Gabungan AQRS Bhd (March 6, RM1.83)

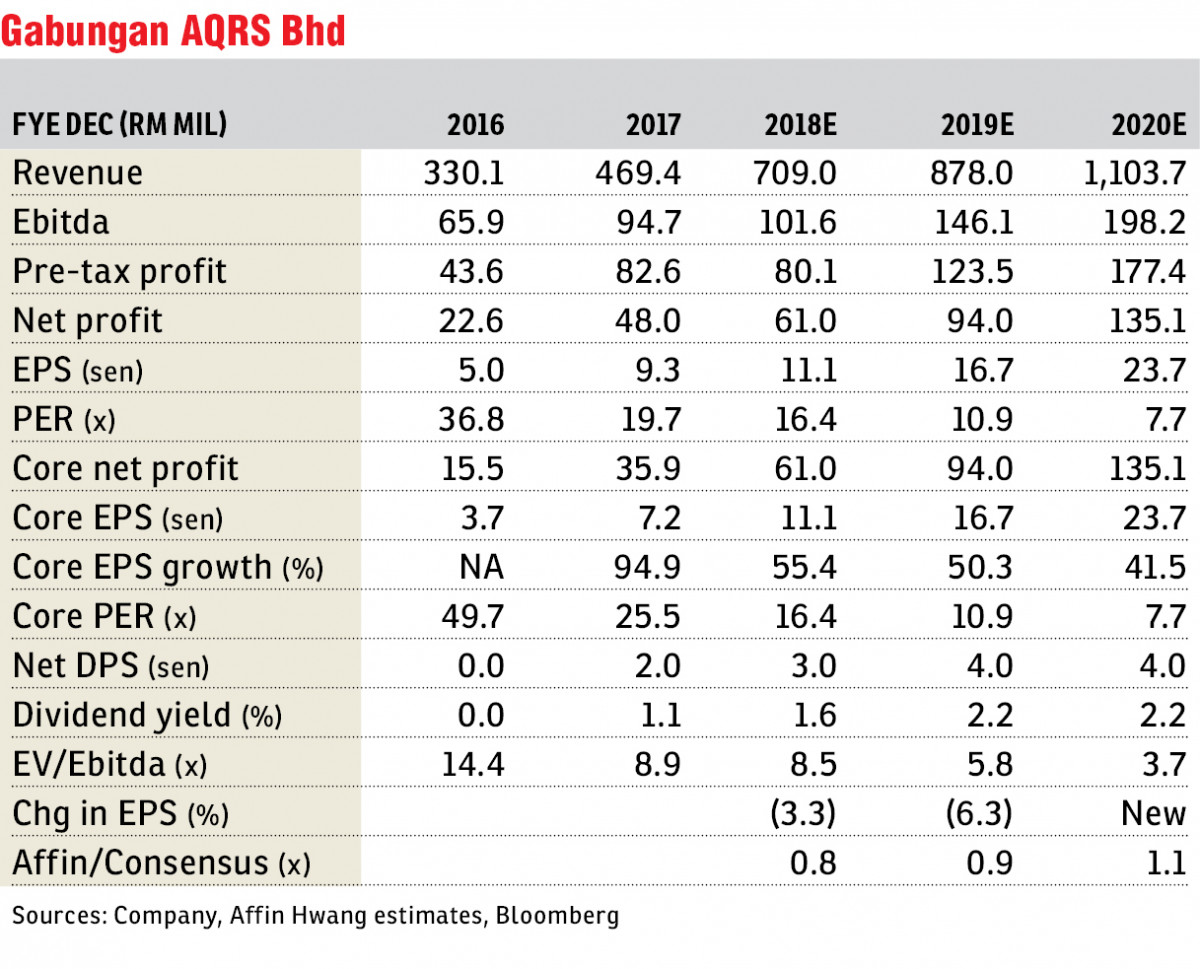

Upgrade to buy with a higher target price (TP) of RM2.25: We upgrade our call on Gabungan AQRS Bhd to “buy” from “hold” with a higher TP of RM2.25, based on a 10% discount to revalued net asset valuation (RNAV). The share price has corrected 14% from the high of RM2.14 on Jan 8. We see good prospects to grow its current order book of RM2.9 billion. Net gearing improved to 0.11 times at end-2017 following the RM78 million cash received for its mass rapid transit Line 1 (MRT1) approved variation order (VO) claims. However, we have cut financial year 2018 estimated (FY18E) and FY19E earnings per share (EPS) by 3% and 6% to reflect the weak sales for The Peak project.

AQRS is bidding for the East Coast Rail Link (ECRL), federal government projects in Kota Sultan Ahmad Shah (KotaSAS), and the Pan Borneo Highway (PBH) Sabah work packages. We believe prospects are good for AQRS to win the contracts, given its established construction operation in KotaSAS, Pahang, which the ECRL runs through; and partnership with Suria Capital, which is a majority-owned listed entity of the Sabah state government, to bid for the PBH Sabah packages. It is targeting to secure RM1.5 billion in new contracts in the first half of 2018 (1H18). We assume in our earnings forecasts that AQRS will clinch RM2 billion worth of new contracts in FY18 and RM1 billion per annum in FY19 to FY20.

AQRS received RM78 million from Mass Rapid Transit Corp Sdn Bhd (MRT Corp) for some of its VO claims in 4Q17, which relate to works completed for the RM523 million Klang Valley MRT1 Package V1 project (completed on Sept 29, 2016). Profit after tax of RM33.3 million was recognised in 4QFY17, offsetting the RM12.2 million liquidated ascertained damages for The Peak condominium project and RM17.5 million write-down for the Altium development cost.

The improved working capital management, land sale proceeds and MRT1 VO claims reduced its net gearing to 0.11 times at end-FY17 from 0.67 times at end FY16. We gather that potential VO claims of RM20 million for the MRT1 project and improved operating cash flow could see AQRS turn net cash positive in 1Q18.

We lift our RNAV/share to RM2.50 from RM2.40 to reflect lower net debt as at end-FY17 and our discounted cash flow valuation for its Petronas Chemicals base camp in Sipitang. — Affin Hwang Capital Research, March 6

This article first appeared in The Edge Financial Daily, on March 7, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur