Gabungan AQRS Bhd (July 13, RM1.26)

Maintain buy with a higher target price (TP) of RM1.60: Gabungan AQRS reported its first half ended June 30, 2018 (1HFY18) results that were above our expectations but within the street’s expectations.

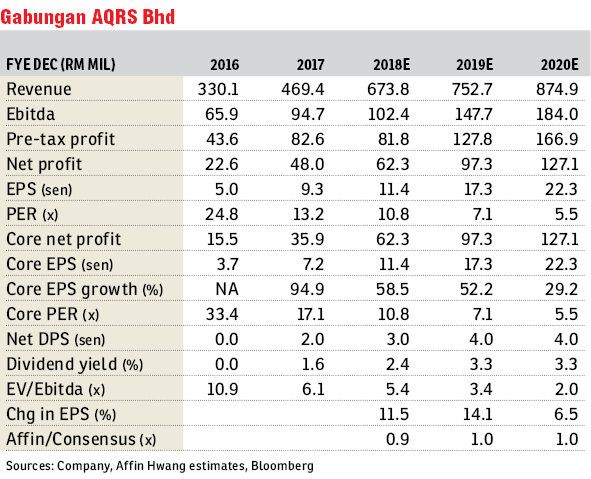

Gabungan AQRS reported a net profit of RM35.6 million in 1HFY18 comprising 50% of consensus full-year forecast of RM71.4 million and 64% of previous estimate of RM55.4 million.

Revenue jumped 32% year-on-year (y-o-y) to RM314.7 million on higher construction (+42% y-o-y) and property development (+70% y-o-y) revenue.

Profit before tax (PBT) increased 36% y-o-y to RM48.7 million in 1HFY18, mainly driven by higher construction PBT (+66% y-o-y) and interest income while its property division incurred a small loss.

Net profit was up 52% y-o-y with lower effective tax rate. Excluding the one-off land sale gains in 1HFY17, core net profit jumped 249% y-o-y to RM35.3 million.

Gabungan AQRS’ high remaining order book of RM2.5 billion comprising the Sungai Besi-Ulu Kelang Elevated Expressway, Kota Sultan Ahmad Shah and light rail transit (LRT) Line 3 projects will sustain construction earnings growth. Gabungan AQRS targets to secure another RM1.5 billion worth of new contracts. Poor sales for The Peak development continues to drag down property earnings.

Unbilled sales of RM128 million and unsold property units valued at RM486 million will contribute to property earnings in FY19 to FY22.

Gabungan AQRS also plans to launch its E’Island Residence affordably-priced apartments (1,104 units) with total gross development value of RM491 million in 2H18.

We upgrade earnings per share (EPS) by 7% to 14% in FY18 to FY20 to reflect better construction PBT margins. Construction PBT margin was high at 16.7% in 1H18 as its projects move to more advance stage of construction.

Assuming a higher sustainable construction earnings of RM70 million (RM60 million previously), we lift our fully-diluted revalued net asset value per share estimate to RM2.30. We reiterate our “buy” call on Gabungan AQRS with TP raised to RM1.60 from RM1.48, based on the same 30% discount on the lifted RNAV per share. Key risk is slower order book replenishment and execution. Key downside risks are project execution risks, delays in launching of the One Jesselton project and lower-than-expected new construction contract procurement in FY18. — Affin Hwang Capital, July 13

This article first appeared in The Edge Financial Daily, on July 16, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)