Selangor Properties Bhd (Dec 28, RM4.82)

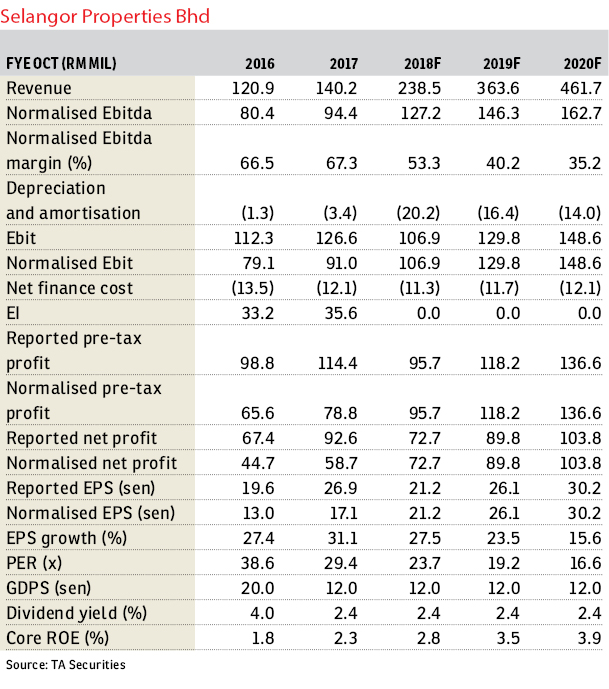

Maintain hold with a higher target price (TP) of RM5.28: Excluding exceptional items amounting to a gain of RM35.6 million, Selangor Properties Bhd (SPB) reported a normalised net profit of RM58.7 million for the financial year ended Oct 31, 2017 (FY17).

Exceptional items include the unrealised foreign exchange losses of RM17.7 million, fair value loss on financial assets of RM4 million, and fair value gain on investment properties of RM21.9 million. Results came within ours but above consensus expectations, accounting for 97% and 108% of ours and consensus full-year estimates respectively.

No dividend was declared during the quarter under review. However, we expect the board to propose a final dividend of 12 sen per share in January 2018, which will be subject to approval in an AGM to be held in February 2018.

SPB’s FY17 normalised net profit grew 31% year-on-year (y-o-y) to RM58.7 million, underpinned by a revenue growth of 15.5% y-o-y to RM140.2 million. Segmental wise, the property investment division’s normalised profit before tax (PBT) decreased 6% y-o-y, largely due to lower occupancy rates.

Meanwhile, the property development division’s FY17 pretax losses narrowed 5.3% y-o-y to RM16.6 million from RM17.6 million a year ago, as the FY16’s results were impacted by higher marketing and administrative costs arising from the official launch of Aira Residence last year.

Its Australian operation was the star performer, with the division’s FY17 normalised PBT surging 54.8% y-o-y to RM32.6 million. The stellar performance was mainly attributed to higher income from the residential development in Piara Waters, Perth and Point Cook in Melbourne.

Quarter-on-quarter (q-o-q), the group’s fourth quarter ended Oct 31, 2017 (4QFY17) normalised net profit decreased 24.7% to RM13.5 million, largely due to higher effective tax rate.

Nevertheless, 4QFY17 normalised PBT grew 35.2% on better performance across all the divisions, with the exception of its property investment division which declined 22% due to lower occupancy.

We updated our earnings model to incorporate the actual FY17 results. The impact on our earnings forecasts is negligible.

Going forward, the Aira Residences property (gross development value: RM850 million), which is expected to be completed by 2021, will anchor the group’s property division earnings.

As for the planned relaunch of the Bukit Permata project, SPB’s management maintains the targeted launch date in the first half of 2018. However, the redevelopment of Wisma Damansara in Damansara Heights has been put under review following the government’s recent freeze on approvals for the development of shopping complexes, offices, serviced apartments and condominiums priced above RM1 million.

We are not overly surprised with the decision and the outlook for the high-end condominium segment remains lacklustre. We have highlighted our concerns on the potential delays that prompted our downgrade on SPB’s rating to “hold” (from “buy” previously) in our 2018 strategy report.

Post housekeeping, our TP is revised slightly to RM5.28 from RM5.27 previously, based on blended CY18 price-earnings ratio/price-book ratio of 14 times/1 times.

SPB’s premium valuation against its peers is justified as its prized asset is the Damansara Town Centre which could be easily worth RM1.1 billion (representing 64% of the group’s market capitalisation [cap] of RM1.7 billion), if we benchmark it with the recent transacted price.

In addition, the group’s net liquid assets stand at RM782 million or a substantial RM2.28 per share. This makes up 45% of the group’s market cap. With a potential return of 7.6%, we maintain a “hold” recommendation on SPB. — TA Securities, Dec 28

This article first appeared in The Edge Financial Daily, on Dec 29, 2017.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)