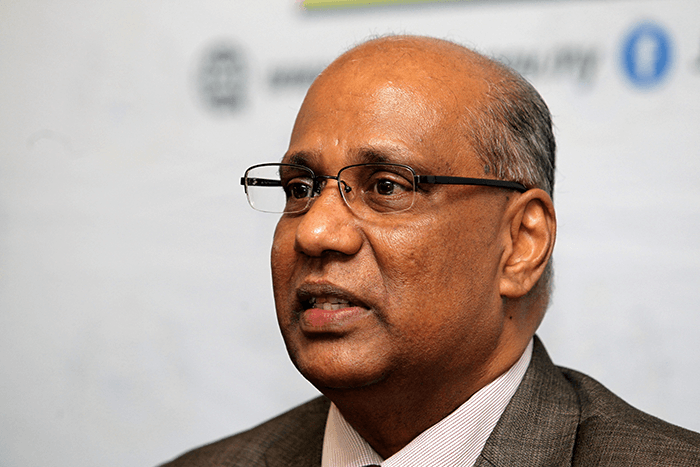

KUALA LUMPUR (July 19): Royal Malaysian Customs Director-General Datuk Seri Subromaniam Tholasy (pictured) said today that the comeback of the sales and services tax (SST) come Sept 1, deemed "SST 2.0", will be much simpler than the first SST and goods and services tax.

"SST is much more simpler than GST that's for sure, but of course there will be challenges and issues. The proposed model for SST 2.0 in terms of the law would probably be the same, but with some enhancements.

"SST filing and payment will be done electronically, as opposed to manual filing [under the old SST]. We are coming out with a new system [for SST filing] in which we are confident on rolling out next month," he said at SST implementation briefing session organised by the Customs today.

The Customs will kick off a "hand holding" program that will commence nationwide on July 24 to help industry players with the transition to SST 2.0. This will include briefings and forums on the tax. — theedgemarkets.com

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)