AWC Bhd (March 8, 83.5 sen)

Maintain add with target price (TP) of RM1.28: We hosted a meeting between AWC’s management and 14 buy-side analysts and fund managers. AWC was represented by group chief financial officer (CFO) Richard Voon, chief executive officer (CEO) of AWC Rail Sdn Bhd Mohan Kumar, and Hisham Najmuddeen, vice-president in the CEO’s Office.

Representing Trackworks were CEO Alwyn Kong and director Gabriel Goh with key takeaways being details on the proposed acquisition, Trackworks’ current order book, and AWC’s plans to venture into rail management.

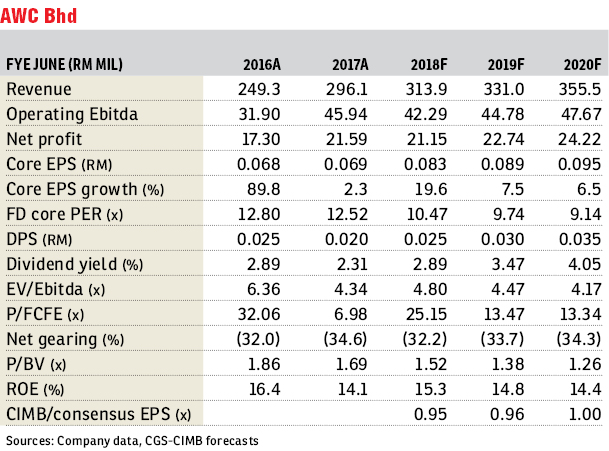

Earnings-accretive acquisition AWC views the valuation of this acquisition at eight times calendar year 2017 forecast (CY18F) price-earnings ratio (P/E) based on profit guarantees of RM8 million in FY18F and RM12 million in FY19F [September year-end]) as fair.

Besides taking into account the two-year profit guarantee, Trackworks’ valuations were determined based on its strong earnings track record and established background in rail-related works.

The deal also features a put-call option, valid for a period of five years upon the completion of the transaction, allowing AWC to acquire the remaining 40% stake it does not own.

Trackworks’ current order book stands at RM120 million over the next two years. This consists mainly of supply, installation and commissioning of various track materials and track-related machinery.

Trackworks also has a tender book amounting to RM600 million and it is confident it can achieve a conservative hit rate of 10%. It has worked with many reputable names in the rail industry, such as Prasarana, MRT, KTM and Express Rail Link.

AWC also highlighted plans to use Trackworks as a platform to venture into rail asset management using UK’s rail network as a model. AWC plans to introduce rail asset management programmes by working with rail asset owners and the Malaysian government.

This will be based on either a concession model or contract basis. With more than RM150 billion worth of rail projects in the nation’s pipeline, AWC is targeting to manage RM1.5 billion worth of rail assets, in particular rail tracks.

Based on our back-of-the-envelope calculations, this acquisition could increase AWC’s FY18 to FY20F earnings per share by 3.7% to 30.4%. However, we are not incorporating potential earnings accretion into our estimates pending the completion of the transaction.

Maintain our “add” call on the stock and sum of parts-based TP of RM1.28 with the downside risks to our view including the unexpected cessation of awarded contracts and termination of the proposed acquisition. — CGSCIMB Research, March 7

This article first appeared in The Edge Financial Daily, on March 9, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Country Heights Kajang

Country Heights, Selangor

Taman Setiawangsa

Taman Setiawangsa, Kuala Lumpur

Taman Setiawangsa

Taman Setiawangsa, Kuala Lumpur

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor