Pesona Metro Holdings Bhd (April 16, 33 sen)

Pesona Metro Holdings Bhd (April 16, 33 sen)

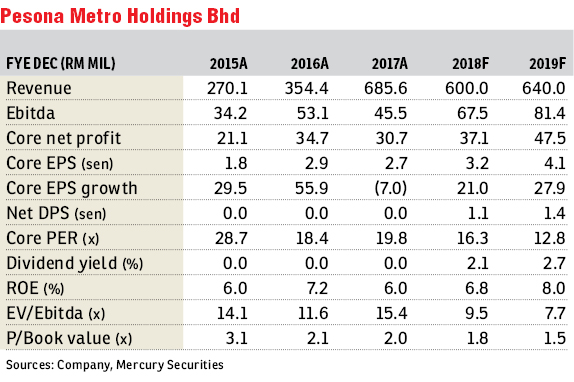

Maintain buy with a target price (TP) of 45 sen. Established as a sub-contractor in 1996, Pesona Metro Holdings Bhd (PMHB) has grown into a successful and award-winning contractor with an excellent track record in project execution and timely completion. Since its listing in 2012, PMHB has completed over RM2 billion worth of jobs.

Large outstanding order book of RM1.9 billion consisting of both private and public sector construction jobs provides good earnings visibility for the next two to three years.

Baring a sharp slowdown in private property construction activities due to oversupply, we expect the group to continue to tender for private and public sector construction jobs, the latter helped by implementation of Economic Transformation Programme jobs and high budgetary spending.

PMHB’s current 70% stake in the Universiti Malaysia Perlis student hostels concession, awarded by the government and Universiti Malaysia Pahang, will provide a steady stream of base income until the year 2037. Ceasing the loss-making manufacturing businesses is a positive move.

We believe PMHB is poised for a good rebound in earnings and sustained growth. Recent share price declines seem overdone and the share price is at an attractive level now.

We initiate coverage on PMHB with a “buy” call and a fully-diluted target price of 45 sen. — Mercury Securities Research, April 16

This article first appeared in The Edge Financial Daily, on April 17, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Taman Nusa Sentral

Iskandar Puteri (Nusajaya), Johor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor