Enra Group Bhd (Aug 14, RM2.30)

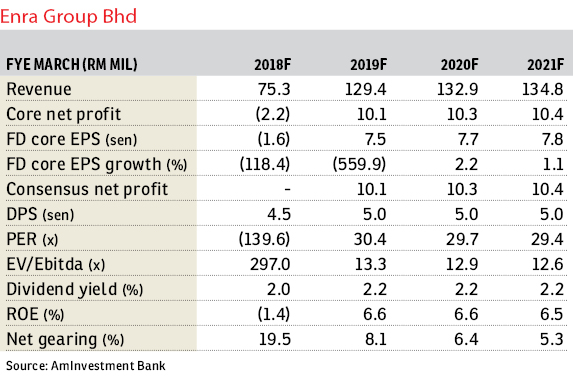

Maintain hold with an unchanged fair value (FV) of RM1.85: Enra Group Bhd registered a first quarter ended June 30, 2018 (1QFY19) net profit of RM1.2 million (+17.9% year-on-year [y-o-y] mainly due to a higher contribution from the energy services division.

Despite making up only 12% of our full-year forecast, we reckon this to be in line with expectations as we expect stronger earnings in coming quarters with bigger contributions from its energy division and revenue recognition of its property development in London. The property development division recorded the sale of one unit of Shamelin Star during the quarter with the revenue to be recognised in 2QFY19. Sale and purchase agreements for two units of Shamelin Star will be signed soon while five bookings have been made. This leaves eight units still available as of August 2018.

The development of 93 Great Titchfield Street, London (75% stake, gross development value [GDV] of £11 million [RM57.59]) is expected to be completed by September 2018 and so far it has received bookings for two units. This project will contribute positively to the bottom line as costs have mostly been incurred. Meanwhile, the company will continue its efforts to sell the remaining eight residential units of Shamelin Star to realise profits.

Meanwhile, Enra is exploring several property development opportunities in the Klang Valley, focusing mainly on landed residential in the price range of RM500,000 to RM600,000 per unit.

The engineering, construction and fabrication division has completed a major project, and is actively seeking to win jobs in various industries. At present, its tender book stands at approximately RM1 billion.

Enra’s forward earnings will be driven largely by its US$48 million (RM210 million) four-year contract for the provision of condensate storing and offloading services for the Yetagun offshore gas field, off the coast of Myanmar; and sales from its remaining eight units in Shamelin Star and its one-off property project in London. Meanwhile the proposed land reclamation project in Labuan is still a long way to go and will not have significant contribution to the group’s bottom line over the short to medium term. — AmInvestment Bank, Aug 14

This article first appeared in The Edge Financial Daily, on Aug 15, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Bandar Puncak Alam

Bandar Puncak Alam, Selangor

Jalan Taman Bukit Kinrara 1/8

Bandar Kinrara Puchong, Selangor

Savanna Executive Suites @ Southville City

Bangi, Selangor