YTL Hospitality Real Estate Investment Trust (March 12, RM1.11)

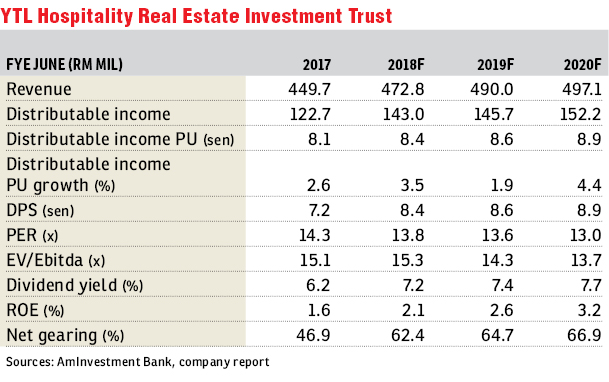

Maintain buy with a fair value (FV) of RM1.32: We raise our financial year 2018 forecasts (FY18F) to FY20F by 4% to 5% but cut our FV by 5% to RM1.32 (from RM1.39). We maintain our “buy” call. The earnings upgrade is to reflect the improved prospects of key assets of YTL Hospitality Real Estate Investment Trust (YTL REIT) while the lower FV is to factor in a higher forward target yield of 6.5% versus 6.1% previously as investors demand for higher yields in the current rising interest rate environment.

We came away upbeat from a recent meeting with YTL REIT. We are positive on its earnings outlook in FY18F to FY20F, underpinned largely by a strong performance from the Australian segment, specifically via the increase in average daily rate (ADR) of the Marriot Hotel in Sydney, and master leases with a 5% step-up clause for properties in Malaysia and Japan.

The completion of the Marriot Hotel in Sydney (89% occupancy) has driven second-quarter of FY18 (2QFY18) net property income (NPI) to improve 23% quarter-on-quarter. There is currently a shortage in the supply of rooms in Sydney, particularly in the luxury segment with newer hotel buildings expected to be gradually completed over the next two to three years. Hence, given the average occupancy rate for 2017 standing at 89%, coupled with the shortage of supply, there is further room for the ADR at Marriot Hotel in Sydney to increase up to A$300 from around A$280.

For the Brisbane Marriot Hotel, we expect occupancy to improve in the coming quarter with the upcoming Commonwealth Games to be held there in April. Moving forward, management has guided that the ADR for the Brisbane hotel will be lower to encourage occupancy. Also, renovations will likely begin in the next quarter. All hotel rooms (10% at a time) and public spaces will be renovated with capital expenditure estimated to be A$20 million.

Master leases with the 5% step-up clause continue to provide stability to the NPI for hotels in Malaysia and Japan. We expect to see earnings increase in the second half of FY18 where earnings from Majestic Hotel as well as Ritz Carlton Suite and Hotel Malaysia will be fully reflected.

The gearing level rose to 40.6% in 2QFY18 as debt was raised to fund the Majestic Hotel acquisition. With current debt levels at RM1.75 billion, management has guided that there is still capacity to take on more debt for accretive acquisitions such as The Green Leaf Niseko Village, which is currently undergoing valuation.

We like YTL REIT due to it being a hospitality REIT with exposure in the Australian market that continues to grow and at the same time has master leases on properties in both Malaysia and Japan that provide steady incomes. — AmInvestment Bank, March 12

This article first appeared in The Edge Financial Daily, on March 13, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Fraser Business Park

Sungai Besi, Kuala Lumpur

Avira Garden Terraces @ Medini

Iskandar Puteri (Nusajaya), Johor

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor