LBS Bina Group Bhd (Aug 30, 88.5 sen)

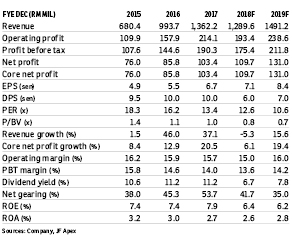

Maintain buy with an unchanged target price (TP) of RM1.30: LBS Bina Group Bhd recorded second quarter of financial year 2018 (2QFY18) net earnings of RM20.8 million, down 26.8% year-on-year (y-o-y) and 9.6% quarter-on-quarter (q-o-q). Its first half of FY18 (1HFY18) net profit was down 17.7% y-o-y, accounting for 40% and 36% of our and consensus full-year estimates respectively. We deem the results as in line as we expect its earnings to pick up in 2HFY18 and meet our full-year net profit forecast, banking on higher progress billings for projects such as Alam Perdana and the Bukit Jalil project.

The lower y-o-y results for 2QFY18 and 1HFY18 were due to lower work in progress as certain projects were completed and handed over to buyers at end-2017; new projects were still in the initial stage of construction. The weaker q-o-q performance was attributed to lower margins (profit before tax margin: -5.9 percentage points q-o-q) as the group enjoyed cost savings from its completed projects in the previous quarter. We believe the lower margin was caused by high start-up costs of newly launched projects.

The group had successfully achieved RM1.1 billion new sales as of August 2018, which accounted for 64% of its sales target of RM1.8 billion set for this year and on track to hit our sales assumption of RM1.7 billion. The majority of sales were contributed by Bukit Jalil and Aman Perdana projects in the Klang Valley (constituting 59% of total sales). LBS’ year-to-date sales have been 42.5% higher than a year ago (January to August 2017 new sales: RM802 million) and possibly exceeded last year’s actual sales of RM1.4 billion.

LBS had chalked up RM1.7 billion of unbilled sales as of 2QFY18 (1QFY18: RM1.6 billion; 1HFY17: RM1.4 billion), which were equivalent to 1.2 times its FY17 top line. This shall underpin the group’s revenue visibility of more than a year.

The group has revised down its launches for this year from an initial gross development value (GDV) of RM2 billion to RM1.5 billion. It will launch its new township project in Dengkil, the Klang Valley named CyberSouth in 4QFY18, with a total GDV of RM493 million. We believe it could garner another success with this township project following good response to its maiden launch of Alam Perdana at the end of last year.

We have made no change to our earnings estimates for FY18 (RM109.7 million; +6.1% y-o-y) and FY19 (RM131 million; +19.4% y-o-y), with new sales assumptions of RM1.7 billion and RM1.9 billion respectively. We maintain “buy” on LBS, with a TP of RM1.30, based on a 20% discount to its revised net asset value per share of RM1.63.

LBS is our top pick in the sector as we favour its: i) rising new sales amid a prevailing soft property market, with the group’s sound business strategy of concentrating on selling affordable landed housing, especially in the Klang Valley; ii) strong earnings visibility, underpinned by its healthy unbilled sales; and iii) potential unlocking of landbank value of the Zhuhai International Circuit, China. We advise investors to accumulate the stock in view of its current share price weakness. — JF Apex Securities Bhd, Aug 30

This article first appeared in The Edge Financial Daily, on Sept 3, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Livia @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Chimes @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Penduline @ Bandar Rimbayu

Telok Panglima Garang, Selangor

Robin @ Bandar Rimbayu

Telok Panglima Garang, Selangor

D'Ambience Residences (Ikatan Flora), Bandar Baru Permas Jaya

Permas Jaya/Senibong, Johor

D'Carlton Seaview Residences (Seri Mega)

Masai, Johor

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor