Pesona Metro Holdings Bhd (Jan 29, 44 sen)

Maintain buy recommendation with a target price (TP) of 70 sen: Pesona Metro Holdings Bhd announced that it had been awarded a RM161.9 million contract by Sime Darby Property Bhd for the Subang Jaya City Centre (SJCC) development in SS16 Subang Jaya. The job scope is for a 30-storey serviced apartment consisting of two blocks of 20-storey residential towers (361 units), facilities, three levels of commercial units and car parks to be completed over a period of 39 months (by April 2021).

This contract is Pesona’s first job win for financial year 2018 (FY18) which also comes after a quiet FY17. Pesona did not secure any new jobs for FY17 as it lost out on three building jobs that it tendered for as the margins were too low for comfort. Assuming a burn rate of RM150 million in 4QFY17 and after including this recent contract, we estimate its order book to now stand at RM1.6 billion. This translates into a cover of 4.3 times FY16 construction revenue.

Looking ahead, in terms of potential job wins, Pesona is targeting several building-type jobs in the tune of more than RM500 million. This includes hospitals, government facilities, condos and affordable housing. There could also be job potential from its sister company, Juta Asia Corp Sdn Bhd (unlisted), via upcoming new property developments.

Pesona’s acquisition of its first tranche (70% stake) in SEP Resources (M) Sdn Bhd (concessionaire of Universiti Malaysia Perlis [Unimap] hostel) was completed at end-September 2017. As such, the fourth quarter (4Q) should begin to see contribution from Unimap which we estimate will amount to RM2 million. The second tranche acquisition (balance 30% stake) is targeted for completion by March 2018.

The risk is a low order book replenishment. Our forecast is unchanged as we have already penned in RM500 million worth of new jobs for FY18.

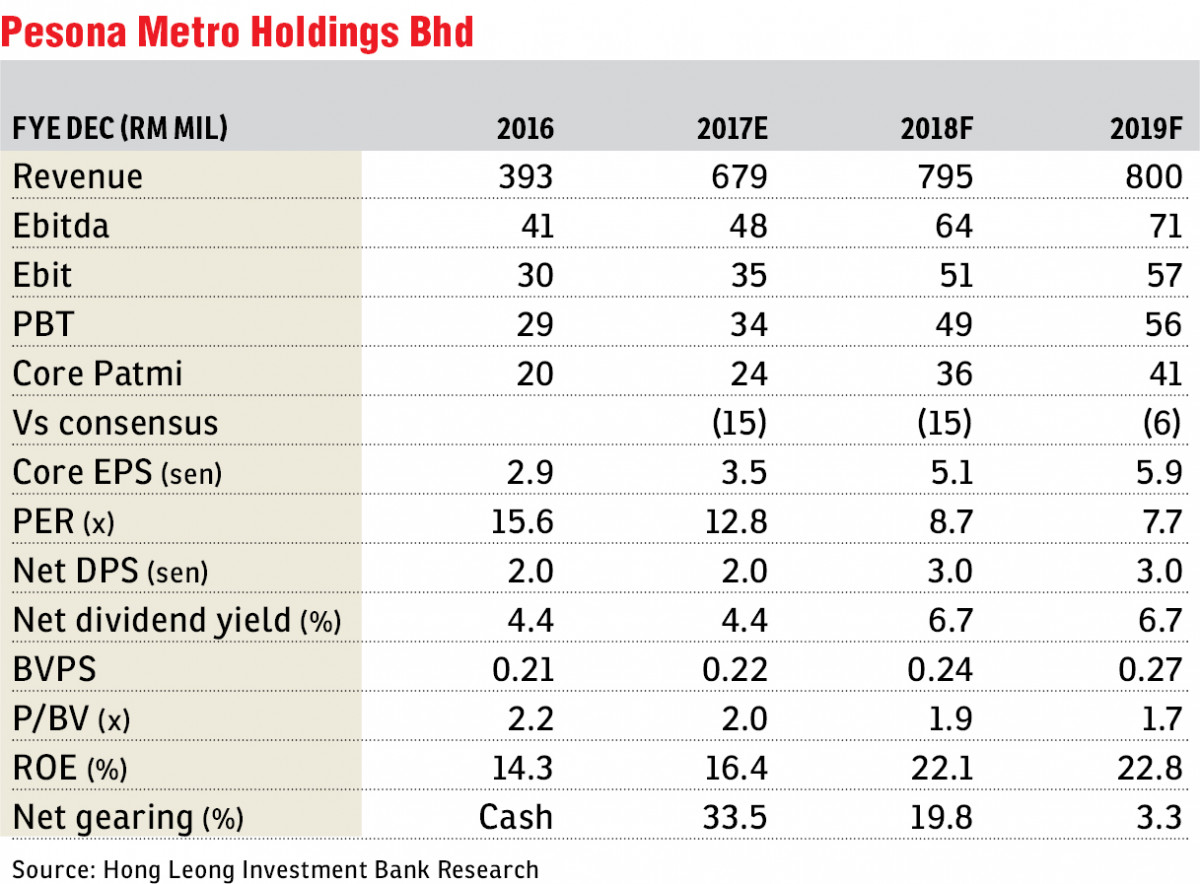

We maintain a “buy” rating with a TP of 70 sen. Pesona offers investors exposure to a pure construction play with an incoming stream of recurring earnings. Its financials are solid with strong earnings growth (three-year compound annual growth rate of 27%) and an increasing return on equity (FY18: 22%).

Our fully diluted sum-of-parts-based TP of 70 sen implies FY18 and FY19 price earnings ratio of 13.6 times and 11.9 times respectively. — HLIB Research, Jan 29

This article first appeared in The Edge Financial Daily, on Jan 30, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Kawasan Perusahaan Telok Mengkuang

Telok Panglima Garang, Selangor

Perdana Villa @ Taman Sentosa Perdana

Shah Alam, Selangor

Berjaya Park (Taman Berjaya)

Shah Alam, Selangor

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor