Malaysian Resources Corp Bhd (April 6, 97.5 sen)

Maintain buy with a target price (TP) of RM1.34: Malaysian Resources Corp Bhd (MRCB) announced last Thursday the MRCB-Gamuda consortium (with each party having a 50% stake) has received a letter of intent from MyHSR Corp for the intention to award the Kuala Lumpur-Singapore High-Speed Rail (HSR) project delivery partner (PDP) Package 1 (North) to the consortium. This package details the section of the HSR which will span from Kuala Lumpur to the state border between Melaka and Johor.

Meanwhile, the YTL Corp-TH Properties Sdn Bhd consortium has been selected for the southern portion (Johor to Singapore border) of the HSR project alignment. MyHSR is the project owner of the Kuala Lumpur-Singapore HSR. The PDPs will be responsible for designing and delivering the civil works for the HSR project at an agreed cost and schedule, involving the planning, construction, testing and commissioning of the railway.

According to the announcement, the terms of the PDP Package 1 agreement will be negotiated over the next three weeks. Upon mutual agreement by both parties, a letter of award would likely be given.

Based on the project’s environmental impact assessment, the northern portion makes up about 45% of the railway alignment. Assuming a total infrastructure cost of RM35 billion and a construction period of eight years, the PDP fees would add six sen to MRCB’s TP, based on a 5% PDP fee and 9% discount rate.

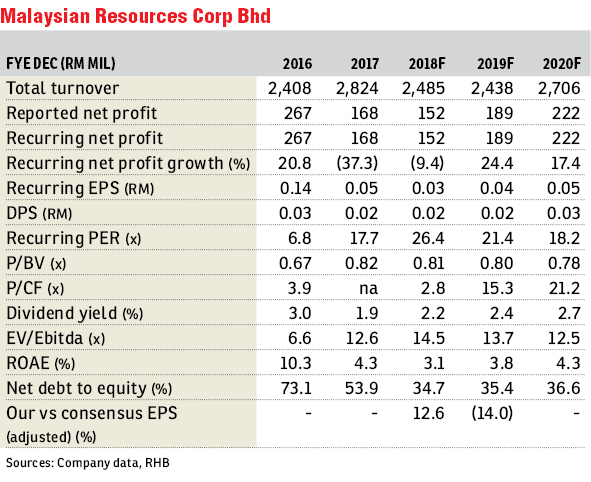

We keep our financial year 2018 (FY18) to FY20 earnings forecasts unchanged, as the contribution of the PDP fees would likely be minimal at the initial phase of the project.

Pending further details of the contract value and firmed PDP fees, we maintain our TP of RM1.34, based on a 15% discount to revalued net asset valuation. We reiterate our “buy” rating on MRCB. — RHB Research Institute, April 6

This article first appeared in The Edge Financial Daily, on April 9, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor