Lafarge Malaysia Bhd (July 24, RM3.36)

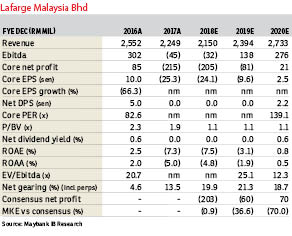

Upgrade to hold with a lower target price of RM3.11: Second quarter of financial year 2018 (2QFY18) results could be disappointing given the rampant competition and softer demand. Our FY18 net loss is raised and we now project for net losses to continue into FY19. Our FY20 earnings are cut by 86%. That said, while the outlook remains challenging, we believe that the negatives have been priced in following a 45% fall in share price year to date.

Based on our channel checks, intense competition continued to suppress cement average selling prices (ASPs) in 2QFY18 as construction activities slowed during the Ramadan/Raya period. No attempt to raise cement ASPs was made since March 2018 (unsuccessful attempt to raise bag cement ASPs by more than 20%) as industry players took a defensive stance to protect sales, we understand.

Also, with spot coal prices on an uptrend year-on-year (y-o-y) (+12% y-o-y), since about 20% of Lafarge Malaysia Bhd’s (LMC) annual coal requirement is sourced from the spot market, we believe LMC’s 2QFY18 earnings could likely be lacklustre (first quarter of financial year 2018 (1QFY18): RM69 million net loss).

We believe any increase in cement ASPs will only occur when industry demand outlook improves. Given that various mega-infrastructure projects have now either been cancelled or put under review (projects like the third Klang Valley Mass Rapid Transit [MRT3], the East Coast Rail Link [ECRL], the Singapore-Kuala Lumpur high-speed rail), our previous expectations for an infrastructure-led demand growth in second half of 2018 (2H18) may not materialise. For LMC, despite being the sole supplier of cement to ECRL, the project was still in its early stages of construction, thus its contribution to LMC’s overall sales volume was less than 5% from the period March 2018 to June 2018.

We raise FY18 net loss to RM205 million (RM87 million previously), and now expect a loss of RM81 million for FY19 versus RM99 million net profit before on: (i) lower FY18 industry demand growth of +3% y-o-y (+5% previously) but leave FY19-FY20 industry demand growth unchanged (+5% per annum), (ii) FY18/FY19/FY20 cement ASP growth of -8%/+6%/+10% y-o-y (from 9%/10%/3%) and (iii) higher FY18-FY20 coal costs by 6% per annum. — Maybank IB Research, July 24

This article first appeared in The Edge Financial Daily, on July 25, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Baypoint @ Country Garden Danga Bay

Johor Bahru, Johor

Menara Bintang Goldhill

Bukit Bintang, Kuala Lumpur

Bandar Bukit Tinggi

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Pangsapuri Akasia, Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur