Scientex Bhd (March 23, RM8.15)

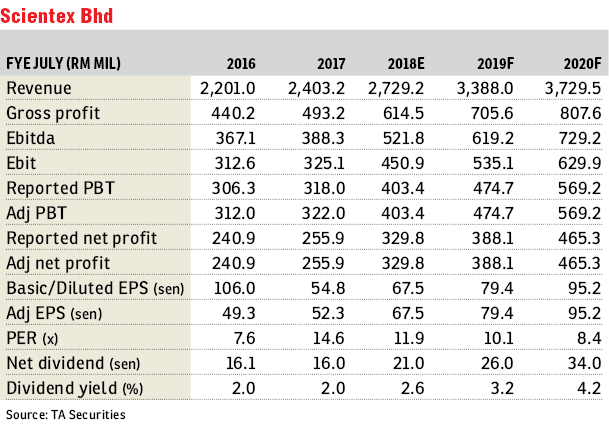

Maintain buy with a target price (TP) of RM10.01: Scientex Bhd’s first half of financial year 2018 (1HFY18) earnings came in at 42% of our and the consensus full-year estimates. We deem this as within expectations as we expect Scientex’s FY18 earnings to be back-end loaded.

On manufacturing, 1HFY18 operating profit improved by 22.7% year-on-year (y-o-y) to RM66.3 million on the back of a higher revenue contribution which increased by 16.9% y-o-y to RM925.5 million, an increase in production volume by 21.7% y-o-y to 113,400 tonnes, positive contribution from export sales, accounting for 78% (plus four percentage points [4ppts]) of total manufacturing revenue, and gain in operating profit margin by 0.3ppt to 7.2% due to a favourable product mix. Quarter-on-quarter (q-o-q), operating profit declined by 8.9% to RM31.6 million due to a lower revenue of RM456.4 million (-2.7%) as a result of strengthening of the ringgit against the US dollar.

On property, operating profit for 1HFY18 increased by 14.9% y-o-y to RM111.9 million attributable to strong progress billing and good take-up rates for developments in Johor, Melaka and Perak. Q-o-q, operating profit declined by 8.9% to RM53.3 million due to sales declining by 5.9% q-o-q to RM178.3 million.

No dividend was declared during the quarter under review. On impact, there’s no change to our earnings forecasts.

On the outlook, Scientex is poised to become the top regional player for plastic packaging manufacturing with a total expected capacity of 455,000 tonnes per year for FY18. Last month, the group announced its plan to acquire Klang Hock Plastic Industries Sdn Bhd (KHPI) for a total consideration of RM190 million which also comes with a profit guarantee of RM18 million to be recognised in FY19. We are positive on this acquisition as this will further support the group’s long-term growth strategy.

The new plant in Arizona, the US, commenced operations of stretch films in January 2018 with an expected total capacity of 30,000 tonnes per year. Furthermore, Scientex is expected to benefit from cost savings due to a growing supply of shale gas-based resin as compared to current usage of fossil fuel-based resin.

Note that with a total capacity of 356,000 tonnes per year as of FY17, Scientex has reached a utilisation rate of 55%. As of 1HFY18, the utilisation rate had reached 62% after active efforts by acquiring new clients through penetrative pricing. After the completion of the KHPI plant in 2HFY18, management plans to ramp up capacity to a 70% level by FY20 through focusing on improving margins in product offerings within the custom film range, coupled with sales volume growth.

To date, Scientex has a total gross development value of RM10 billion of future development to sustain earnings from the property segment for the next eight to 10 years. Note that the property segment has delivered positive take-up rates of between 90% to 100% upon launching. Currently, Scientex has presence in the Klang Valley, as well as the Northern and Southern Peninsula of Malaysia. The group will continue to look for opportunities to acquire land and hope to expand in new areas while still focusing on the affordable housing segment.

Risks include: Strengthening of the ringgit may limit top-line growth and a rising level of crude oil prices may limit the gross margin within the manufacturing division, as well as lower-than-expected take-up rates for new launches in the property division.

We maintain our “buy” call on Scientex, with an unchanged TP of RM10.01 per share based on sum-of-parts valuation. We like Scientex due to its market-leading regional position as a flexible plastic packaging manufacturer, high take-up rates of newly launched property development projects and a healthy balance sheet position. — TA Securities Research, March 23

This article first appeared in The Edge Financial Daily, on March 26, 2018.

For more stories, download EdgeProp.my pullout here for free.

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)