Sime Darby Property Bhd (May 21, RM1.46)

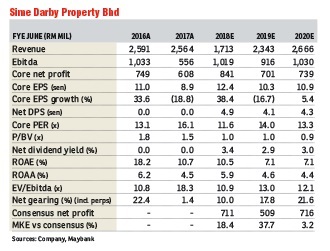

Maintain hold with a target price (TP) of RM1.57: We are positive on Sime Darby Property Bhd’s latest venture with Japanese property players to jointly develop Sime Darby Property’s industrial land in Bandar Bukit Raja (BKK) as the joint venture (JV) will not only enhance the long-term value of the Bandar Bukit Raja project (BKK) but also allow Sime Darby Property to tap its foreign partners’ expertise and provide a steady recurring rental income. We maintain our earnings forecasts and RM1.57 RNAV TP (on an unchanged 0.55 times P/RNAV peg) pending the release of its third quarter of financial year 2018 (3QFY18) results. Maintain “hold”.

Sime Darby Property is partnering Japan’s Mitsui & Co Ltd and Mitsubishi Estate Co Ltd to develop and lease build-to-suit industrial facilities on a 39-acre (15.8ha) site at the Bandar Bukit Raja integrated township in Klang. Sime Darby Property will hold a 50% stake in the JV company while the remaining 50% will be held by Mitsui’s Malaysian subsidiary, Mitsui M-Co. Mitsubishi Estate will participate in the JV indirectly via its 40% holdings in Mitsui M-Co. The gross development value (GDV) for the 39-acre industrial project is estimated at RM530 million.

We are not surprised by the JV as we understand that Sime Darby Property has been working on the JV deal before its listing in November 2017. We are positive on the deal as the venture will not only enhance the long-term value of the Bandar Bukit Raja project by creating more jobs and serve as a pull factor there but also allow Sime Darby Property to tap into Mitsui’s and Mitsubishi’s expertise as well as provide a steady recurring rental income. The JV could result in a net disposal gain of RM41 million to be recognised in 2018, we estimate.

We maintain our earnings forecasts pending the release of its 3QFY18 results by the end of May 2018. The execution of the definitive and binding agreement between S P Setia-Sime Darby Property and PNB-EPF for the sale of Battersea The Power Station’s commercial spaces has been postponed to June 2018, from April 2018. Foreign shareholdings were 14.7% at end-April 2018. — Maybank IB Research, May 18

This article first appeared in The Edge Financial Daily, on May 22, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Petaling Jaya Commercial City

Petaling Jaya, Selangor