Sunway Real Estate Investment Trust (Jan 2, RM1.70)

Maintain buy with a lower target price (TP) of RM1.90: Sunway Real Estate Investment Trust (REIT) has a good mix of quality assets including retail assets (70% of net property income [NPI]) that enjoy consistent, high occupancy rates; hotels (20%) that are seeing better demand; a medical centre (5%) where rental is covered by a triple net lease agreement; and offices (5%).

Sunway REIT’s diversified, defensive rental stream is a virtue in prevailing property market conditions, where offices are facing a supply glut and retail malls are seeing lower occupancy or weaker rental revisions. The retail-centric Malaysian REITs (MREITs) have seen a rising equity beta in recent years, partly due to the weak retail mall market. In contrast, diversified MREITs (such as KLCCP Stapled Group [KLCCSS]) and manufacturing/logistic peers (such as Axis REIT) have seen a lower equity beta.

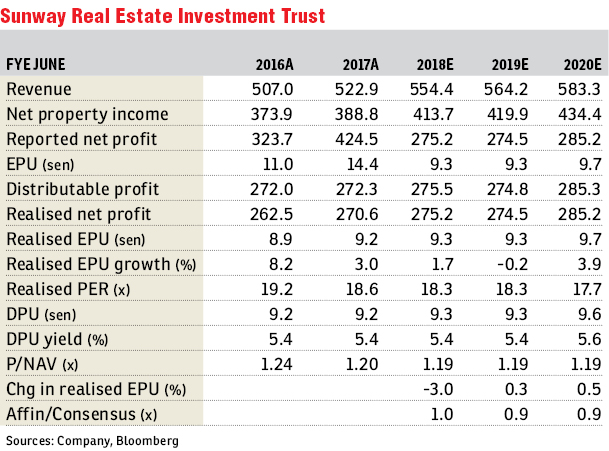

We tweaked our financial year ending June 30, 2018 (FY18)/FY19/FY20 earnings per unit (EPU) forecasts by -3%/+0.3%/+0.5%, imputing 3% annual rental revisions for Sunway Pyramid (from 5%), in view of the weak prevailing retail market conditions, and lower interest costs of 4.1% to 4.2% for FY18 to FY20 (from 4.1% to 4.3%), given Sunway REIT’s proactive hedging strategy (82% of current borrowings are at a fixed rate).

We reiterate our “buy” rating on Sunway REIT, with a lower dividend discount model (DDM)-derived TP of RM1.90 (from RM2.05) after lowering our retail growth forecasts and raising our cost of equity to 7.9% (from 7.6%).

Sunway REIT is our preferred pick among MREITs for its diversified asset portfolio. At a 5.4% distribution yield for 2018, its valuation looks attractive, considering its lower earnings risk (vis-à-vis other MREITs) and attractive asset injection pipeline from its sponsor (Sunway Bhd).

The downside risks to our positive view on Sunway REIT include rapid, successive interest rate hikes (we pencil in an overnight policy rate [OPR] hike for 2018), further deterioration in the retail mall market, leading to weaker-than-expected earnings, and lower-than-expected occupancy rates at its hotels. — Affin Hwang Capital, Jan 2

This article first appeared in The Edge Financial Daily, on Jan 3, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Setia Indah

Setia Alam/Alam Nusantara, Selangor

Pulau Indah ( Pulau Lumut )

Port Klang, Selangor

Sri Kayangan Apartment, Ukay Perdana

Ampang, Selangor

Section 14, Petaling Jaya

Petaling Jaya, Selangor