UOA Development Bhd (Feb 26, RM2.59)

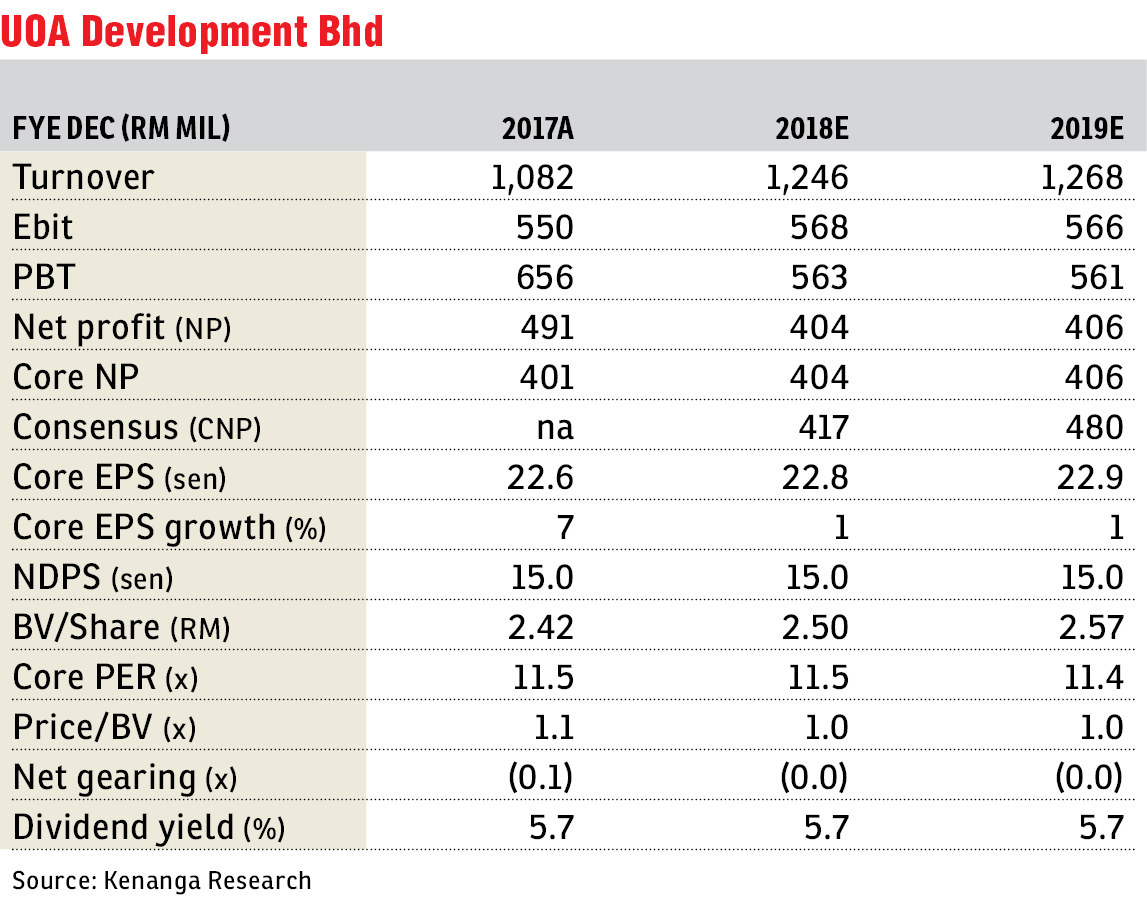

Reiterate market perform with a higher target price of RM2.60: UOA Development Bhd is acquiring 9.4-acre (3.8ha) freehold land in Sri Petaling for RM61.1 million (RM149 psf). We gather that it will be for a mixed development with emphasis on residential with RM1 billion gross development value (GDV). Note that this is UOA Development’s second project in the area, following its successfully completed-and-sold Le Yuen. The land is opposite Le Yuen and is on the other side of the Maju Expressway and in close proximity to the proposed mass rapid transit station.

There have not been many identical transactions in the area although we note there are detached plots transacted between RM110 psf and RM165 psf. Based on the GDV guidance, the land-cost-to-GDV ratio is at 6%, which implies a gross margin of about 45% or very much in line with UOA Development’s projects. Impact on the balance sheet is minimal as the estimated net cash position for financial year 2018 (FY18) will be reduced to 0.02 times (from 0.03 times). While details of the project are not available, we gather that management intends to keep unit pricing between RM500,000 and RM800,000 per unit, which we think will be digestible by the market.

For FY18, UOA Development has lined up RM1.37 billion worth of new launches for sale. The group’s inventory has hit a record high of RM1 billion (at cost) — but we estimate a market value of about RM2 billion. While this may look alarming, UOA Development has a very strong holding power and has demonstrated its ability to realise its inventory at the “right time”. Notably, there is more emphasis on recurring income.

No changes to forecast earnings, as the group is likely to switch drivers around for FY19 as the Jalan Ipoh project may be held back further from being launched. We reiterate “market perform”. — Kenanga Research, Feb 26

This article first appeared in The Edge Financial Daily, on Feb 27, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Kinrara 3

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 5

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor

Bandar Kinrara 2

Bandar Kinrara Puchong, Selangor

Taman Perindustrian Tungzen

Kampong Kepayang, Perak

Desa ParkCity (The Breezeway Garden Condo)

Desa ParkCity, Kuala Lumpur

BANDAR AINSDALE FASA 3B (TENANG)

Seremban, Negeri Sembilan