PETALING JAYA (Jan 29): More retailers are expected to embrace the “clicks and mortar” concept as e-commerce sees rapid growth in Malaysia, said Knight Frank Malaysia in its latest research report titled “Real estate highlights for 2nd half of 2017”.

“This is also seen in the F&B segment. For example, Uber has launched its food delivery service in Malaysia via its UberEATS app, joining other well-established food delivery service providers operating in the country, namely FoodPanda, PappaDelivery and HonestBee.

* ‘Cloudy outlook for KL, Selangor office markets’

* ‘More discounts being offered by KL high-end condo developers’

* Penang is tops with approved investments worth RM7.7b

* ‘Johor developers clearing stock, postponing launches’

* Concern over ‘sustainability’ of retail sector in Kota Kinabalu

“Additionally, the popularity of e-hailing services has changed the way we commute and helped to boost footfalls to selected shopping centres, with many having dedicated pick-up stands at strategic locations,” it elaborated.

However, the report noted that physical stores are still very much a fixture in the local retail scene.

“Online retail sales account for less than 5% of total retail sales in Malaysia as most shopping is done in stores. Visiting shopping centres remains a favourite pastime for Malaysians during weekends and holidays,” said the report.

Nonetheless, e-commerce is expected to grow, propelled by factors such as greater choices, bargains and convenience.

Meanwhile, the average occupancy rate level for prime and regional shopping centres such as Suria KLCC, Pavilion Kuala Lumpur Mall, Mid Valley Megamall, The Gardens Mall and Sunway Pyramid Shopping Mall continue remain high at 95% and above.

“During the similar review period, Suria KLCC’s occupancy level was at 96%. Meanwhile, the occupancies of selected suburban malls improved marginally such as The Mines (95.4%), Tropicana City Mall (93.7%) and Subang Parade (93%),” said the report.

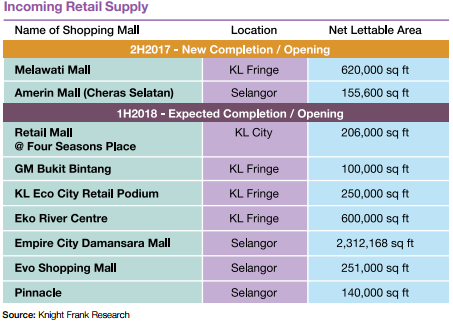

For 1H18, seven new shopping centres and supporting retail components with combined retail space of about 3.9 million sq ft are expected to enter the Klang Valley market.

They include KL Eco City Retail podium, Retail Mall @ Four Seasons Place, GM Bukit Bintang, Eko River Centre, Empire City Damansara Mall, Evo Shopping Mall Bangi and Pinnacle Petaling Jaya.

As for the rental market, the report noted that the monthly gross rentals of selected prime shopping centres remained resilient during the review period.

“Mid Valley Megamall commands rentals ranging from RM21.40 to RM45.30 per sq ft while for Suria KLCC, rentals are from RM35.10 to RM103.25 per sq ft. As for Sunway Pyramid Shopping Mall, rentals range from RM12.10 to RM23.80 on average,” said the report.

As for the outlook of the retail market, the short-term outlook for the retail industry is said to remain challenging; however, its mid- to longer-term prospects remain positive.

“For 2017, Retail Group Malaysia has revised down its earlier retail sales growth projection of 3.7% to 2.2% from an initial projection of 5% as retail sales declined by 1.1% in 3Q17. The Malaysia Retail Chain Association, however, expects the country’s overall sales to grow at 4.5%. The retail industry outlook remains subdued in the short term. Amid growing price pressures leading to lower disposable income, consumers continue to spend prudently, cutting back on discretionary purchases,” it said.

“However, the high GDP posting of 6.2% in 3Q17, up by 6.9% q-o-q, and the recent strengthening of the local currency, may however lift consumer sentiment and improve retail sales going forward,” the report concluded.

TOP PICKS BY EDGEPROP

Shamelin Star Serviced Residences

Cheras, Kuala Lumpur

Taman Nusa Bestari, Skudai

Iskandar Puteri, Johor