KUALA LUMPUR (September 5): After months of speculation, Prime Minister Tun Dr Mahathir Mohamad confirmed on Monday that construction of the Pan Borneo Highway is facing delays in Sabah, despite huge sums having been channelled into the project.

He said the government would be investigating where the funds had gone to as it involves a major development and that the government is committed to continue with the implementation of the highway even though its completion date may be delayed.

Former works minister Datuk Seri Fadillah Yusof said the delay is because a lot of money had been used for land compensation, according to a Borneo Post report yesterday.

Regardless, such news do not help sentiments in the construction sector, which had weathered a slew of negative news recently, including the deferment of megaprojects such as the East Coast Rail Link and the Kuala Lumpur-Singapore high-speed rail.

However, the highway project facing problems is not unexpected, given the muted market reaction to the news yesterday. Analysts said most of the megaprojects that could face delays, be deferred or cancelled are well known and the outlook for the sector in the near term is still uncertain if not bearish, though the long-term prospects remain intact.

“The market is not surprised [by the news], mainly because it is known that funding has always been an issue for the project,” Areca Capital Sdn Bhd chief executive officer Danny Wong Teck Meng told The Edge Financial Daily in a phone interview yesterday.

Nevertheless, Wong is optimistic the new government will continue with the project as it is one of Malaysia’s biggest and most ambitious infrastructure projects to date.

When completed — originally by 2023 — it will be Malaysia’s longest highway, three times longer than the 772km North-South Expressway spanning the length of Peninsular Malaysia.

Meanwhile, analysts remain wary about the near-term outlook for the construction sector.

“I won’t say [the dust for the construction sector] has completely settled, even though the majority of these mega-infrastructure projects had been put on hold by the government, including the [Kuala Lumpur-Singapore] high-speed rail and the East Coast Railway, after the 14th general election (GE14),” said Malacca Securities Sdn Bhd analyst Kenneth Leong.

Leong said the research house is “neutral” on the construction sector, and expects the sector to remain soft in the short term until the market gets more clarification from the upcoming Budget 2019.

“The construction sector will slowdown in [terms of] workflow going forward. I don’t think there will be any catalysts for now, given the government’s budget is very tight, thus things will slow down,” Leong added.

Likewise, Wong said the construction sector continues to face a downside risk in three to six months until the uncertainties clouding the sector are resolved.

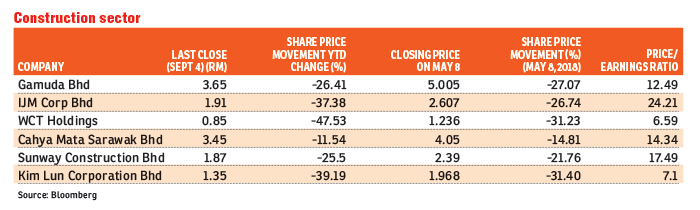

“Post-GE14, the performance of construction stocks has generally been weak. Most of them (construction stocks), such as Gamuda Bhd’s share price, have been bogged down by a slew of negative news and their share prices have not recovered to pre-GE14 levels,” Wong said.

However, Wong remains keen on the construction sector for long-term investment, suggesting to accumulate the stocks now, as the sector is lagging behind the FBM KLCI.

The valuation on construction stocks are also looking attractive, said Wong, adding those that can show their ability to replenish orders aggressively will perform well, though it will take some time.

“We cannot ignore the construction sector, but it needs more time. After a while, when the [negative] sentiment dissipates, I believe investors will realign their focus back to the construction sector,” Wong added.

As at market close yesterday, the construction index has retreated 25.6% since May 8. In contrast, the FBM KLCI has declined only 1.83% in that period.

This article first appeared in The Edge Financial Daily, on Sept 5, 2018.

For more stories, download EdgeProp.my pullout here for free.

TOP PICKS BY EDGEPROP

Citizen 2

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Citizen 2

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Citizen 2

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Razak City Residences

Salak Selatan, Kuala Lumpur

Razak City Residences

Salak Selatan, Kuala Lumpur

Millerz Square

Jalan Klang Lama (Old Klang Road), Kuala Lumpur