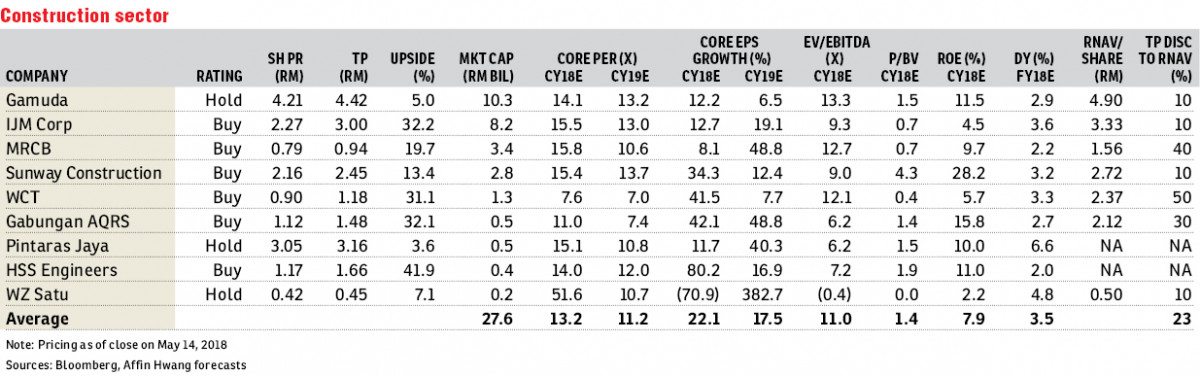

Construction sector

Downgrade to neutral: The surprise election outcome with Pakatan Harapan (PH) winning the election led to a knee-jerk selldown in construction stocks. This is due to PH’s manifesto to review infrastructure projects in the implementation stage, which raises the risk of cancellation, variation in scope or postponement. We downgrade the construction sector to “neutral” from “overweight” on these concerns. We also downgrade our call on Gamuda to “hold” from “buy” given the heightened risks on order-book replenishment and cut target prices for other construction stocks

The new PH government has indicated that it will review infrastructure projects to be implemented, especially those involving loans and investments from China, to ensure that the cost is reasonable and will not overly burden the federal government’s financial position. We believe the projects that will likely be affected include the RM55 billion East Coast Rail Link (ECRL), RM60 billion Kuala Lumpur-Singapore high-speed rail (HSR), RM45 billion Klang Valley mass rapid transit Line 3 (MRT3) and RM9 billion Gemas-Johor Bahru electrified double-tracking rail projects.

Given that the ECRL project has been awarded to China Communication Construction Co Ltd, we believe the project is unlikely to be cancelled to ensure that the sanctity of government contracts is preserved. However, the implementation of the project could be staggered to reduce the government’s loan obligations, namely the more viable Port Klang-Kuantan Port stretch could be implemented first. The implementation of the MRT3 and HSR projects could be postponed to reduce the government’s financial burden.

Given the risk that the HSR and MRT3 projects that Gamuda is pursuing could be affected, we cut our earnings per share forecasts by 7% and 16% in financial year 2019 estimate (FY19E) and FY20E assuming no new contracts. We downgrade our call on Gamuda to “hold” from “buy” with a reduced RNAV-based target price (TP) of RM4.42. We cut our TPs and EPS forecasts for selected construction companies in our universe to reflect the de-rating of the sector and future order-book replenishment risks.

We downgrade the construction sector to “neutral” from “overweight” due to concerns about delays in implementation of infrastructure projects slowing the companies’ order-book replenishment prospects. We switch our top “buys” to IJM Corp for large-cap (previously Gamuda), Sunway Construction for mid-cap (previously MRCB) and HSS for small-cap picks, favouring apolitical companies. — Affin Hwang Capital Research, May 15

This article first appeared in The Edge Financial Daily, on May 16, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Telok Panglima Garang

Telok Panglima Garang, Selangor

ZETA PARK @ CITRA HILL

Seremban, Negeri Sembilan

Condominium Bercham Prima @ Kiara Condo Bercham

Ipoh, Perak

Jalan Taman U Thant 1

Taman U-Thant, Kuala Lumpur

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)