Construction sector

Maintain neutral. The whopping light rail transit line (LRT) 3 project cost (of RM31.45 billion) is a negative surprise. Previously, we expected LRT3 to proceed given construction progress is about 10%; the rail would be beneficial to below 40% (B40) and middle 40% (M40) groups, have positive socio-economic impacts, and the ability to reduce traffic congestion in the Klang Valley, especially along the New Klang Valley Expressway and Federal Highway.

No breakdown of the project cost was given but we suspect the inflated cost may include land acquisition and financing costs.

As such, the new project cost is not comparable with the original budgeted cost of RM9 billion, nor the escalated RM15 billion project cost reported by the media recently, as we believe the latter excludes land acquisition and financing costs.

Based on the statement given by the finance minister and if a minimal cost reduction of RM6 billion is insisted for the project to proceed, we see a likelihood of the project being suspended for a major revamp before it could proceed further.

We see limited avenues for the government to reduce the project cost by more than RM6 billion without suspending and revamping the project as majority of the work packages have been awarded and contract sums have been determined; land acquisition has achieved significant progress, and construction progress has achieved approximately 10%.

Sector-wise, the statement by the finance ministry is expected to raise further concerns about the near- to medium-term outlook for the construction sector. The benchmark KL construction index has plunged 28.9% since the 14th general election to close at 199.76 points yesterday.

This comes after the suspension/cancellations of East Coast Rail Line, KL-Singapore high-speed rail and third mass rapid transit, with a combined value of more than RM180 billion.

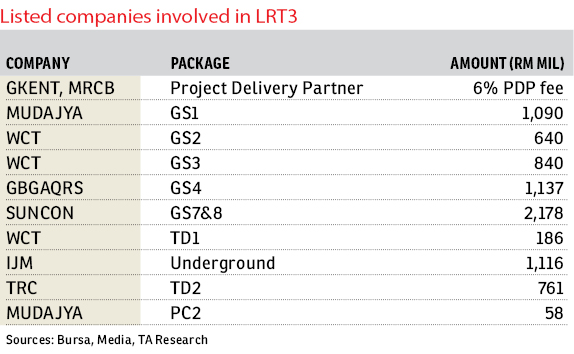

Given the gloomier industry outlook and increasing uncertainty in the sector, we reduce the target price-to-earnings ratio (PER) multiple for construction companies with exposure to rail-related projects and arrive at a revised target price (TP) for Gamuda Bhd (TP: RM4.48), IJM Corp Bhd (TP: RM1.73), Sunway Construction Group Bhd [SunCon] (TP: RM1.71), WCT Holdings Bhd (TP: RM1.02) and Gadang Holidngs Bhd (TP: RM1.10). Subsequent to the TP adjustment, we downgrade SunCon to “sell”.

While there is no change to Pesona Metro Holdings Bhd’s TP, the stock is downgraded from “buy” to “sell” on valuation grounds. — TA Securities, July 11

This article first appeared in The Edge Financial Daily, on July 12, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Norton Garden Semi D @ Eco Grandeur

Bandar Puncak Alam, Selangor

Yayasan FAS Business Avenue

Petaling Jaya, Selangor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Canal Gardens, Kota Kemuning

Kota Kemuning, Selangor

Utamara Boutique Residences

Petaling Jaya, Selangor

Brunsfield Embassyview

Taman U-Thant, Kuala Lumpur

ViPod Residences (6 Kia Peng)

KLCC, Kuala Lumpur

Taman Cahaya Alam, Seksyen U12

Shah Alam, Selangor

Damansara Heights

Damansara Heights, Kuala Lumpur