Selangor Properties Bhd (June 27, RM4.14)

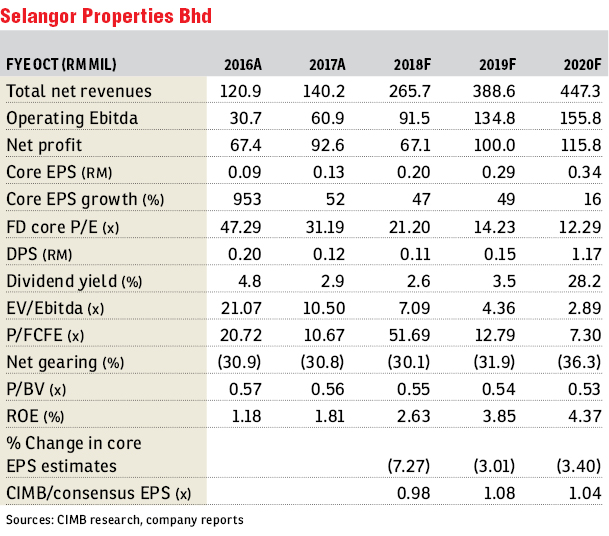

Maintain hold with a lower target price (TP) of RM4.40: Selangor Properties Bhd’s first half ended April 30, 2018 (1HFY18) core net profit came in below expectations at 40% of our full-year estimate and 42% of the Bloomberg consensus number.

The underperformance was due to higher-than-expected costs arising from AIRA Residence’s marketing efforts.

Excluding forex loss (RM53.8 million), gains from disposals (RM2.2 million) and mark-to-market loss (RM11.5 million) on financial and investment assets, 1HFY18 core net profit rose 23% year-on-year (y-o-y) on stronger revenue (+7% y-o-y).

The higher 1HFY18 revenue was driven by improvements in property development (+47.6% y-o-y) supported by AIRA Residence, and better sales from Australian operations (+16.2% y-o-y) due to higher rental income, which offsets the 15.5% y-o-y sales decline in investment holding.

Loss before tax of RM28.6 million was recorded in 1HFY18 dragged down by forex losses in investment holding with the strengthening of the ringgit against the US dollar. This offsets the narrowing losses in property development and higher profits from the Australian operations.

We believe the overall property outlook for 2018 remains bleak, amid an unfavourable macro environment.

The approval freeze on luxury projects (including shopping complexes, offices, serviced apartments and condominiums priced above RM1 million), low affordability and mismatch between supply and demand, are still risks to private developers’ sales.

The group has put mixed development Wisma Damansara under review due to the muted market outlook.

We cut our FY18 to FY20 forecast earnings per share by 3% to 8% to reflect the higher-than-expected marketing expenses and changes in project timelines.

Nonetheless, we still expect stronger 2HFY18 earnings in the property development division, arising from work progress recognition on units of AIRA Residence sold.

Although earnings prospects seem intact in FY18F, in our view, the stock may remain undervalued due to its low return on equity of just 2% to 5% from FY18 to FY20.

Our TP is cut to RM4.40 as we widen our realised net asset value discount to 60% from 50% previously, after factoring in the rising interest rate environment.

The large discount reflects the uncertainty over its land bank development time frame and low trading liquidity. Thus, we maintain “hold”.

The key upside risk to our “hold” call is faster-than-expected development of its land bank while the key downside risk is a deterioration in property market sentiment. — CGSCIMB Research, June 26

This article first appeared in The Edge Financial Daily, on June 28, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Clarinet @ Taman Desa Tebrau

Johor Bahru, Johor

Nusa Perdana Serviced Apartment

Gelang Patah, Johor

Plenitube Harp @ Taman Desa Tebrau

Johor Bahru, Johor

Pangsapuri Sri Ilham, Bandar Baru Seri Alam

Masai, Johor