Gamuda Bhd (June 5, RM3.62)

Maintain hold with a lower target price (TP) of RM3.50: Gamuda Bhd’s remaining order book of RM13.5 billion (including a RM6.6 billion for project delivery partner [PDP] contract) will sustain construction activities over the next three years. This excludes MRCB Gamuda Consortium’s appointment as the PDP for the northern section of the Kuala Lumpur-Singapore high-speed rail (HSR) project. This follows the suspension of negotiations on the PDP agreement with the government on May 31, 2018. We gather that the MMC Corp-Gamuda-George Kent joint venture was a frontrunner for the mass rapid transit Line 3 (MRT3) project before the project was cancelled recently. Gamuda hopes to revive the MRT3 project, as the Circle Line will integrate the existing public rail services in the Klang Valley.

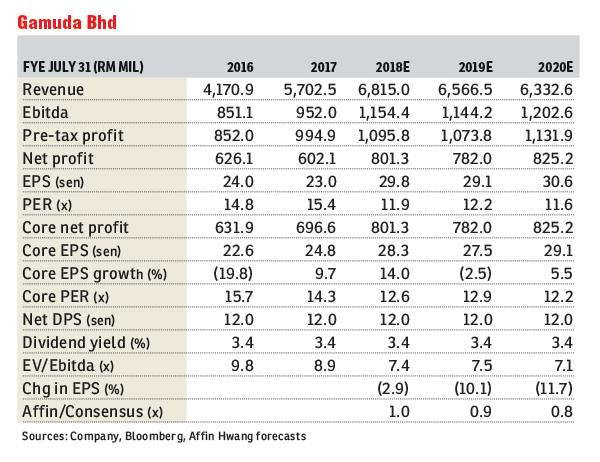

We gather that the estimated cost of RM45 billion for the project could be reduced to RM20 billion to RM22 billion by scaling down the project. The Gamuda-led SRS Consortium (60% stake) remains the PDP for the RM32 billion Penang Transport Master Plan (PTMP), which may be revived.We expect Gamuda to see slower progress billings on its remaining construction order book while its property projects continue to face weak market conditions. We cut earnings per share by 3% to 12% for financial year 2018 (FY18) to FY20 to reflect these concerns. We revise down our fully diluted revalued net asset valuation (RNAV)/share estimate to RM4.38 from RM4.90 to reflect the lower construction and property division valuations.

Applying a higher 20% discount to RNAV (from 10%) to reflect the heightened risks, we slash our TP to RM3.50 from RM4.42 previously.We reiterate our “hold” call as the current share price is at 10-year trough historical price-to-earnings ratio and price-to-book valuations. However, any upward rerating catalyst for Gamuda is limited amid government policy risks. — Affin Hwang Capital, June 5

This article first appeared in The Edge Financial Daily, on June 6, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Vista Sri Tanjung Condominium

Semenyih, Selangor

Bandar Sungai Long

Bandar Sungai Long, Selangor