million.

Nevertheless, while the market is a little lacklustre, it remains stable simply because most of the owners bought their properties a long time ago and have the ability to hold on to these units.

“These pioneering shop owners have definitely made their fair share of returns on their investment and many of them own multiple units,” Ng says.

Even some of the tenants have been here for decades, so rentals have not gone up significantly. “These old tenants have built very good relationships with the owners over the course of many years,” he adds.

As for the rental yield from these shop units, he says it ranges from 4% to 5% with the ground floors of the units commanding the highest rents due to their visibility and accessibility.

According to Ng, the ground floor rental of an intermediate unit on the inner lane can be anything from RM5,000 to RM6,000 while those facing the main road can range from RM7,500 to RM8,000.

The units on the first floor of the inner row of shop units are mostly occupied by offices and can command rentals from RM2,500 to RM3,000.

The second and third floors can fetch average rentals of around RM2,000 and around RM1,600 to RM1,800 respectively. That comes up to an estimated rental of RM11,000 to RM13,000 for the entire unit.

“If you own a corner unit, you can fetch a rental of around RM12,000 to RM15,000,” says Ng.

What’s next?

In 3Q16, two 4-storey multi-storey car parks and a food court on the ground floor located between Jalan SS22/19 and Jalan SS22/21D, and Jalan SS22/23 and Jalan SS22/25 commenced construction.

Footfalls to Atria could be raised if the mall has its own cinema. However, there is a requirement to have 2,000-over car park bays before a cineplex can start operations in an area, hence the multi-storey

carpark.

“When the car parks are ready and when the approvals for the cinema take place, it will be a new catalyst to the area,” says Ng.

More recently, he has noticed that there are buses bringing tourists for meals in DJ, which is known as a foodie haven, thus adding more vibrancy to the area.

Other similar neighbourhood commercial areas that are thriving in Petaling Jaya include Damansara Utama (DU) and SS2. These places are a constant hive of activity.

However, Ng says the shoplots in DU and SS2 are bigger than those in DJ. DU ones have a mezzanine floor while those in SS2 are twice the size of those in DJ.

Meanwhile, Sherman notes that although current rentals in the area could be lower than other areas such as DU or SS2, in the long term, rentals could increase as more investors are sourcing out established but older areas due to their relatively stable rentals and readily available catchment market especially for F&B type outlets.

Home to KDU, DJ has seen a decrease in its student population since the college’s main campus was moved to Utropolis in Glenmarie, Shah Alam.

This had impacted the housing rental market in DJ. However, houses are still well sought after by homebuyers and in the long term, more people would be seeking out homes here due to its location that borders Petaling Jaya and Kuala Lumpur and good accessibility, offers Sherman.

This story first appeared in EdgeProp.my pullout on Dec 12, 2017. Download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Wangsa Maju Seksyen 5

Wangsa Maju, Kuala Lumpur

Duduk Se.Ruang @ Eco Sanctuary

Kuala Langat, Selangor

Pulau Indah Industrial Area

Pulau Indah (Pulau Lumut), Selangor